Gasoline and air conditioners are both essential goods. At the meeting of the National Assembly Standing Committee, opinions proposed to remove the regulation on applying special consumption tax on these two goods.

On the afternoon of March 10, the National Assembly Standing Committee gave opinions on explaining, accepting and revising the draft Law on Special Consumption Tax (amended).

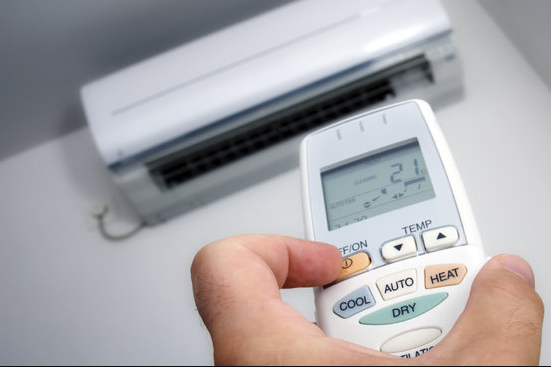

The draft law stipulates that air conditioners with a capacity of 90,000 BTU or less, except those designed by the manufacturer only to be installed on means of transport including cars, railway cars, ships, boats, and airplanes, are also subject to special consumption tax.

In case the manufacturing organization or individual sells or the importing organization or individual imports each part separately, the hot block or cold block, the goods sold or imported (hot block, cold block) are still subject to special consumption tax as for the finished product (complete air conditioner).

In addition, the draft law also stipulates special consumption tax on all types of gasoline.

Permanent Vice Chairwoman of the People's Aspirations and Supervision Committee Le Thi Nga said that the draft law still stipulates that gasoline of all kinds is subject to special consumption tax. The nature of special consumption tax is to levy on luxury goods, discouraging consumption. Meanwhile, gasoline is an essential commodity, indispensable in people's lives.

"Imposing special consumption tax on essential goods for people is not in accordance with the nature and purpose of this tax," Ms. Nga stated.

She reiterated that at the previous Standing Committee meeting as well as at the discussion group of the National Assembly session, she had proposed and seen many opinions in the media in this amendment requesting to review and remove the special consumption tax on gasoline, but it has not been explained.

She requested that the drafting and reviewing agencies provide further explanations. "Currently, there is no explanation in the report stating that it is necessary to keep the special consumption tax on gasoline. I propose to remove this tax on gasoline," Ms. Nga suggested.

Regarding normal capacity air conditioners, Ms. Nga said that ten years ago air conditioners were a luxury item, but now normal capacity air conditioners are also an essential item.

"We propose to remove the special consumption tax on this item. We propose to remove the special consumption tax on gasoline and normal capacity air conditioners. If not removed, we need to explain why we put essential goods under special consumption tax?", Ms. Nga added.

Speaking later, Chairman of the Law and Justice Committee Hoang Thanh Tung agreed with the opinion of Permanent Deputy Chairman of the People's Aspirations and Supervision Committee Le Thi Nga on special consumption tax on gasoline and air conditioners.

Mr. Tung emphasized that gasoline is a very essential commodity and an input commodity of the economy, in people's lives everyone must use gasoline. According to him, this is not really a luxury item to be subject to special consumption tax and gasoline is also subject to environmental protection tax.

He raised the question, "Is this the right time to consider whether or not to continue to regulate gasoline as a commodity subject to special consumption tax? Similarly, air conditioners should also be reconsidered.

National Assembly delegates discussing this bill at the 8th session also had many opinions suggesting consideration of this issue.

"From rural to urban areas, there is almost no house that does not have 1-2 air conditioners. We believe that air conditioners with a capacity of 90,000 BTU or less are luxury goods, and imposing a special consumption tax is not really appropriate. If we continue to implement it, we must have a very specific explanation to convince the National Assembly delegates," Mr. Tung stated.

Explaining later, Chairman of the Economic and Financial Committee Phan Van Mai said that if we approach essential inputs of life without imposing special consumption tax, we can consider increasing environmental protection tax. The drafting and reviewing agency will re-evaluate and, if necessary, ask for further opinions.

Deputy Minister of Finance Cao Anh Tuan said that in recent years, the demand for refrigeration and air conditioning equipment in our country has increased.

Although some air conditioners have changed technology to reduce environmental impact and save electricity, they still use different refrigerants, many of which are harmful to the environment, the ozone layer, and have the potential to cause global warming.

South Korea, India, and Norway impose excise taxes on HFCs used in air conditioners. In Europe, many countries have regulations restricting the use of air conditioners to save energy. Therefore, the drafting agency believes that it is necessary to continue collecting excise taxes on air conditioners with a capacity of 90,000 BTU or less to raise awareness of limiting consumption, saving electricity, and protecting the environment.

Regarding gasoline, the Deputy Minister of Finance said that there are many fossil fuels that are not renewable, so it is necessary to use energy economically, so most countries collect special consumption tax on gasoline.

In Vietnam, the collection of special consumption tax on gasoline has been applied since 1995, for over 20 years now, very stable. In order to encourage businesses and people to use biofuel and the collection has been stable, there should be no issue of removing gasoline from the subject of special consumption tax.

Low-income people also use air conditioners, why impose special consumption tax?

Source: https://vietnamnet.vn/de-nghi-bo-thue-tieu-thu-dac-biet-voi-xang-dieu-hoa-vi-khong-phai-hang-xa-xi-2379212.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Podcast]. Kites and Childhood](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/a4697c2294a843f39084a21134c3feb0)

Comment (0)