VN-Index increased by more than 20 points last week; A series of bank stocks surpassed their peak; Female chairwoman of Vietcap Securities received 0 VND salary; Dividend payment schedule.

VN-Index surpasses highest level in 3 years

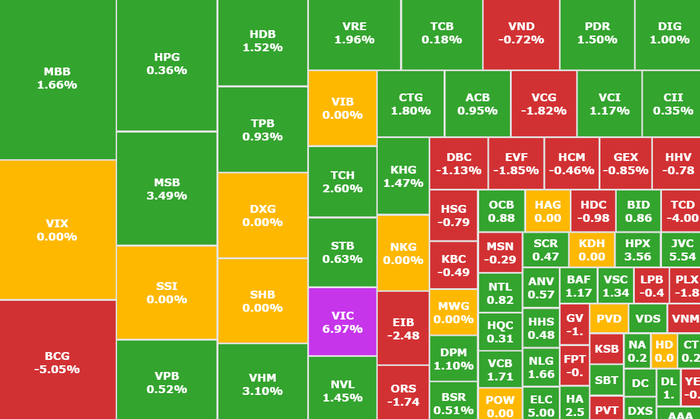

The stock market recorded impressive growth last week when the VN-Index closed with an increase of 20.6 points compared to the previous week, reaching 1,326.05 points, the highest level in nearly 3 years.

Positive signals show that market sentiment has strongly surpassed the resistance level of 1,300 points in the fact that trading volume has increased sharply, exceeding the 20-week average. On the HOSE floor alone, the total trading value last week reached VND109,800 billion, up more than 15.9% compared to the previous week, becoming the 7th consecutive week of increasing liquidity.

The driving force of the market last week mainly came from key sectors such as banking, securities and real estate. Of which, VIC (Vingroup, HOSE) and VCB (Vietcombank, HOSE) were the two largest contributing stocks, followed by VHM (Vinhomes, HOSE), CTG (VietinBank, HOSE), BID (BIDV, HOSE) and MBB (MBBank, HOSE).

Positive market growth

The market received a positive signal from the news that Vinpearl submitted its listing application to HOSE after a long period of absence of initial public offerings (IPOs).

In terms of foreign investors, net selling by foreign investors has cooled down in the past week, notably through negotiated transactions of over VND2,600 billion worth of VIB shares (VIB, HOSE) and strong sales of TPB shares (TPBank, HOSE). In total, this group net sold 42.43 million units, with a total selling value of VND775.89 billion, down nearly 41% in volume and over 69% in value compared to the previous week.

According to experts, positive sentiment is being maintained, the market may continue to rise and head towards a strong resistance zone of 1,340 - 1,360 points, so there is a risk of "shaking" developments.

Bank stocks simultaneously surpass historical peaks

In agreement with the general market picture, a series of VN30 stocks broke the peak, mainly from the banking group.

First, MBB stock (MBBank, HOSE) recorded its 5th consecutive increase of 6%, up to VND24,500/share, marking a historical peak. Liquidity in the session on March 7 recorded more than 47.4 million trading units, 2.5 times higher than the average of the past 10 days.

Next, ACB shares (ACB, HOSE) also surpassed the historical peak when they increased by 1% in the last session of the week, reaching 26,650 VND/share. Liquidity also improved when the trading volume reached 10.7 million units, a sharp increase compared to the previous period.

CTG (VietinBank, HOSE) also showed positive signs when it increased by 1.8% in the session of March 7 to VND42,400/share. With this price, VietinBank's capitalization recorded a new record, reaching VND227,688 billion.

According to securities companies, in 2025, the banking industry will continue to play a major role in promoting economic growth, especially in the context of the Government's ambition to set a very high economic growth rate and the banking group will continue to be the "locomotive" leading the market's profit growth. Furthermore, credit is forecast to continue to grow strongly; non-interest income is also expected to remain stable thanks to the strong digital transformation process and expansion of non-credit business.

Female Chairman of Vietcap Securities receives 0 VND salary

According to the documents of the 2025 Annual General Meeting of Shareholders scheduled to be held on April 1, Vietcap Securities JSC (VCI, HOSE) has revealed the remuneration for the Board of Directors last year. Notably, Chairman of the Board of Directors Nguyen Thanh Phuong and two members of the Board of Directors, Mr. To Hai and Mr. Dinh Quang Hoan, all received 0 VND in remuneration in 2024 despite the company's large profits.

Ms. Nguyen Thanh Phuong, Chairwoman of the Board of Directors of Vietcap Securities, received a salary of 0 VND in 2024 (Photo: Internet)

Meanwhile, independent members of the Board of Directors such as Mr. Nguyen Lan Trung Anh, Mr. Le Ngoc Khanh, and Mr. Nguyen Viet Hoa received remuneration of 180-240 million VND. Mr. Le Pham Ngoc Phuong only received 60 million VND because he was dismissed from April 2, 2024.

In 2024, Vietcap recorded positive business results with operating revenue reaching more than VND 3,695 billion and after-tax profit reaching nearly VND 911 billion, up 49% and 85% respectively over the same period in 2023.

VCI shares have recovered significantly in the past 6 months (Photo: SSI iBoard)

Vietcap's Board of Directors plans to submit to shareholders for approval the 2025 business plan with total revenue of VND4,325 billion, an increase of more than 15%. Pre-tax profit is targeted at VND1,420 billion, an increase of 30% compared to the previous year.

Regarding profit distribution, Vietcap plans to pay dividends at a rate of 5-10%. In 2024, the company has paid two cash dividends with a total rate of 6.5% (VND 650/share).

On the floor, VCI shares have recovered significantly since the beginning of 2025. The closing price on March 7 reached VND 38,950/share - the highest in more than 3 years and an increase of 18% since the beginning of the year.

VNDirect launches investment strategy for March

In its newly released strategic report, VNDirect Securities highly appreciated the fact that VN-Index regained the 1,300-point mark. Especially in the context of the US's increasing trade protection policy, the VN-Index still recorded an impressive increase of 4.4% in February thanks to a relatively positive macro picture.

In March, VNDirect expects the market to maintain its growth momentum with internal strength, with the main driving force coming from corporate profit growth when building investment portfolios.

VN-Index is expected to reach the resistance zone of 1,340 points. Key factors supporting this uptrend include new cash flow as VN-Index surpasses the psychological resistance level of 1,300 points, strengthening investor confidence; progress in implementing the KRX system; FTSE's market upgrade assessment results in March as well as market valuation remaining at an attractive level.

Regarding investment strategy, VNDirect Securities highly appreciates two industry groups including Electricity and Construction Plastics.

For the power sector, VNDirect said expectations of double-digit growth in electricity consumption to support high GDP growth targets will boost the prospects of power plants.

As for the Construction Plastics group, the analysis team highly appreciates that the recovery of the real estate market will boost output growth along with low PVC input costs due to weak demand from China.

Notable Stocks

KB Securities Vietnam (KBSV) recommends buying MWG (Mobile World, HOSE) with a target price of VND 76,200/share.

Accordingly, MWG's business situation has improved in recent times, with net revenue of VND 34,794 billion, up 9.9% year-on-year in the fourth quarter of 2024, and profit after tax of VND 852 billion, up 9.4 times year-on-year. In addition, this is the second quarter that MWG has recorded profit from the Erablue chain (reaching VND 2.4 billion).

Projected business results for 2025 of MWG with net revenue reaching VND 144,132 billion (+7.3% yoy) and profit after tax of VND 4,798 billion (+28.5% yoy). With the positive outlook of business segments, especially the long-term growth potential of Bach Hoa Xanh, KBSV recommends buying MWG shares for 2025.

MB Securities (MBS) recommends KBC (Kinh Bac Urban Area, HOSE) with a target price of VND 35,100/share.

Accordingly, the supporting factors from the prospect of the industrial park real estate industry are improving thanks to the “China +1” strategy, especially after Donald Trump took office as US President; Trang Due 3, Trang Cat and Kim Thanh 2 Phase 1 projects were approved to create new land funds for long-term development; Plan to issue 250 million individual shares to strategic shareholders. Additional capital helps to make the financial structure healthier.

VPBankS Securities recommends holding BSR (Binh Son Refining and Petrochemical, HOSE) with target price of VND 21,650/share.

The driving force comes from the prospect of production and business activities in 2025 when BSR operates at full capacity throughout the year, production output will increase back to normal levels, up 15-16% compared to 2024, which is expected to bring better efficiency to the company.

In addition, BSR will increase capital to more than VND50,000 billion, strengthening financial capacity, helping to ensure financial capacity when implementing the expansion and upgrading project and other projects in the coming time.

Comments and recommendations

Mr. Bui Ngoc Trung, investment consultant, Mirae Asset Securities, commented that it has been 2 weeks since the VN-Index officially broke through the 1,300-point mark spectacularly. This breakthrough will be different from usual when it can be seen that large cash flows are returning very clearly due to the consensus of macro factors, economic recovery and investor confidence gradually returning.

The market trend was better consolidated when Banking and Securities stocks took the lead as large-cap stocks continuously broke out. Foreign trading also recorded a bright spot when the net selling value was significantly reduced.

Therefore, the main trend will still remain positive with the score milestones possibly higher with the targets of 1,400 - 1,500 points this year. The main driving force comes from the strong determination from the government in promoting Public Investment which is more effective than ever, credit is boosted from the banking system showing that the target of completing 16% credit growth in 2025 is convincing.

The real estate market is also witnessing a growth trend again with a new stable legal framework, banks promoting attractive home loan policies, the "unfreezing" of the real estate market is one of the important factors to pull other industries to spread growth.

In addition, the story of market upgrading is witnessing many new changes to transform for a new era with the KRX trading system rushing to complete the final steps and can be expected to operate in the second quarter of this year.

Asean Securities said the market has grown for 7 consecutive weeks without any significant adjustments. Investors need to consider carefully and cautiously in the coming period, disburse in case of adjustments, and take advantage of the strong growth potential of the market in the long term.

Proof Bao Viet Securities assessed that market adjustment pressure may appear in the following sessions. However, the level of adjustment will not be widespread. Stock groups are still differentiated, and there will still be stocks that increase points even when the market adjusts and fluctuates. This unit believes that some potential stock groups in the coming time such as industrial parks, real estate,

Dividend schedule this week

According to statistics, there are 13 businesses that have decided to pay dividends in the week of February 24-28, of which 11 businesses pay in cash and 2 businesses pay in shares.

The highest rate is 49.5%, the lowest is 5%.

2 companies pay by stock:

Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB, HOSE) , ex-right trading date is March 12, rate 49.5%.

Vinh Phuc Infrastructure Development JSC (IDV, HNX), ex-right trading date is March 10, rate 15%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| Architect | HNX | 10/3 | 10/4 | 10% |

| NTH | HNX | 11/3 | 3/27 | 10% |

| LAF | HOSE | 11/3 | 15% | |

| PJC | HNX | 12/3 | 2/4 | 15% |

| EBS | HNX | 13/3 | April 28 | 8% |

| NBE | UPCOM | 13/3 | 12/8 | 11% |

| SMN | HNX | 14/3 | 5/5 | 11% |

| FOX | UPCOM | 14/3 | 30/5 | 20% |

| SHP | HOSE | 14/3 | 3/27 | 15% |

| NDP | UPCOM | 14/3 | June 19 | 5% |

| STC | HNX | 14/3 | 10/4 | 14% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-10-14-3-2025-vn-index-vuot-moc-cao-nhat-3-nam-nha-dau-tu-can-than-trong-20250310090557504.htm

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)