What to invest in at the end of 2024: Gold has a narrow chance of increasing, waiting for opportunities from the stock market

Domestic gold prices are currently high due to benefiting from the rising trend of world gold. However, AFA Capital representative said that gold has reflected expectations of recession risk scenarios and there may not be much room left.

|

| Mr. Nguyen Minh Tuan, CEO of AFA Capital, Co-founder of the Vietnam Financial Advisor Community. (Photo: Chi Cuong) |

According to the recently released strategic report by AFA Capital sent to investors at the WeTalk Program "What to invest in at the end of 2024?" held in Hanoi on September 15, the "Tight defense, quick counterattack" strategy has shown its effectiveness in 2024.

Defensive and growth assets outperformed fixed income and liquid assets such as deposits. In the coming months, AFA Capital believes that financial investment assets with price volatility may have to face the uncertainty of the world's macro economy.

Regarding the liquid asset class, Mr. Nguyen Minh Tuan, CEO of AFA Capital, Co-founder of the Vietnam Financial Advisors Community (VWA) forecasts that in the current global macro context, deposit interest rates will increase but slightly when commercial banks have to increase preferential loan packages in terms of interest rates to compete for mobilization sources.

The difference between mobilization and credit of commercial banks is the reason why mobilization interest rates continue to maintain a recovery trend from the beginning of the second quarter of 2024. Monthly credit growth (compared to the beginning of the year) is increasing faster than the same period in 2023, and the rate may continue to increase from now until the end of 2024 to complete the credit growth target of 14-15%. However, interest rates increase at a slow pace and do not cause great pressure on the residential market. However, Mr. Tuan also emphasized that when talking about deposits, in addition to the income obtained when investing, this is also a liquid asset that needs to be allocated in the portfolio to be ready to act when there is an investment opportunity.

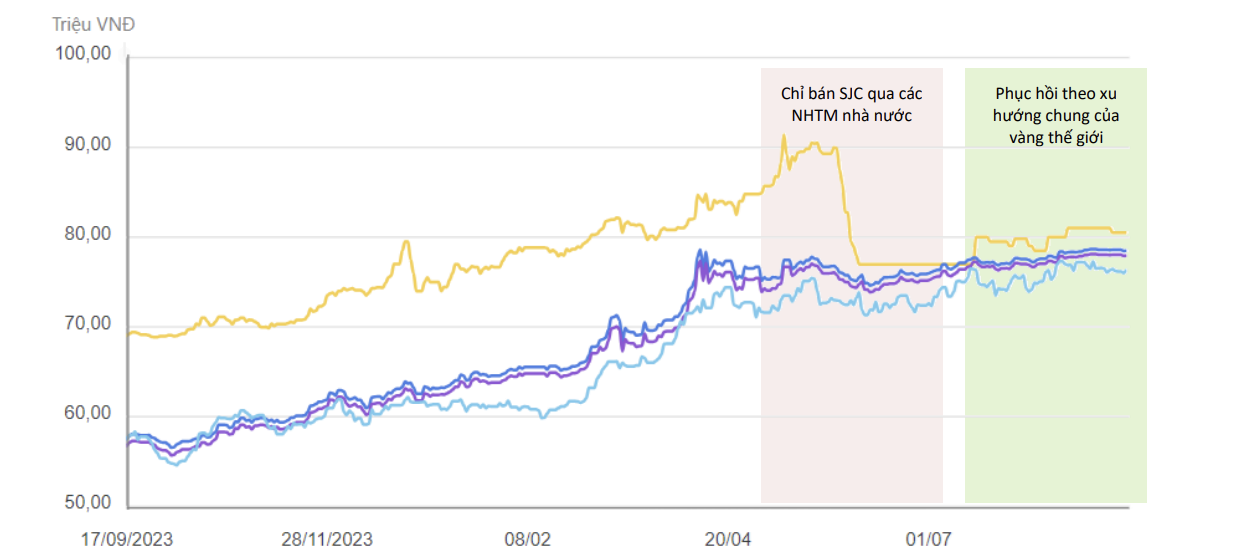

For the defensive asset class, domestic gold prices are still high due to benefiting from the upward trend of global gold prices. The weakening USD and the uncertainty of the US economy are positive factors for gold prices.

A representative from AFA Capital believes that gold will still benefit from this trend as well as stable gold demand for the rest of 2024. Despite benefiting from uncertainty, Mr. Tuan believes that there is not much room for gold to increase due to high prices. The current gold price has reflected the expectations of the recession risk scenario and there may not be much room left. According to a report by JP Morgan, the gold price is forecast to reach $2,600/ounce in the fourth quarter of 2025. With the price of $2,578/ounce updated at the end of this week, gold may not have much room to break out.

|

| Vietnam's gold price has moved quite close to the world's, especially SJC gold - Source: AFA Capital |

For the fixed-income asset class, the CEO of AFA Capital predicts that the corporate bond investment channel will maintain its recovery trend. The slight decrease in the value of overdue bonds is also a positive signal. The restructuring of overdue bonds is also progressing steadily. However, the risk level increases as the real estate sector still accounts for a high proportion and has a large number of overdue issuers.

Maturity risk is high as monthly maturing bonds in risky sectors still account for a fairly high proportion. The value of high-risk maturing bonds in August 2024 is 3 times higher than in July 2024. It is estimated that in the next 12 months, 20% of maturing bonds are high-risk bonds with delayed principal payments. Meanwhile, the modest value of new issuance shows that market confidence remains low. The maturity structure is gradually concentrating on short-term groups under 3 years, but the average maturity is on an upward trend.

As for the stock investment channel, market sentiment is hindered by liquidity issues and the persistent net selling trend of foreign investors. “According to the current baseline scenario, we still expect positive signals for this asset class to return in the fourth quarter when the US Federal Reserve (Fed) lowers interest rates,” said Mr. Tuan.

|

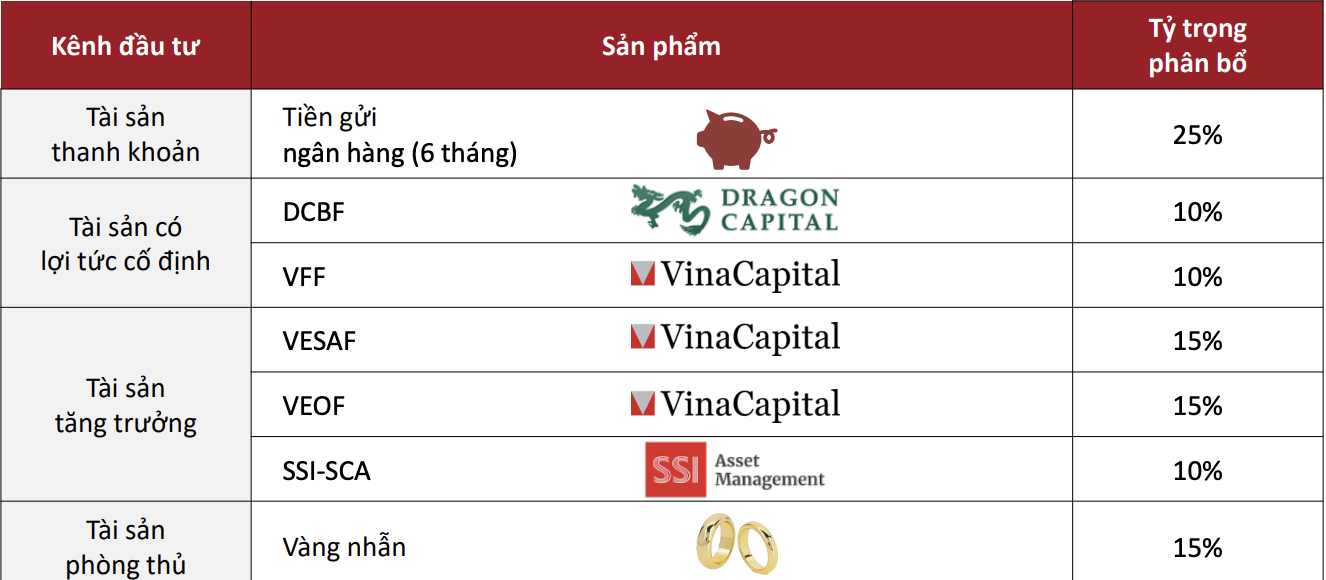

| Suggested allocation ratio for Q4/2024 investment portfolio according to balanced taste - Source: AFA Capital |

Sharing about asset allocation in the fourth quarter, according to AFA Capital's recommendation, the investment portfolio can increase the proportion of liquid assets to wait for opportunities; maintain the proportion of defensive assets as a reserve in case the world economy enters a recession. Meanwhile, AFA Capital recommends reducing the proportion of investment in bonds. For growth assets, keep the proportion of stocks unchanged in a period with many variables like the present to wait for opportunities, and can be structured from gold and deposits to seize opportunities.

Source: https://baodautu.vn/dau-tu-gi-cuoi-nam-2024-vang-hep-cua-tang-cho-co-hoi-tu-thi-truong-co-phieu-d225021.html

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

Comment (0)