|

| Import and export activities have continuously shown signs of improvement recently. (Source: VnEconomy) |

Import and export recover clearly

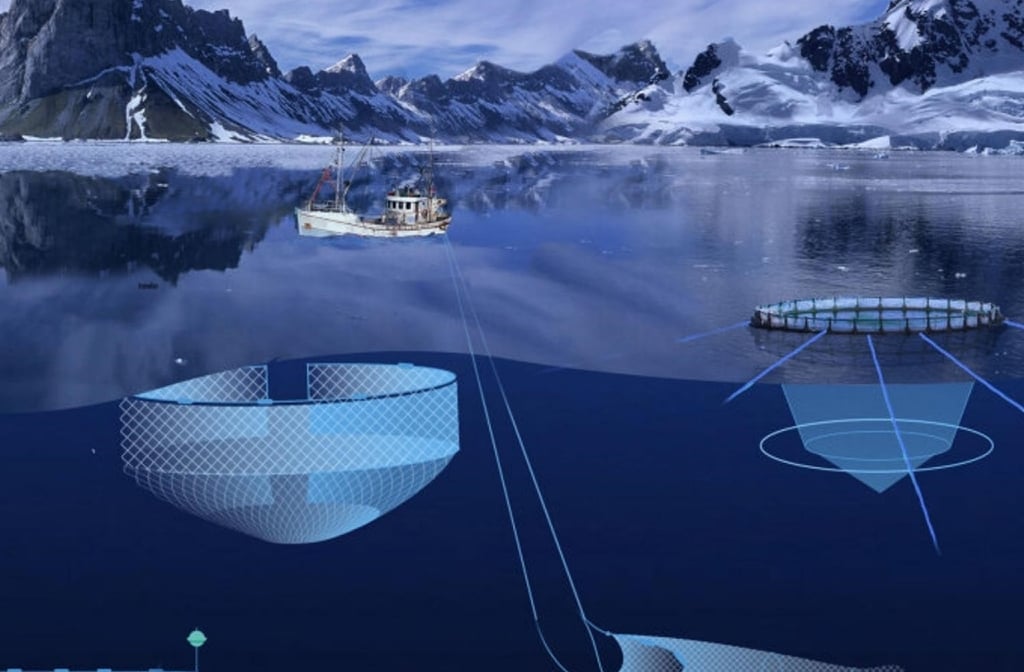

In the report reviewing economic developments in August 2023 recently released by the World Bank (WB) in Vietnam, economic indicators show that export and import activities of goods continued to decrease by 7.3% and 8.1% respectively in August compared to the same period last year.

The decline in exports was due to a decline in exports of major manufactured products, including smartphones (-14.6%), machinery (-17.9%), textiles (-17.8%) and footwear (-19.3%). The decline in exports directly affected imports of input materials, leading to a decline in imports of textiles, electrical equipment and machinery.

"However, monthly import and export activities have improved continuously since May, suggesting that the decline in export activities may have bottomed out," the report said.

Import and export activities have shown signs of improvement recently. According to the General Department of Customs, Vietnam's total export turnover in the second period of August (August 16-31) reached 18.23 billion USD, an increase of 26.2% (equivalent to an increase of 3.79 billion USD) compared to the first period of August 2023.

Export turnover in the second period of August increased compared to the first period of August 2023 in some key commodity groups such as: machinery, equipment, tools and spare parts increased by 545 million USD (equivalent to an increase of 35.6%); computers, electronic products and components increased by 525 million USD (equivalent to an increase of 22.1%); textiles and garments increased by 347 million USD (equivalent to an increase of 22.4%); phones of all kinds and components increased by 309 million USD (equivalent to an increase of 12.8%); iron and steel of all kinds increased by 239 million USD (equivalent to an increase of 102%); aquatic products increased by 125 million USD (equivalent to an increase of 33.9%); vegetables and fruits increased by 109 million USD (equivalent to an increase of 61%)...

Thus, by the end of August, Vietnam's total export turnover reached 228.17 billion USD, still down 9.8%, equivalent to a decrease of 24.79 billion USD compared to the same period in 2022. However, the rate of decrease was lower than in previous months.

Many items are still maintaining high export speed and value. For example, statistics show that in August 2023, the average export price of Vietnamese coffee reached a record high of 3,054 USD/ton, up 8.0% compared to July 2023 and up 29.7% compared to August 2022. In the first 8 months of 2023, the average export price of our country's coffee reached 2,463 USD/ton, up 8.9% over the same period last year.

In the first 8 months of the year, coffee exports reached 1.2 million tons, worth nearly 3 billion USD, down 5.4% in volume but up 3.1% in value compared to the same period last year thanks to high selling prices.

Or for textile products, Mr. Truong Van Cam - Vice President of the Vietnam Textile and Apparel Association (VITAS) said that after many gloomy months, the order situation from now until the end of the year of the textile and garment industry will improve and it is expected that textile and garment export turnover will reach 40 billion USD in 2023.

The Vietnam National Textile and Garment Group also stated that the Vietnamese textile and garment industry has passed the “worst bottom”. The Vietnam National Textile and Garment Group said that more than half of its customers assessed the market situation as improving, a general signal that the garment industry’s performance in the last 6 months of this year will be equivalent to the first 6 months.

Similarly, SSI Research believes that orders for Vietnam's textile and garment industry are expected to gradually improve from the fourth quarter of 2023.

An export item to India has triple digit growth

According to statistics from the General Department of Customs, in August 2023, the export value of wood and wood products reached 1.29 billion USD, up 15.1% compared to July 2023, but down 9.4% compared to August 2022.

Of which, the export value of wood products reached 839.8 million USD, up 12.4% compared to July 2023, but down 6.1% compared to August 2022. In the first 8 months of 2023, the export value of wood and wood products reached 8.5 billion USD, down 24.1% over the same period in 2022. Of which, the export value of wood products reached 5.7 billion USD, down 27.1% over the same period in 2022.

Exports of wood and wood products to major markets continue to decline, as export markets continue to face difficulties as inflation and recession in many countries continue to drag on, severely affecting purchasing power. As a result, export values to major markets have decreased significantly in the first eight months of 2023.

The decline in traditional markets forced wood industry enterprises to seek new markets such as India, the Middle East, etc. Therefore, the export value of wood and wood products to the Indian market recorded a strong growth rate in the first 8 months of 2023, reaching 64.9 million USD, an increase of 265.8% over the same period in 2022.

According to information from the Vietnam Trade Office in the United Arab Emirates, furniture imports in the countries of the Gulf Cooperation Council (GCC) have a growth rate of more than 45% per year, while countries in this region almost do not produce furniture. This is considered an opportunity for wooden furniture exporting enterprises to exploit in the coming time.

According to annual practice, the demand for wood and wood products, especially wooden furniture, tends to increase sharply at the end of the year, when the housing market is completed and the demand for replacing furniture increases to meet the holiday season.

Along with that, in key export markets such as the US and EU, inventories are decreasing and import demand is expected to increase, creating opportunities for wood industry enterprises to receive orders in the coming months.

Vietnam is a major rubber supplier to the EU.

According to statistics from the European Statistical Office, in the first 6 months of 2023, the EU imported 1.1 million tons of rubber (HS 4001, 4002, 4003, 4005) from markets outside the bloc, worth 2.42 billion Euros (equivalent to 2.59 billion USD), down 21.2% in volume and 24% in value compared to the same period in 2022.

Among the non-bloc sources, Thailand, Ivory Coast, Indonesia, the United States, and South Korea are the five largest markets supplying rubber to the EU.

Vietnam is the 12th largest non-EU rubber supplier in the first 6 months of 2023, reaching 33.64 thousand tons, worth 48.18 million Euros (equivalent to 51.56 million USD), down 19.5% in volume and 40.3% in value compared to the same period in 2022.

|

| Vietnam is the 12th largest non-bloc rubber supplier to the EU in the first 6 months of 2023. (Source: Industry and Trade Newspaper) |

Vietnam's rubber market share in the EU's total rubber imports from non-bloc markets accounted for 3.04%, a slight increase compared to 2.98% in the same period in 2022.

In terms of types, in the first 6 months of 2023, the EU imported natural rubber, synthetic rubber, recycled rubber and mixed rubber from markets outside the bloc with both volume and value decreasing compared to the same period in 2022.

Vietnam is the 5th largest natural rubber supplier to the EU, with 33.63 thousand tons, worth 48.1 million EUR (equivalent to 51.47 million USD), down 19.3% in volume and 40.2% in value compared to the same period in 2022.

Vietnam's natural rubber market share in the total import volume of the EU market accounts for 6.41%, equivalent to the same period in 2022.

Statistics show that Vietnam still ranks 4th among ASEAN countries in terms of rubber market share in the EU. According to the European Tyre and Rubber Manufacturers Association (ETRMA), European tire market revenue decreased in the second quarter of 2023.

With the global economic recession and rising costs due to inflation, ETRMA forecasts that tire sales in 2023 are expected to continue to decline compared to 2022. Therefore, this will greatly affect Vietnam's rubber exports to the EU market in the coming time.

In the first 6 months of 2023, the EU imported 524.1 thousand tons of synthetic rubber (HS 4002) from markets outside the bloc, worth 1.37 billion Euros (equivalent to 1.47 billion USD), down 24.4% in volume and 19.6% in value compared to the same period in 2022.

Vietnam's synthetic rubber accounts for only 0.001% of the EU's total imports from non-bloc markets.

Source

Comment (0)