TikTok began rolling out its TikTok Shop sales feature in 10 ASEAN countries in 2021. Since then, the gross merchandise value (GMV) on TikTok Shop is estimated to have increased 7 times.

This is the figure just announced in a report by consulting firm Momentum Works (Singapore). From GMV of 600 million USD in 2021, TikTok Shop will bring in 4.4 billion USD in 2022, the fastest growth rate among e-commerce platforms.

Speaking at a conference in Jakarta, Indonesia, TikTok CEO Shou Zi Chew announced that the company will expand its presence in the Southeast Asian market, which is currently the "playground" of giants such as Sea and GoTo.

“We’re going to be investing billions of dollars in Indonesia and Southeast Asia over the next few years,” Chew said. As part of the commitment, TikTok Shop will spend more than $12 million over the next three years to support more than 120,000 sellers and businesses in the region.

According to TikTok's CEO, the platform now employs 8,000 people here, up from about 100 when it first entered the market six years ago.

TikTok is very determined to push e-commerce in Southeast Asia, said Weihan Chen, an analyst at Momentum Works. It is too early to know if they will succeed, as people still rely on more traditional platforms.

Momentum Works estimates GMV from paid orders at major digital retail platforms, as well as interviews with industry experts and its own calculations.

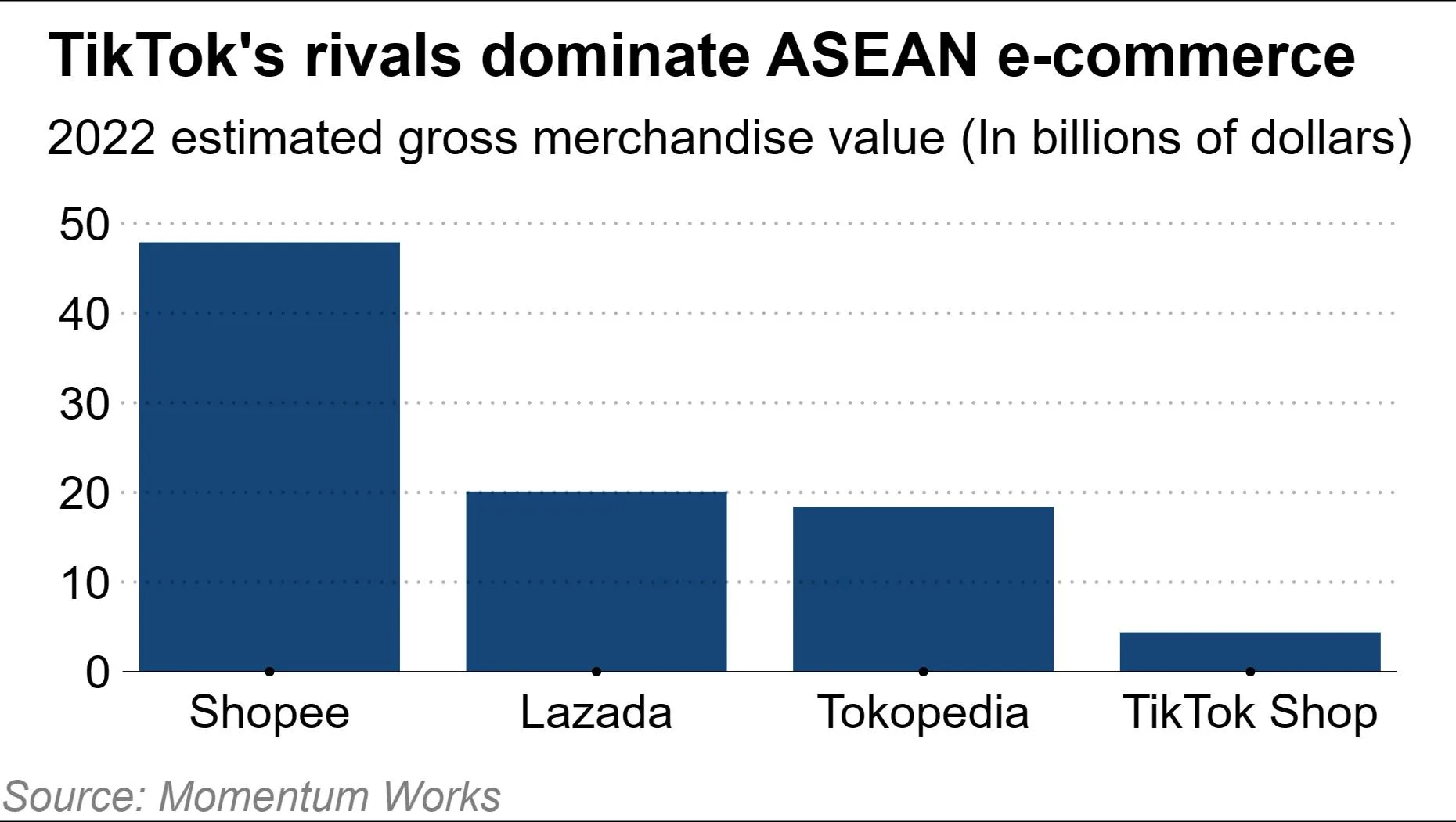

Despite its significant progress, TikTok Shop is still dwarfed by larger rivals. Shopee’s GMV grew from $42.5 billion to $47.9 billion between 2021 and 2022, making it the region’s largest e-commerce platform, accounting for nearly half of the market. Alibaba’s Lazada came in second. However, Lazada was the only platform to see a decline in market share. Its GMV fell from $21 billion in 2021 to $20.1 billion in 2022, according to a report by Momentum Works. GoTo’s Tokopedia ranked third, with GMV growing from $15.5 billion to $18.4 billion over the same period.

The ranking does not hinder TikTok Shop’s ambition to capture a larger retail “pie” in ASEAN. After launching in Indonesia, the platform quickly expanded to Thailand, Vietnam, Malaysia, the Philippines, and Singapore in 2022.

TikTok is leveraging its massive user base to attract online shoppers. Sellers can offer direct sales through their TikTok accounts, offer shopping suggestions via livestreams, and have a dedicated section on their personal pages.

The company also launched many promotions to attract both buyers and sellers. TikTok started its campaign in Singapore by waiving seller commissions and charging only 1% payment fees. For buyers, there are many coupons to attract them to the platform.

Ng Chew Wee, Head of Business Marketing for APAC at TikTok, said TikTok Shop is a convergence of content and commerce, not only empowering local businesses to reach a fast-growing customer base, but also providing entertaining content.

(According to Nikkei)

Source

Comment (0)