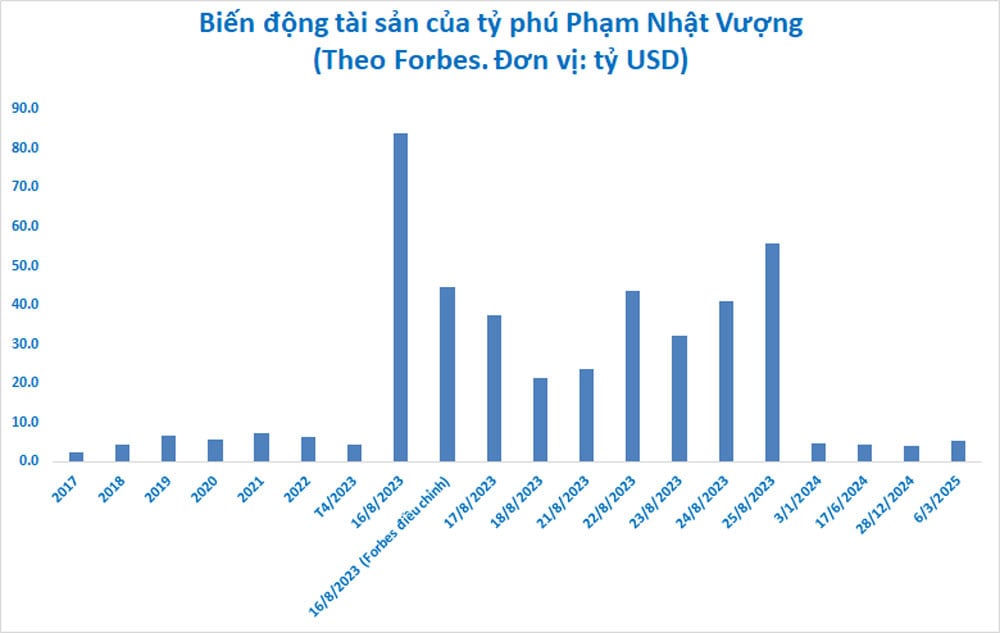

Many Vietnamese billionaires such as Mr. Pham Nhat Vuong, Truong Gia Binh, Nguyen Dang Quang... recorded an increase in assets due to policy signals for economic breakthrough ambitions despite the strong fluctuations in the world from the 'Donald Trump storm'.

The assets of many Vietnamese billionaires, including Vingroup (VIC) Chairman Pham Nhat Vuong, FPT Chairman Truong Gia Binh, Masan (MSN) Chairman Nguyen Dang Quang... increased quite strongly following stock fluctuations in the early trading session on March 6.

Ambitions for strong economic growth of 8% and new policy signals from the Government have pushed the stock market to increase quite strongly, firmly above the 1,300 point threshold.

VN-Index at the beginning of the session on March 6 increased by about 8 points, to 1,312 points.

Billionaire Pham Nhat Vuong's Vinhomes (VHM) shares increased by VND550 to VND43,250/share. This is the highest price of this stock since the end of October last year.

Shares of Vingroup (VIC) and Vincom Retail (VRE) also stood at multi-month highs. Billionaire Pham Nhat Vuong’s fortune, according to Forbes, soared to more than $5.3 billion from $4.1 billion at the beginning of the year.

Mr. Ho Hung Anh - Chairman of Techcombank (TCB) - recorded an increase in assets to 1.9 billion USD compared to 1.7 billion USD at the beginning of the year. The assets of Mr. Nguyen Dang Quang, Mr. Ngo Chi Dung (Chairman of VPBank), Mr. Nguyen Duc Tai (MWG) ... also recorded positive signals.

This is contrary to the general situation in the world, when the "Donald Trump storm" with trade wars is causing financial markets to fluctuate.

Vietnam's stock market is on an upward trend after successfully conquering the 1,300-point threshold recently, in the context of Vietnam's high economic growth ambition of 8%. Many policies have been and are being introduced, such as monetary and fiscal policies to serve 8% growth.

Loose monetary policy and pumping money into the economy often benefits many groups of businesses on the Vietnamese stock market, especially those that benefit from cheap credit, low interest rates and growing consumer demand.

Some groups benefited such as banking, real estate, construction, securities, retail,... with names such as VCB, VIC, HPG, SSI, MWG. In the morning session of March 6, many stocks in this group, especially banks, performed positively. The assets of many billionaires increased.

For banks, loose monetary policy is often accompanied by lower interest rates, allowing banks to expand credit, increase loan balances and improve profits. For real estate, low interest rates boost demand for home purchases and real estate investment.

Construction and building materials businesses also benefited when credit flows expanded, infrastructure and construction projects accelerated, including Hoa Phat (HPG) of billionaire Tran Dinh Long, Binh Minh Plastics (BMP)...

The securities industry also benefits with names like SSI of Mr. Nguyen Duy Hung, VPS... Low interest rates promote cash flow into the stock market, helping securities companies increase revenue from brokerage and margin lending.

The retail consumer segment has Mobile World (MWG), Vinamilk (VNM), Masan Group (MSN), FPT Retail (FRT)... Low interest rates help consumers increase spending, stimulating growth in the retail industry.

On the afternoon of March 6, the Prime Minister will meet with leaders of Vingroup, Sun Group, a series of real estate businesses, and several banks to discuss promoting the project to develop at least 1 million social housing units by 2030.

Source: https://vietnamnet.vn/tai-san-ty-phu-pham-nhat-vuong-truong-gia-binh-nguyen-dang-quang-but-pha-2377918.html

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

Comment (0)