There is the presence of speculative groups.

According to information recently released by the Vietnam Association of Realtors (VARS), the Vietnamese real estate market in the third quarter in particular and the first 9 months of 2024 also showed a positive recovery after a difficult period, thanks to the stability of the economy and the Government's support policies.

In particular, the 2023 Housing Law, 2023 Real Estate Business Law and 2024 Land Law officially taking effect from August 1, 2024, 5 months earlier than the previous regulations, have contributed to perfecting the legal corridor and opening a new cycle for the market in a safer, healthier and more sustainable direction.

The data also shows that real estate segments, from housing, commercial to industrial real estate, all show signs of positive growth with many new projects being implemented. In addition, Ms. Pham Thi Mien - Deputy Director of VARs IRE said that the residential real estate market has begun to record signs of "heating up". Starting with the story of land auctions being "hotter" than ever with auctions held "overnight", recording hundreds, even thousands of people accepting to "eat and lie down to compete for a spot. The winning price is also a record high, equal to the land of projects with well-invested infrastructure.

Bustling land auctions are seen as a sign of market heating up.

Next, the heat of the market is also led by the apartment segment, with prices continuously setting new high levels, in both the primary and secondary markets. The high demand has caused thousands of apartment owners to regularly receive calls asking to sell their houses. Despite the high selling prices, newly launched apartment projects have recorded very good absorption rates.

Along with the apartment type, some newly launched low-rise projects of major investors also recorded a “record” number of bookings despite the increasing prices. Many apartments have good locations, not only are the prices high, but to buy them, customers/investors also have to accept paying a difference.

However, in addition to the results from actual supply and demand, the market has also shown signs of "heating up". This situation is reflected in land speculation, pushing up housing prices, and the emergence of non-transparent real estate transactions. Many small investors participate in the market for the purpose of surfing, causing real estate prices to be unreasonably high. Signs of "heating up" are also shown in the apartment segment with the increasingly high asking price of transferred apartments, due to the "assistance" of some speculative groups.

According to VARS, these signs all stem from a lack of supply. Specifically, in the third quarter of 2024, the residential real estate market continued to record a supply of 22,412 products offered on the market, with about 14,750 new products launched, down 25% quarter-on-quarter but up 60% year-on-year.

The market is on the rise

Despite the statistical decrease in quantity, the supply in the third quarter of 2024 still showed growth when a number of new projects appeared, especially with the presence of large-scale projects that began to be deployed and rumored in the market, making the market more vibrant. In the first 9 months of 2024, the market recorded 38,797 new products for sale.

However, the supply still recorded strong differentiation when 70% of the new supply came from the apartment segment. Of which, products with prices of over 50 million VND/m2 or more dominated. The market was almost completely devoid of affordable commercial apartments. In terms of region, the North led the new supply with 46%, followed by the Central region with 29% and the South with 25%.

VARS research data also shows that, although the supply is mainly in the high-end and luxury segments, the whole market recorded about 10,400 successful transactions in the third quarter of 2024, equivalent to an absorption rate of 51%. This reflects the market's interest in new real estate products, although most of the new supply is completed to high standards and investment costs, especially land-related costs, are increasing.

In the first 9 months of 2024, the market recorded 30,589 successful transactions, 2.5 times higher than the same period in 2023. Many new projects launched at the end of September, starting to receive bookings, also recorded a large amount of interest and deposits.

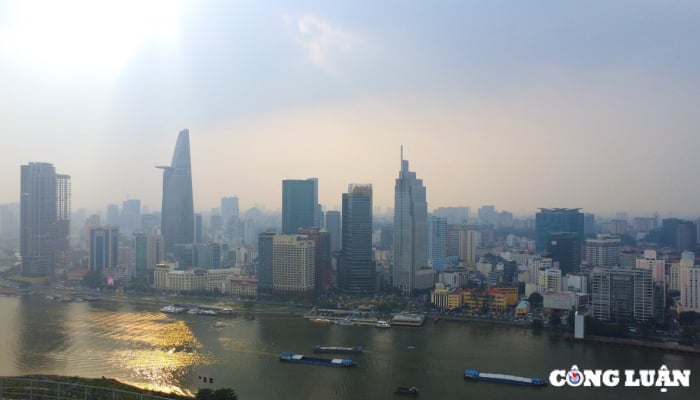

Apartments are leading the supply of the real estate market.

In terms of selling prices, housing prices continue to be “anchored” at high levels, in both the primary and secondary markets, especially in the apartment segment. The imbalance between supply and demand is becoming increasingly serious as supply, although improved, is still difficult to meet demand. In addition, most of the new supply continues to be completed at high standards with investment costs, especially land-related costs, increasing.

In the HCMC market alone, the primary price level remained stable at a high level due to the supply mainly coming from ongoing projects. Meanwhile, the primary price level in the provinces and cities surrounding HCMC increased slightly, ranging from 3-5%, with new supply having higher selling prices.

Research on the apartment price index, reflecting the average selling price fluctuations of projects in the sample set of 150 projects selected and observed by VARS, also shows that, as of the third quarter of 2024, the average selling price of the project cluster in Hanoi is approaching 60 million VND/m2, an increase of 64% compared to the second quarter of 2019. The average selling price of the project cluster in Ho Chi Minh City increased from 49.2 million VND/m2 to 64.2 million VND/m2, an increase of 30.6%.

Demand for real estate, including housing and investment, continues to shift to suburban areas, provinces/cities surrounding the two special urban areas and the secondary market with many options at more reasonable prices. Apartments and houses under 3 billion VND are being "hunted" strongly in Hanoi and Ho Chi Minh City.

Source: https://www.congluan.vn/thi-truong-bat-dong-san-dang-tang-nhiet-hay-bi-tac-dong-boi-cac-nhom-dau-co-post316642.html

Comment (0)