(CLO) On February 13, Savills released a report on the real estate market, focusing on the types of properties in the two major cities of Hanoi and Ho Chi Minh City. This shows the developments of the industry in the context of Vietnam's economy having strong resilience in the face of global difficulties.

Residential real estate restores supply

According to Savills' report, the housing market in 2025 will have many bright spots. Specifically, entering the new year, the supply of apartments in the Hanoi market is expected to reach 25,200 units. Of which, class B continues to lead, accounting for 88% of future supply, and metropolitan projects will account for 70% of the market share. From 2026 onwards, about 70,000 apartments from 91 projects will be opened for sale. Dong Anh, Hoai Duc and Hoang Mai are expected to contribute 52% of the market share.

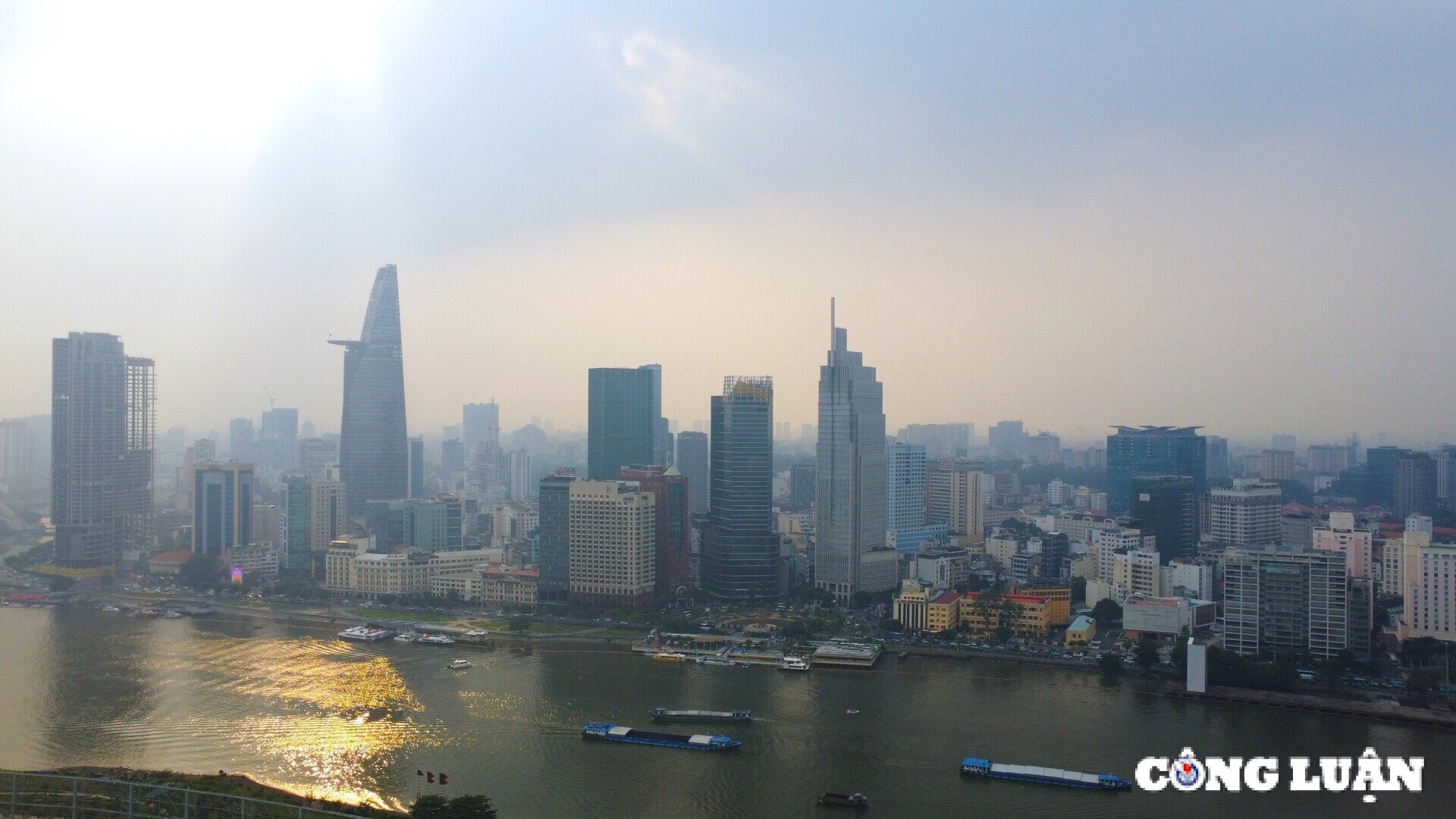

In Ho Chi Minh City, primary supply reached approximately 6,500 units in Q4/2024, up 35% QoQ but down 13% YoY. In 2024, primary supply increased 10% YoY to nearly 11,900 units. Sales in Q4/2024 reached 2,700 transactions, up 43% QoQ but down 10% YoY. Average price reached VND91 million/m2 net, up 36% QoQ and 33% YoY, due to high-priced new supply and existing projects increasing selling prices.

The scarcity of affordable apartments has driven budget-conscious buyers to neighboring markets such as Binh Duong, Dong Nai and Long An. The shift in demand has driven significant growth in Binh Duong apartment transactions, up more than 200% year-on-year.

By 2025, more than 10,000 units are expected to be launched, of which Class B accounts for 54% of the total. Regarding the outlook and vision to 2027, the future supply in Ho Chi Minh City will reach 46,000 units from 69 projects. Thu Duc City is expected to account for 52%, Binh Tan 11% and District 7 10%.

Apartment supply will recover strongly in 2025

Similarly, the Villa/Townhouse segment also showed more positive developments compared to the previous period. In Hanoi, new supply in the fourth quarter of 2024 reached 4,655 units from 11 projects. Primary supply reached 5,002 units from 18 projects, up seven times quarter-on-quarter and year-on-year. The number of transactions in the last quarter of 2024 increased sharply, reaching 3,317 transactions, up 10 times quarter-on-quarter and 52 times year-on-year. The absorption rate in the quarter increased by 18 percentage points, reaching 66%.

In Ho Chi Minh City, new supply in 2024 is limited with only 197 units launched from two projects. Primary supply decreased by 2% YoY to 970 units. The segment above VND30 billion/unit continues to dominate with 74% market share. In Q4/2024, transaction volume decreased sharply by 65% QoQ and 6% YoY. Primary prices in Q4 increased by 20% QoQ but decreased by 10% YoY to VND330 million/m2 of land.

The high-end segment will continue to dominate in Ho Chi Minh City due to limited land fund and high input costs, while affordable supply will expand to neighboring provinces thanks to increasingly developed infrastructure. In 2025, in the Ho Chi Minh City market, more than 700 units will be launched for sale, with 55% from the next phases of existing projects. Products priced above VND20 billion will account for 70%.

Commercial real estate maintains strong demand

According to Saivlls' report, the supply of retail types in the Hanoi market remained stable on a quarterly basis and increased by 2% on a yearly basis thanks to three new retail podiums of the Heritage West Lake, Taisei Square and Grand Terra projects. Gross ground floor rents in Hanoi increased by 2% on a quarterly basis and 5% on a yearly basis. Notably, in the central area, rents recorded a sharp increase, up 33% on a quarterly basis and 40% on a yearly basis, reaching VND4.5 million/m2/month, while occupancy decreased by 3 percentage points on a yearly basis, reaching 85%.

In terms of outlook, by the end of 2025, the Hanoi retail market is expected to expand with 140,700m2 of new retail supply from four shopping malls and three retail podiums. In 2026 and 2027, supply will continue to increase by 174,100m2 of leasable floor area from seven projects.

Ms. Hoang Nguyet Minh, Senior Director, Commercial Leasing, Savills Hanoi commented: “International retail groups continue to expand in Hanoi, and demand for high-end retail space remains high due to limited suitable supply.”

Hoang Nguyet Minh, Senior Director, Commercial Leasing, Savills Hanoi

Meanwhile, in the Ho Chi Minh City market, total retail supply increased by 1% quarter-on-quarter and 6% year-on-year to 1.6 million square meters. New supply was concentrated in non-central areas thanks to large land funds and urban expansion.

Of the 2024 retail leases in Ho Chi Minh City, 88% are brand extensions, with new brands accounting for only 12% of the total leased area. Food and beverage (F&B) tenants lead the way, accounting for nearly a third of the leased area, followed by fashion tenants with 24% of the market share and entertainment with 17% of the market share.

The average ground floor rent reached VND1.4 million/m2/month, increasing year-on-year in all three areas. The annual price increase policy, high rents in new projects and projects in the central area have driven the growth. According to forecasts, with increasing consumer demand and the growth of the wealthy class, Ho Chi Minh City continues to attract international brands, especially in the luxury segment.

Many types of commercial real estate also recorded many bright spots in 2025.

In the hotel sector, the potential is also more evident thanks to the growth of the tourism industry. Savills believes that future supply is expected to reshape the Hanoi market, with 68 projects expected to provide 12,065 rooms from 2025. Notable brands coming to Hanoi include Hilton, Fusion, Accor and Four Seasons.

In Ho Chi Minh City, all segments recorded improvements QoQ and YoY, with occupancy up 10 ppts QoQ and 4 ppts YoY to 71%. Average room rates increased 10% QoQ and 6% YoY to VND2.1 million/room/night.

Mr. Neil McGregor, General Director, Savills Vietnam commented: “The hotel segment in Ho Chi Minh City is expected to fully recover by 2025, thanks to the strong return of international tourists, especially from key source markets”.

Source: https://www.congluan.vn/thi-truong-bat-dong-san-nam-2025-se-giu-nhip-tang-truong-post334372.html

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

Comment (0)