USD exchange rate today February 10, 2025: Analysts say that the USD/VND exchange rate still faces challenges, especially the tariff policy will have a direct impact.

USD exchange rate today 02/10/2025

At the time of survey at 5:00 a.m. on February 10, the central exchange rate at the State Bank was currently 24,462 VND/USD, unchanged from yesterday's trading session.

Specifically, at Vietcombank, the USD exchange rate is 25,080 - 25,470 VND/USD, unchanged in both buying and selling compared to yesterday's trading session.

TPB Bank is buying USD cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying USD transfers at the lowest price: 1 USD = 24,430 VND

LPBank and OceanBank are buying USD cash at the highest price: 1 USD = 25,222 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,549 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 25,429 VND

Saigonbank is selling USD cash at the highest price: 1 USD = 25,685 VND

MB Bank is selling USD transfers at the highest price: 1 USD = 25,620 VND

|

| USD exchange rate at some banks today. Source Webgia.com |

| 1. Agribank - Updated: February 10, 2025 1:30 PM - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,180 | 25,200 | 25,540 |

| EUR | EUR | 25,602 | 25,705 | 26,793 |

| GBP | GBP | 30,804 | 30,928 | 31,907 |

| HKD | HKD | 3,191 | 3,204 | 3,310 |

| CHF | CHF | 27,277 | 27,387 | 28,254 |

| JPY | JPY | 162.87 | 163.52 | 170.64 |

| AUD | AUD | 15,548 | 15,610 | 16,127 |

| SGD | SGD | 18,363 | 18,437 | 18,963 |

| THB | THB | 729 | 732 | 764 |

| CAD | CAD | 17,348 | 17,418 | 17,926 |

| NZD | NZD | 14,063 | 14,559 | |

| KRW | KRW | 16.66 | 18.39 | |

| 2. Sacombank - Updated: 01/05/2001 07:16 - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25200 | 25200 | 25580 |

| AUD | AUD | 15535 | 15635 | 16198 |

| CAD | CAD | 17348 | 17448 | 18004 |

| CHF | CHF | 27448 | 27478 | 28366 |

| CNY | CNY | 0 | 3441.9 | 0 |

| CZK | CZK | 0 | 985 | 0 |

| DKK | DKK | 0 | 3485 | 0 |

| EUR | EUR | 25715 | 25815 | 26692 |

| GBP | GBP | 30943 | 30993 | 32108 |

| HKD | HKD | 0 | 3241 | 0 |

| JPY | JPY | 164.04 | 164.54 | 171.05 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 17 | 0 |

| LAK | LAK | 0 | 1,133 | 0 |

| MYR | MYR | 0 | 5827 | 0 |

| NOK | NOK | 0 | 2219 | 0 |

| NZD | NZD | 0 | 14123 | 0 |

| PHP | PHP | 0 | 402 | 0 |

| SEK | SEK | 0 | 2272 | 0 |

| SGD | SGD | 18342 | 18472 | 19199 |

| THB | THB | 0 | 694.3 | 0 |

| TWD | TWD | 0 | 760 | 0 |

| XAU | XAU | 8680000 | 8680000 | 9000000 |

| XBJ | XBJ | 7900000 | 7900000 | 9000000 |

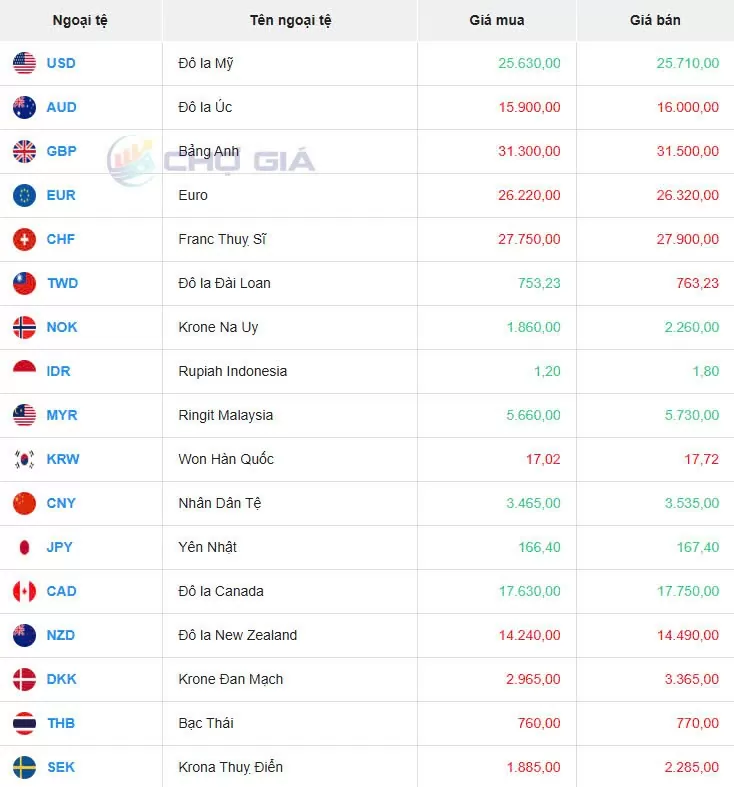

In the "black market", the black market USD exchange rate as of 5:00 a.m. on February 10, 2025 remained unchanged in both buying and selling compared to yesterday's trading session, trading around 25,630 - 25,710 VND/USD.

|

| Black market on February 10, 2025. Photo: Chogia.vn |

USD exchange rate today February 10, 2025 on the world market

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 108.04 - unchanged from February 9, 2025.

|

| DXY index developments in recent times. Source: Investing |

The DXY index started January at 109.4 and maintained its upward trend, even reaching 110 – its highest level in more than two years – on January 13.

The gains come as the US economy continues to grow solidly, with manufacturing posting its first positive growth in two years, with the PMI hitting 50.9 in January, job growth unexpectedly accelerating in December, while the unemployment rate fell to 4.1% and GDP growth in 2024 reached 2.8% thanks to strong consumer spending.

However, the greenback declined after President Trump took office and confirmed that he would not impose tariffs on his first day in office. This move showed the US's orientation towards using tariffs as a negotiating tool and wanting to reach agreements with other countries. As a result, this decision caused the DXY index to fall to 108 on January 21.

Notably, although inflation has cooled significantly from its 40-year highs by mid-2022, it remains a challenge for the Fed to continue cutting rates. Inflationary pressures persisted in the final month of 2024, with the PCE index rising 2.6% in December – still above the Fed’s 2% target.

Given the potential impact of the new administration's policies and the lingering risk of inflation, Fed officials decided to pause rate cuts at their January meeting after three cuts in 2024. As a result, the DXY index recovered slightly to 108.4 by the end of January.

However, this stability was quickly broken after Mr. Trump announced tariffs on goods from Mexico, Canada and China in early February, causing the USD price to increase again.

The euro and many other Asian currencies are also expected to continue to depreciate due to the strength of the USD. Analysts believe that the Fed will cut interest rates 1-2 times this year, around 25-50 basis points. Meanwhile, the European Central Bank (ECB), Bank of England (BoE) and Reserve Bank of Australia (RBA) are expected to cut between 75 and 100 basis points.

This widening interest rate differential will further strengthen the USD in the first half of 2025. UOB expects the euro to come under further pressure from the threat of US tariffs, leading it to fall alongside the pound and the Australian dollar.

Similarly, Asian currencies are also expected to depreciate. The USD/CNY exchange rate is expected to continue to rise to 7.65 yuan per dollar in the third quarter, from around 7.29 on the international market now. Meanwhile, the Singapore dollar, Thai baht, and Indonesian rupiah may be at their weakest in July/September.

|

| USD exchange rate today February 10, 2025. Illustration photo |

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop - No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts - No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Gold and Silver Store - No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company - No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store - No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones - No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store - No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store - No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store - No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange - 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop - 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop - 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center - 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store - Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop - No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop - No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop - No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Source: https://congthuong.vn/ty-gia-usd-hom-nay-10022025-nhieu-du-bao-bat-ngo-373004.html

Comment (0)