| Declining inventories push export coffee prices back to their highest level. Red Sea tensions push export coffee prices to stay high at the peak. |

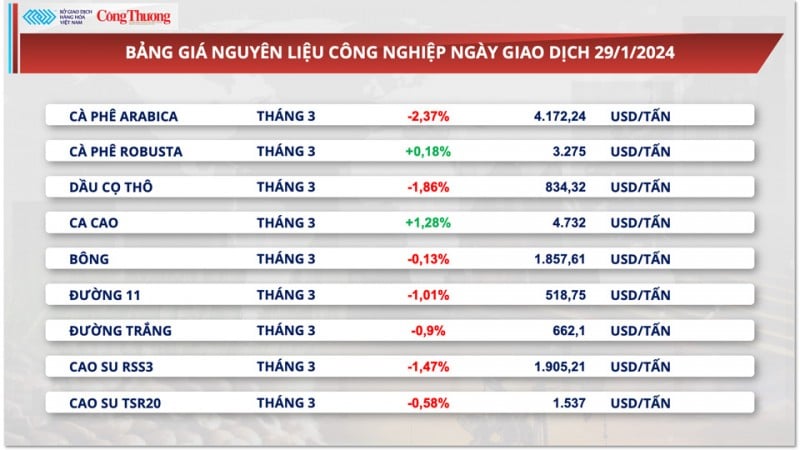

According to the Vietnam Commodity Exchange (MXV), at the end of the trading day on January 29, Robusta prices increased slightly by 0.18% to 3,275 USD/ton, the highest level in 30 years. Concerns about local supply shortages continued to keep prices high.

Robusta inventories on the ICE-EU as of January 28 were 29,770 tonnes, down 1,030 tonnes from the previous closing report. This brings the total Robusta stockpiled to a historic low. The alarming inventory levels amid disruptions in coffee supplies from Asia have further heightened concerns about supply shortages in the market.

|

| Concerns over local supply shortages continue to keep export coffee prices high |

On the contrary, Arabica prices decreased by 2.37% compared to the reference price, the increasing exchange rate difference between the currencies of the two largest exporting and importing countries in the world has put pressure on prices.

Accordingly, the USD strengthened in the middle of the session yesterday evening, while the domestic Brazilian Real weakened. This caused the USD/BRL exchange rate to increase sharply by 0.71%. The easing of the gap between the two currencies somewhat helped stimulate the demand for coffee sales by Brazilian farmers due to earning more foreign currency.

In addition, the stock of qualified Arabica on the ICE-US Exchange at the end of the session on January 26 decreased by 5,130 bags of 60kg. However, on the ICE Exchange, there are 73,708 bags awaiting certification, with more than 50,000 bags coming from Brazil. This is still a good balance for inventory to recover in the coming time when coffee certification activities are promoted.

According to the US Department of Agriculture (USDA), global coffee production in the 2022-2023 crop year will decrease, and exports will also decrease. In particular, sharp declines in Vietnam and Colombia, leading to a decrease in exports, are the main reasons for this adjustment.

Colombia’s Arabica coffee output is forecast to rise by 800,000 bags to 11.5 million on higher yields. However, Colombia’s output is still nearly 15% below the annual average. Vietnam’s Robusta coffee output in 2023-24 is forecast at around 26.6 million bags, up 1.2% from the previous year, while Arabica is forecast to fall 11.1% to 880,000 bags.

In India, coffee production is forecast to remain largely unchanged from the previous crop year at 6 million bags. In 2023-24, India’s Arabica coffee production is forecast to fall by 200,000 bags to 1.4 million bags.

|

| Vietnam's coffee exports in January 2024 continued to increase |

According to preliminary data from the General Statistics Office, Vietnam's coffee exports in January 2024 continued to increase, estimated at 210,000 tons, with a turnover of 621 million USD, up 1.1% in volume and 3.5% in turnover compared to the previous month; up sharply 47.6% in volume and 99.6% in turnover compared to the same period in 2023.

The average export coffee price in January 2024 increased again, reaching 2,955 USD/ton, up 2.3% over the previous month and up 35.2% over the same period in 2023.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)