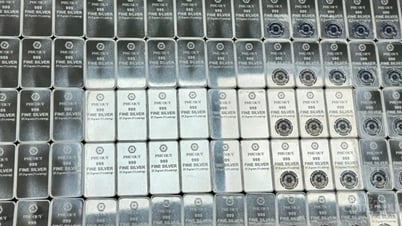

Silver price today (February 23, 2025), domestic and world silver prices decreased simultaneously in the weekend session.

Silver price today at Phu Quy Jewelry Group, silver price is stable, listed at 1,226,000 VND/tael (buy) and 1,264,000 VND/tael (sell) in Hanoi . In addition, according to a survey at other trading locations in Hanoi, domestic silver price has reversed sharply, currently listed at 1,017,000 VND/tael (buy) and 1,047,000 VND/tael (sell). In Ho Chi Minh City, silver price also decreased, currently at 1,019,000 VND/tael (buy) and 1,053,000 VND/tael (sell). World silver price continued to decrease after the previous increase, currently at 830,000 VND/ounce (buy) and 835,000 VND/ounce (sell).

Specifically, the latest information on silver prices today in the two largest markets of Hanoi and Ho Chi Minh City on February 23, 2025:

Silver type | Unit | Hanoi | Ho Chi Minh City | ||

Buy | Sell | Buy | Sell | ||

Silver 99.9 | 1 amount | 1,017,000 | 1,047,000 | 1,019,000 | 1,053,000 |

| 1 kg | 27,125,000 | 27,923,000 | 27,177,000 | 28,074,000 | |

| Silver 99.99 | 1 amount | 1,025,000 | 1,055,000 | 1,026,000 | 1,057,000 |

| 1 kg | 27,331,000 | 28,135,000 | 27,373,000 | 28,186,000 | |

Update the latest silver price list at Phu Quy Gold and Gemstone Group on February 23, 2025:

Silver type | Unit | VND | |

Buy | Sell | ||

Silver bars, Phu Quy 999 silver bars | 1 amount | 1,226,000 | 1,264,000 |

| Phu Quy 999 Silver Bar | 1 kg | 32,693,252 | 33,706,582 |

Latest update on world silver prices on February 23, 2025:

| Unit | World silver price today (VND) | |

Buy | Sell | |

| 1 Ounce | 830,000 | 835,000 |

| 1 only | 100,037 | 100,652 |

| 1 amount | 1,000,000 | 1,007,000 |

| 1 kg | 26,677,000 | 26,841,000 |

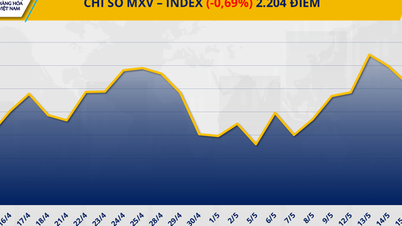

After the previous increase, recorded in the domestic and world markets, silver prices today decreased quite sharply. Specifically, the spot silver price stopped at 32.71 USD/ounce, down 0.34%.

Earlier, silver prices recovered 1.34% to $33.49/ounce - the highest level since late October 2024. The main reason driving the increase in metal commodities came from concerns about rising inflation in the US and signs of recovery in demand in China.

In a speech at a conference hosted by the Saudi Arabian Public Investment Fund in Miami on February 19, US President Donald Trump pledged to work with Republicans to implement a series of sweeping tax cuts to boost consumption and investment. Trump’s plan includes tax exemptions for service bonuses, social security and overtime pay, and tax incentives for domestic oil and gas producers.

In addition, the US President has proposed allowing businesses to fully deduct the cost of investing in new factories and other capital expenditures. Although these policies are expected to stimulate economic growth, experts warn that they could increase the budget deficit and put upward pressure on prices and bring back inflation. This will spur safe-haven buying and support the price of precious metals.

Source: https://congthuong.vn/gia-bac-hom-nay-2322025-bac-da-o-chieu-u-gia-m-375182.html

![[Photo] Prime Minister Pham Minh Chinh holds talks with Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/23b5dd1e595d429491a54e3c1548fb79)

![[Photo] Welcoming ceremony for Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra on official visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/cdd9e93739c54bb2858d76c3b203b437)

Comment (0)