Investors join hands with banks?

In fact, there are many projects where, before selling houses to customers, the investor mortgaged the entire project to the bank. Instead of releasing the mortgage and selling to customers, the investor did not do so and has not paid the debt, leading to the bank seizing the people's house debt. In many high-rise buildings, the investor, after selling the house to customers, continued to mortgage the house to the bank to borrow money for other purposes. Only when the debt could not be paid, the bank seized the house to recover the principal and interest did the residents fall flat. Therefore, the pink book for each apartment could not be made.

An apartment building in Ho Chi Minh City mortgaged residents' pink books to the bank.

A resident who suddenly had his house seized asked: "When an individual borrows money, the mortgaged property is checked very carefully by the bank in terms of legality, value, documents... I don't understand why investors can easily borrow money from sold apartments and still get through the bank's procedural barriers?" This is also the question of many people when witnessing the above awkward situation.

In fact, according to regulations when signing a real estate sale and purchase contract with a customer, if the investor is mortgaging the real estate at the bank, he must release the mortgage. When handing over the house to the customer to move in, the house must be inspected and accepted as eligible. After a certain period of time, the investor is responsible for issuing a pink book to the customer. The regulations are like that, but in reality, many apartments have not been inspected and accepted as eligible to move in, even without fire prevention and fighting inspection, and the project was built illegally, but they are still sold and handed over to customers to move in. In particular, the situation of "selling unripe rice" apartments is also one of the reasons leading to the situation where residents are at risk of losing their homes. Specifically, right at the beginning of the project implementation, even before completing the procedures, only having land, many investors have opened for sale. Buyers can pay in one go or pay in installments according to the progress of the project. Thus, on paper, the project is under the name of the investor, but in fact the property is already owned by the customer. In many cases, banks know that investors have sold houses to customers but still "turn a blind eye" and let investors mortgage them to borrow money.

Lawyer Nguyen Mau Thuong, Deputy Director of Hoang Thu Law Firm, said: There are cases where the investor mortgaged the real estate first, then sold it to the customer without the customer knowing. There are also cases where the investor sold the house to the customer, then continued to mortgage the project to the bank to borrow money. Because when selling to the customer, the sales contract was not registered with any agency but only stored at the company, so the bank did not know whether the investor had sold the real estate to the customer or not. It is also possible that the investor intentionally concealed the case, and the bank did not carefully evaluate the case, so it lent the investor, while these apartments were actually sold.

"During construction, the investor lacked capital and mortgaged the land use rights and future assets, which were houses, to the bank. The buyer had no way of knowing that the apartment he bought was mortgaged. The bank that accepted the mortgage should have posted the information publicly so that people would know. Only when the investor had released the mortgage could the buyer sign the sales contract. But here the investor circumvented the law, ambiguously signing a cooperation contract or a contract promising to buy and sell. Now that the incident has been exposed, the buyer has suffered all the losses. It is clear that the real estate was mortgaged to the bank but the investor still sold it to customers, proving that the investor defrauded customers. The investor must be prosecuted criminally. Even the bank is responsible in this case, it cannot be innocent," lawyer Nguyen Mau Thuong analyzed.

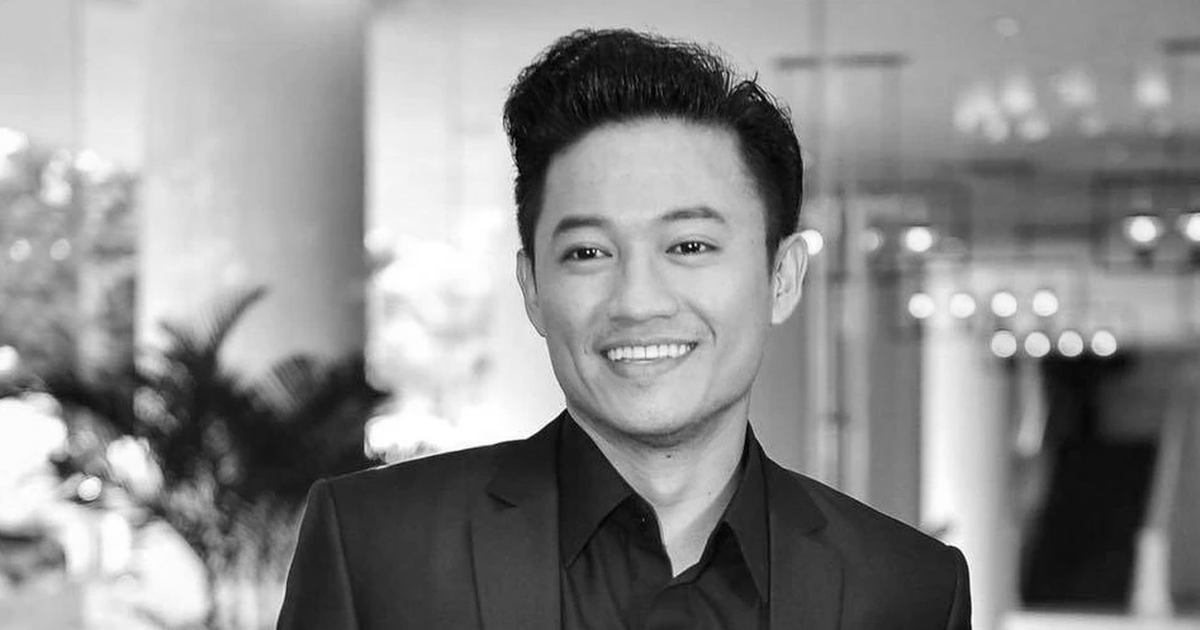

Mr. Le Hoang Chau, Chairman of Ho Chi Minh City Real Estate Association

Must issue pink book to home buyers

In terms of legal analysis, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, said that the 2006 Real Estate Business Law is not as strict as the 2024 Real Estate Business Law, because the law only prohibits investors from illegally mobilizing and appropriating capital from buyers and hire-purchasers. The law also allows projects to be operated when they are completed or formed in the future.

"But the Civil Code stipulates that a property cannot be traded twice. If the entire building has been mortgaged to the bank, it cannot be sold to customers. If the mortgage has been done to the bank and the investor continues to sell it to customers, the investor is violating the law. The bank is also at fault, because when accepting the mortgage, the bank must manage the mortgaged property, and cannot say that it does not know that the investor has sold it to customers. Especially when the mortgaged property is a house formed in the future, it must be even more careful to monitor the loan source to ensure that it is used and disbursed for the right purpose. Thus, the bank is at fault, responsible; and the buyer is the honest party, the victim," Mr. Chau analyzed and added: "If the investor has fully announced the mortgaged project but the customer still buys it, the customer is responsible. On the contrary, if the investor conceals the mortgage of the project and still sells it to the customer, the customer is the victim. In the case of an apartment that has been sold to the customer and is mortgaged, the investor has the right to The error and the bank are also at fault for not assessing carefully. At that time, the customer is innocent and protected. Therefore, the state needs to issue pink books for customers; the investor and the bank will deal with each other or drag each other to court."

"Since 2013, we have made such a recommendation, but until now people still have not had their legitimate rights protected," Mr. Le Hoang Chau emphasized.

Lawyer Vu Anh Tuan (Ho Chi Minh City Bar Association) also affirmed: The investor sold real estate to the people and also mortgaged the property to the bank, which is a fraud. The bank and the people buying real estate must file a complaint against the investor to the police and file a civil lawsuit against the investor in court to protect the customers. When the bank sues the investor, the people buying the house are the ones with related rights and obligations whose rights will be considered and resolved by the court. Particularly, if the investor is considered and processed in a criminal case, the civil part of the bank and the people buying the house will also be resolved, there can be no such thing as seizing the customers' houses.

It is known that up to now, in Ho Chi Minh City, there are still about 60,000 houses that have not been granted pink books, including many projects where investors have mortgaged people's houses to borrow money from banks but could not repay the debt and the banks kept the pink books. Recently, the Ho Chi Minh City People's Council also held a meeting to question the Ho Chi Minh City People's Committee about the responsibility in managing apartments and granting pink books. Accordingly, in addition to the violations of investors and banks, there is also a part of the responsibility of the authorities when managing and punishing them not strictly, even showing signs of covering up and condoning wrongdoing. Therefore, it is necessary to separate the handling of violations of investors and banks from the granting of pink books to home buyers.

Source: https://thanhnien.vn/bong-dung-bi-ngan-hang-siet-nha-ngan-hang-khong-the-vo-can-185240624210628743.htm

Comment (0)