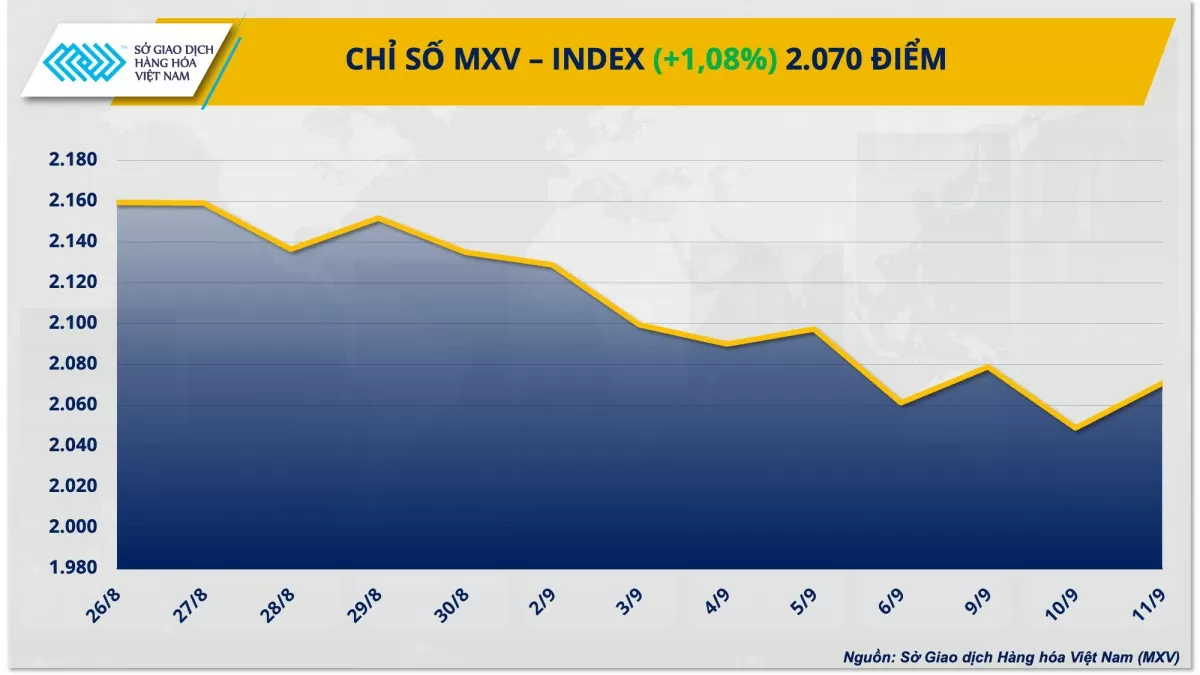

| Commodity market today, September 10: Strong buying power pushes the MXV-Index up Commodity market today, September 11: After a positive session, world raw material prices continue to reverse |

Notably, all 10 items in the metal group closed in the green. In the industrial raw materials market, prices of most items are recovering and increasing strongly. Notably, the trading price of Robusta coffee has surpassed the 5,000 USD/ton mark. Closing, the MXV-Index increased by 1.08% to 2,070 points.

|

| MXV-Index |

Metal markets are green after US inflation report shows low

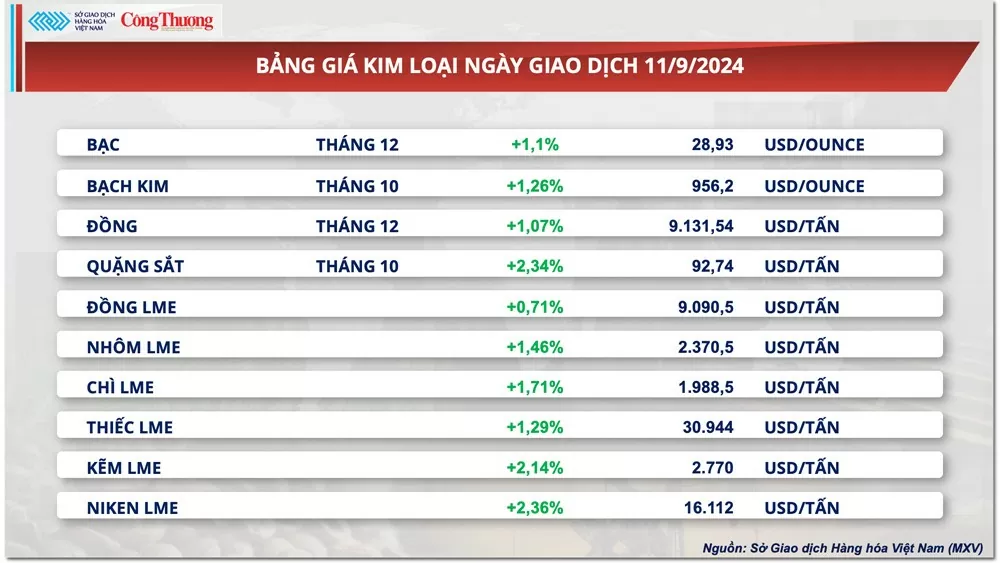

The metals market had a good trading day as all commodities increased in price. For precious metals, silver and platinum both increased by more than 1%, closing at $28.93/ounce and $956.2/ounce, respectively. Precious metals prices benefited after the US announced cooling inflation data, helping the market confirm that the US Federal Reserve (FED) will cut interest rates by 25 basis points at its September meeting.

|

| Metal price list |

Specifically, according to data released by the US Department of Labor's Bureau of Labor Statistics yesterday, the country's consumer price index (CPI) increased 2.5% year-on-year in August, in line with forecasts and down from the previous month's 2.9% increase. In addition, the core CPI, which excludes volatile food and energy prices, held steady at 3.2% for the second consecutive month. However, on a monthly basis, the core CPI unexpectedly increased 0.3% in August. This figure was 0.1 percentage points higher than forecast and the highest level in the past four months.

The unexpected monthly increase in core CPI data has dampened the case for a large-scale Fed rate cut. However, the report continues to confirm that U.S. inflation remains on track to fall back to the Fed’s 2% target, allowing the Fed to cut rates at its meeting next week, expected to be by 25 basis points. Silver and platinum prices have also benefited as the low-interest-rate environment is a favorable investment environment for precious metals.

In terms of base metals, COMEX copper prices experienced a rather volatile session yesterday. However, thanks to the dominant buying force, COMEX copper prices closed the session up 1.07% to $9,131/ton. Although the gloomy consumption outlook still put heavy pressure on copper prices, the support of macro factors helped copper prices recover in yesterday's trading session. In addition, the risk of supply shortages at major copper suppliers also contributed to boosting copper buying force during the session.

Specifically, according to data from the Chilean Copper Commission Cochilco, copper output at Codelco, the world's largest copper supplier, reached only 111,400 tonnes in July, down 10.7% compared to the same period last year. This copper supplier is still struggling with a decline in production due to disruptions in mining operations, especially in Chile.

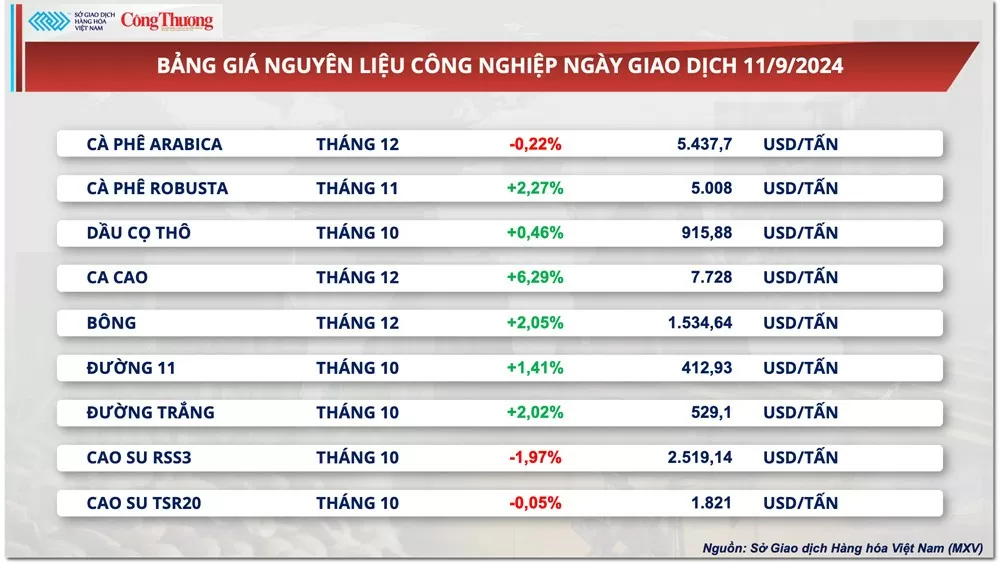

Cocoa prices skyrocket

In another notable development in the industrial raw material market, cocoa prices jumped nearly 6.3% to $7,728 a tonne yesterday. Global cocoa prices have surged this year due to disease and adverse weather in Ghana and Ivory Coast - which supply more than 60% of the world's cocoa - pushing the market into deficit for the third consecutive year. Recently, according to a foreign source, Ghana has increased its cocoa purchasing price by nearly 45% to increase profits for farmers and prevent cocoa bean smuggling.

|

| Industrial raw material price list |

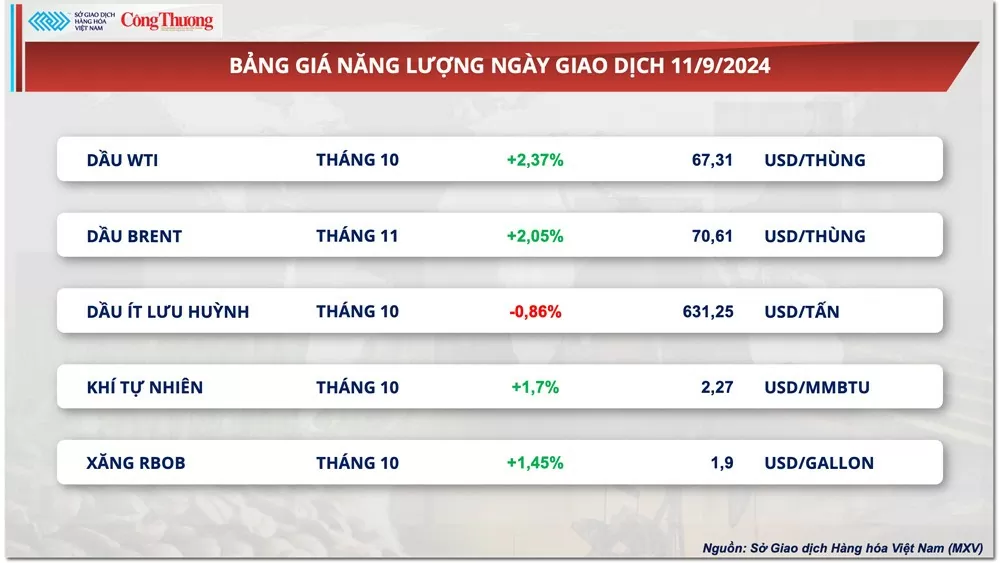

Prices of some other goods

|

| Agricultural product price list |

|

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-129-luc-mua-manh-quay-lai-thi-truong-keo-chi-so-mxv-index-phuc-hoi-345312.html

Comment (0)