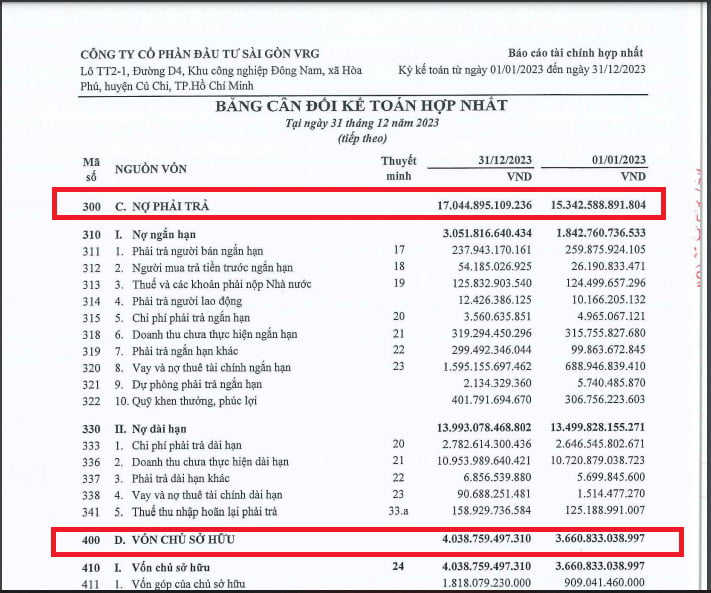

The liabilities of Saigon VRG Investment JSC (Stock code: SIP) as of December 31, 2023 were recorded at VND 17,044 billion, an increase of 11% compared to the beginning of the year. Meanwhile, the company's equity (VCSH) only reached VND 4,038 billion. SIP's liabilities at the end of 2023 were 4 times higher than its equity.

Similarly, liabilities at Tin Nghia Corporation (Stock code: TID) were also 2.8 times higher than equity, recording VND 11,486 billion at the end of 2023, up 8% over the same period last year. Meanwhile, TID's equity was only VND 4,076 billion.

At the end of 2023, liabilities at Van Phu Investment Joint Stock Company - INVEST (Stock code: VPI) reached VND 8,553 billion, an increase of 16% over the same period last year, while equity at this enterprise was only VND 3,919 billion.

These businesses all have liabilities 2 - 4 times higher than equity.

What is a safe ratio?

According to Dr. Nguyen Tri Hieu, a finance and banking expert, the debt/equity ratio according to the financial leverage ratio is 1/1, which is considered normal, meaning that for every 1 dong of debt, the equity is also 1 dong. Even a ratio of 2/1 is not too risky, the alarming situation is when the ratio reaches 3/1.

However, this expert also believes that to assess whether a business is able to pay or not, it is necessary to consider the business's cash flow. If we only talk about equity and total debt, it is only a temporary picture. For example, at this time, the leverage ratio is 1/1 or 2/1, but it does not say whether the cash flow will come in the future or not.

A business's cash flow is money coming in from profits, from investors' contributions, or borrowing from other places, selling assets, selling inventory... and this number must be greater than liabilities to be safe.

The expert also said that it is necessary to consider the industry, because each industry has a different leverage ratio. For example, in the banking industry, the K coefficient is around 8%, divided by the leverage ratio of around 11/1; or for the construction industry, the acceptable ratio is 2/1; or the wholesale industry, the equity is often very thin and there is a lot of debt, in this case, the ratio of wholesale enterprises can be up to 5/1 or 6/1; and for the service industry, the acceptable ratio is at 2/1...

Dr. Nguyen Tri Hieu analyzed that there are two possible scenarios when businesses have a debt/equity ratio of up to 3/1, which is at an alarming level. Accordingly, the enterprise's equity can decrease sharply due to the loss of assets of the enterprise, such as customers not paying debts, damaged inventory, damaged fixed assets, etc., which will reduce the enterprise's equity.

When the equity decreases, this ratio will no longer be 3/1, but will increase to 4/1, 5/1... At that time, the business can easily go bankrupt because their equity is too low to bear a large debt burden.

In addition, with thin equity, businesses often have to borrow. In case the business does not do well and has to borrow a lot to bear financial debt or to develop, the leverage ratio will be very high, which can lead to bankruptcy.

Source

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

![[Photo] President Luong Cuong receives Ambassador of the Dominican Republic Jaime Francisco Rodriguez](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/12c7d14ff988439eaa905c56303b4683)

Comment (0)