Nam A Commercial Joint Stock Bank (Nam A Bank, HoSE: NAB) has just announced the appointment of Mr. Nguyen Hai Dang as Deputy General Director with a term of 12 months.

According to information from Nam A Bank's 2023 annual report, Mr. Nguyen Hai Dang graduated from the University of Economic Law. Mr. Dang has more than 13 years of experience in the field of Finance - Banking, holding many important positions at domestic banks.

He has been with Nam A Bank since 2019, holding the positions of Deputy General Director's Office, Head of General Director's Office, and Director of Risk Management Division.

Before being appointed to the position of Deputy General Director, Mr. Dang was the Director of Personal Customer Division at Nam A Bank from February 2023.

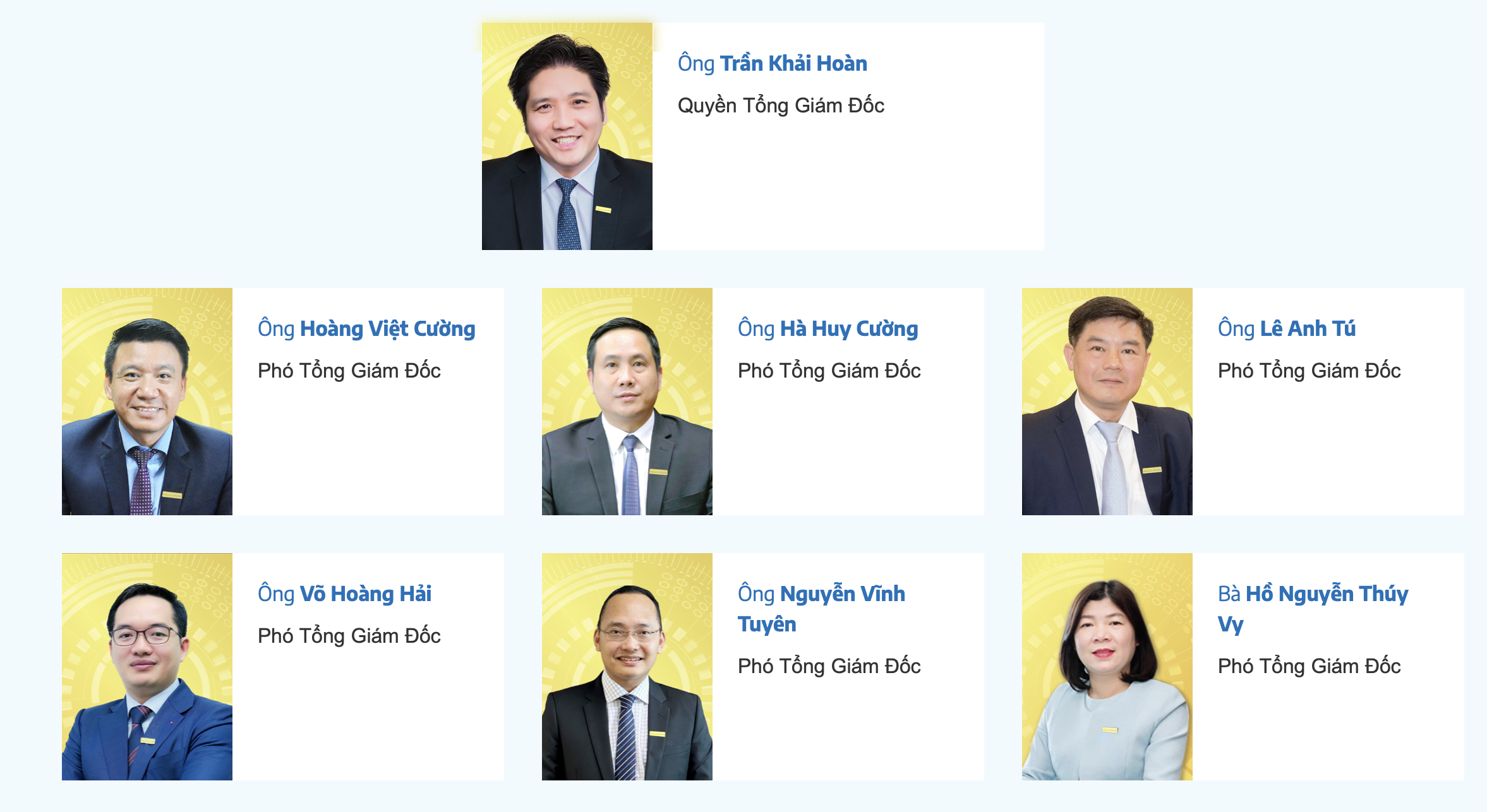

On the Nam A Bank website, the bank's Board of Directors currently has a total of 7 members with Mr. Tran Khai Hoan as Acting General Director. Thus, with the appointment of Mr. Dang as Deputy General Director, the bank's Board of Directors will have 8 members.

Information about Nam A Bank's Board of Directors on the bank's website.

On the same day, the bank also announced that it will close the list of shareholders issuing shares to increase share capital from equity on July 12, 2024.

Accordingly, Nam A Bank will issue an additional 264.5 million shares with an exercise ratio of 25%, equivalent to shareholders owning 100 shares will receive 25 new shares. After completion, the bank's charter capital will increase by VND2,654 billion.

The source of issuance is undistributed profits in 2023 (after deducting funds) and undistributed profits from previous years.

At the same time, the bank also plans to increase capital from issuing shares under the employee stock option program (ESOP) by VND500 billion, equivalent to issuing 50 million shares.

After two issuances, Nam A Bank is expected to increase more than VND3,145 billion, raising its charter capital from over VND10,580 billion to VND13,725 billion.

The purpose of increasing charter capital is to strengthen financial capacity to meet the needs of developing banking activities such as purchasing and investing in fixed assets; improving facilities; enhancing banking technology; and developing human resources .

Source: https://www.nguoiduatin.vn/nam-a-bank-co-them-pho-tong-giam-doc-a671200.html

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Infographic] Vietnam's manufacturing industry recovers: Positive signals in early 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/53389fc2248e47c8a06ec8c00a632823)

Comment (0)