Average deposit interest rate 5.8%/year

At the press conference of the State Bank of Vietnam (SBV) on the morning of June 21, Deputy Governor Dao Minh Tu said that the interest rate level has basically stabilized, and deposit and new lending interest rates have tended to gradually decrease. The average deposit interest rate of commercial banks (CBs) is at about 5.8%/year, down 0.7% compared to the end of 2022). The average lending interest rate in VND is at about 8.9%/year (down 1.0%/year compared to the end of 2022).

Regarding exchange rate management, the domestic foreign exchange market and exchange rates have been relatively stable over the past 6 months, market liquidity has been smooth, and legitimate foreign currency needs have been fully met. The State Bank of Vietnam has purchased foreign currency from credit institutions to supplement the state foreign exchange reserves.

In credit management, the State Bank directs credit institutions to direct credit to production and business sectors, priority sectors and economic growth drivers according to the Government's policy; ensure safe and effective credit activities; strictly control credit in potentially risky sectors; create favorable conditions for businesses and people to access bank credit capital.

In addition, the State Bank has proactively implemented many solutions to increase access to formal credit and protect the legitimate rights and interests of people and businesses when borrowing from credit institutions, thereby contributing to limiting and repelling "black credit".

As of June 15, outstanding credit balance of the entire economy reached about 12.32 million billion VND, up 3.36% compared to the end of 2022, up 8.94% over the same period last year.

Orientation of monetary policy management in the coming time

Deputy Governor Dao Minh Tu affirmed that in the coming time, the State Bank will continue to closely follow market developments and the domestic and foreign economic situation to flexibly and synchronously manage monetary policy tools and solutions to control inflation, contributing to stabilizing the macro-economy, stabilizing the money and foreign exchange markets, and controlling credit growth according to the set orientation.

Conduct open market operations flexibly and proactively, ready to support liquidity for the credit institution system. Recapitalize credit institutions to support liquidity, lend to programs approved by the Government and the Prime Minister, support the restructuring of credit institutions and bad debt settlement; Operate compulsory reserve instruments in accordance with economic and monetary developments, and other monetary policy management measures to implement monetary policy objectives.

Regulate interest rates in line with macroeconomic balance, inflation and monetary policy targets; continue to encourage credit institutions to cut costs and reduce lending interest rates to support businesses in recovering and developing production and business.

Manage the growth of credit volume and structure reasonably, meet the credit capital demand of the economy to contribute to controlling inflation, supporting economic growth, directing credit to production and business sectors, priority sectors and economic growth drivers according to the Government's policy, strictly control credit in sectors with potential risks; create favorable conditions for businesses and people to access bank credit capital.

Continue to implement assigned tasks in the Project on Restructuring the System of Credit Institutions in conjunction with Bad Debt Handling for the 2021-2025 period according to the direction of all levels.

Source

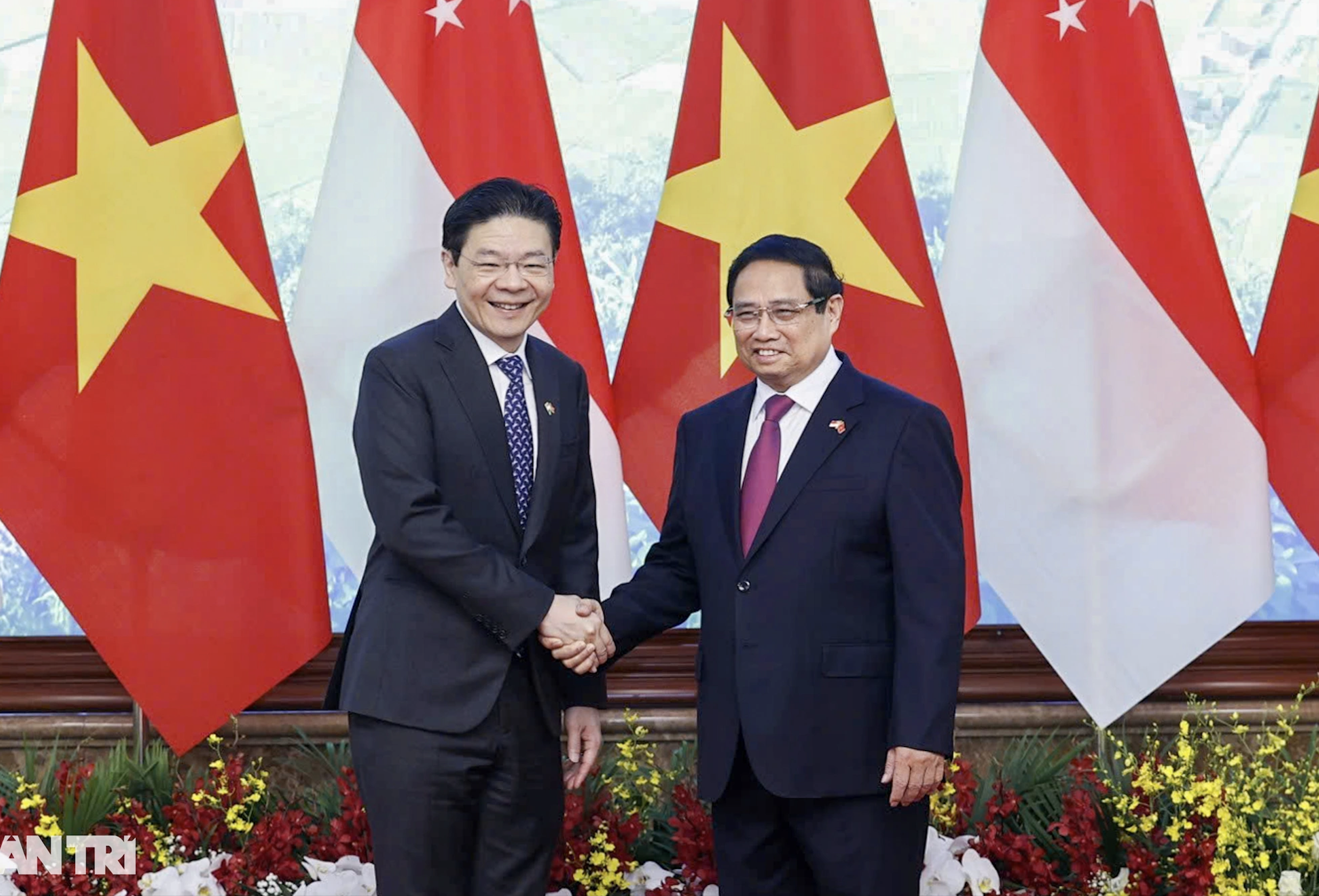

![[Photo] Prime Minister Pham Minh Chinh holds talks with Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/04f6369d4deb43cfa955bf4315d55658)

![[Photo] Close-up of old apartment building waiting to be renovated](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/bb2001a1b6fe478a8085a5fa20ef4761)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

Comment (0)