Depositors, whether one dong or one day in the account, are still charged interest, an increasingly popular trend with many commercial banks joining in. This trend helps credit institutions mobilize idle money at low interest rates, thereby contributing to reducing input costs and stabilizing lending rates.

High interest rate

As an office worker, every month after receiving her salary, Ms. Ngoc Hanh (living in Binh Thanh District, Ho Chi Minh City) always puts several million to tens of million VND in her account as idle money. Previously, this amount of money of hers had a non-term interest rate of 0.1 - 0.5%/year. In the past few months, she has seen some banks launch the feature of interest-bearing accounts - interest rates many times higher than non-term deposits and much more flexible than savings deposits with terms of 1 month or more.

According to the reporter of Nguoi Lao Dong Newspaper, more and more banks are launching interest-bearing account features on the market. Vietnam Prosperity Bank (VPBank) is the latest name to join this wave.

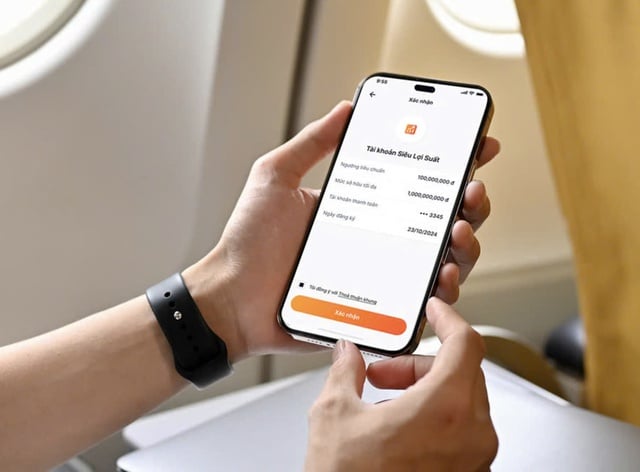

Accordingly, from mid-March 2025, VPBank launched the automatic profit-making super tool "Super Profit" - a feature that helps customers optimize profits from idle money in their accounts with a fixed interest rate of 3.5%/year. Just one minute of registration on the VPBank NEO application, the system of this bank will automatically process and idle money in the account - paying both principal and interest to the customer's account daily.

At VIB, customers only need to activate the super yield feature on their VIB payment account to optimize daily profits with a yield up to 43 times higher than usual. Leaving money in the account for 1 day, customers will also be charged an interest rate of up to 4.3%/year, after selecting 2 standard account thresholds of 10 million VND and 100 million VND.

"After the customer selects the threshold, the excess amount in the payment account balance will be connected to the account to enjoy an interest rate of up to 4.3%/year, much higher than the 0.1%/year of a regular payment account," said a VIB representative.

Previously, the first bank to launch this feature was Vietnam Technological and Commercial Joint Stock Bank (Techcombank). Since the beginning of 2024, Techcombank has deployed the "Automatic Profit" account - paying high interest rates on idle funds in payment accounts with this feature enabled. After more than 1 year, nearly 3 million customers with account balances of approximately VND 80,000 billion have optimized benefits, enjoying interest rates higher than non-term interest rates.

Recently, Techcombank continues to improve this product with "Automatic Profit" version 2.0, helping customers flexibly use the entire account balance for all transactions such as payment, transfer or withdrawal 24/7 anytime, anywhere. All idle money of customers is profitable, even for just 1 day. The highest interest rate is up to 4%/year.

Banks are racing to deploy automatic profit-making features with interest rates many times higher than non-term deposit accounts. Photo: Lam Giang

Optimize capital flow

Previously, some banks required a minimum balance of VND10 million to start calculating interest from payment accounts, but now, even if customers deposit just one dong or one day, they will receive the maximum interest rate from interest-bearing accounts.

In a broader sense, personal finance is not just about the individual, but also has a direct impact on the functioning of the economy. When money flows and is optimized, not only customers benefit but the economy also grows stronger.

Mr. Ho Van Long, Deputy General Director and Director of VIB Retail Banking, analyzed that a large part of the total amount of money in the economy is in payment accounts without generating interest. This is a huge financial waste.

If this flow of money is operated intelligently, not only individuals benefit but the entire economic system becomes more dynamic. When more people know how to take advantage of their financial assets, aggregate demand increases, capital flows more efficiently, and this creates a positive spillover effect for the entire economy.

"It is estimated that when the super-yield account reaches the expected scale, VIB can reduce up to 10% of capital costs, thereby helping to reduce loan interest rates, bringing more practical benefits to customers. This is also the direction that the Government and the State Bank are calling on banks to implement in order to develop a green economy, a circular economy, promote digital transformation and innovation" - Mr. Ho Van Long said.

According to banking finance experts, automatic interest-bearing accounts are not just a trend but could be a revolution in the banking industry. Banks are contributing to changing customers' thinking about a completely new financial product, bringing more value like what Apple did with phones, making the iPhone a symbol of the world.

Associate Professor, Dr. Nguyen Huu Huan, Ho Chi Minh City University of Economics (UEH), commented that attracting customers with interest-bearing accounts is creating a race to attract more commercial banks to participate. Because compared to non-term deposit accounts (CASA), interest-bearing accounts will help banks proactively plan customers' idle capital better.

"The trend of personalizing banking financial products and services is becoming more and more popular. In the race to attract idle cash from customers, banks not only provide financial solutions to personalize the experience but also use technology, AI, and consumer behavior analysis to cross-sell products and services" - Associate Professor, Dr. Nguyen Huu Huan said.

Source: https://nld.com.vn/hut-tien-nhan-roi-bang-tai-khoan-sinh-loi-196250324205831419.htm

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)