Payment history, collateral, loan term, business plan, repayment plan, customer's level of 'loyalty',... are key factors that determine the loan interest rate.

According to banks and businesses, being “loyal” to a bank will help build trust in the bank, thereby being able to get preferential interest rates. For businesses, a standard accounting system will also help score points in the eyes of the bank.

As a business operating in the field of rice purchasing, processing and exporting, Hoang Minh Nhat Joint Stock Company (Thoi Lai town, Thoi Lai district, Can Tho city) always has outstanding debt of hundreds of billions of VND at a state-owned commercial bank.

General Director Nguyen Van Nhut said that since its establishment in 2006, for nearly 20 years the company has had credit relations with only one bank.

“Hunting” for a bank loan package with low interest rates is always the top desire of borrowers. Banks today all provide preferential interest rate credit packages not only for priority areas according to regulations.

According to Mr. Nhut, the interest rate his business has to pay to the bank is always 1.5%/year lower than the general level.

“There are many commercial banks inviting us to borrow capital, they are even willing to lend on credit. The company itself has tried using the services of some other banks. But I realized that a long-term relationship with a bank will help the company gain high credit, thereby enjoying preferential interest rates as well as related procedures, especially for export companies like Hoang Minh Nhat,” said Mr. Nhut.

However, Mr. Nhut said that the first important thing is that businesses must be responsible for their loans. Once they have paid their debts on time and have a good business plan, banks are ready to continue lending.

From a banking perspective, a BIDV bank leader said that businesses borrow capital from many places, making it impossible for the bank to truly achieve its goals.

“There are businesses that have relationships with 5-7 banks at the same time, while their financial reports are not transparent. This makes some banks feel discouraged in implementing solutions to support and restructure businesses,” he said.

Meanwhile, sharing experiences to be able to enjoy preferential interest rates when borrowing from banks is summarized by a bank in the following notes:

Building a good credit history: Paying old loans in full and on time, without any outstanding debts, bad debts, etc. will help the customer's credit history to be at a good level. This is one of the bases for the bank to consider preferential interest rates for subsequent loans.

Choose a short-term loan, small loan amount: For large value loans, the longer the repayment period, the higher the interest rate to be paid.

Prepare collateral of appropriate value: Collateral is one of the important bases for loan approval and interest rate. Bank loan products also meet diverse conditions and needs of customers, accepting collateral from savings books, cars, real estate,...

Prepare personal records and documents proving financial resources in full and transparent: These are documents that support the quick loan approval process. At the same time, proving financial resources can help borrowers choose loan packages with preferential interest rates.

In particular, for unsecured consumer loans, financial documents are an important basis for approving loan interest rates.

In addition, borrowers need to pay attention to updating the bank's preferential credit policies from time to time. In each period, the bank will deploy new loans with preferential interest rates for different subjects. Customers can follow these programs through the bank's website, fanpage, customer care email or contact the bank's hotline, credit specialist, etc.

In general, repayment history, collateral, loan term, etc. are key factors that determine the loan interest rate.

Source: https://vietnamnet.vn/bat-mi-kinh-nghiem-vay-ngan-hang-lai-suat-thap-2382140.html

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

![[Photo] Celebrating the 70th Anniversary of Nhan Dan Newspaper Printing House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a7a2e257814e4ce3b6281bd5ad2996b8)

![[Photo] Prime Minister Pham Minh Chinh works with state-owned enterprises on digital transformation and promoting growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f55bfb8a7db84af89332844c37778476)

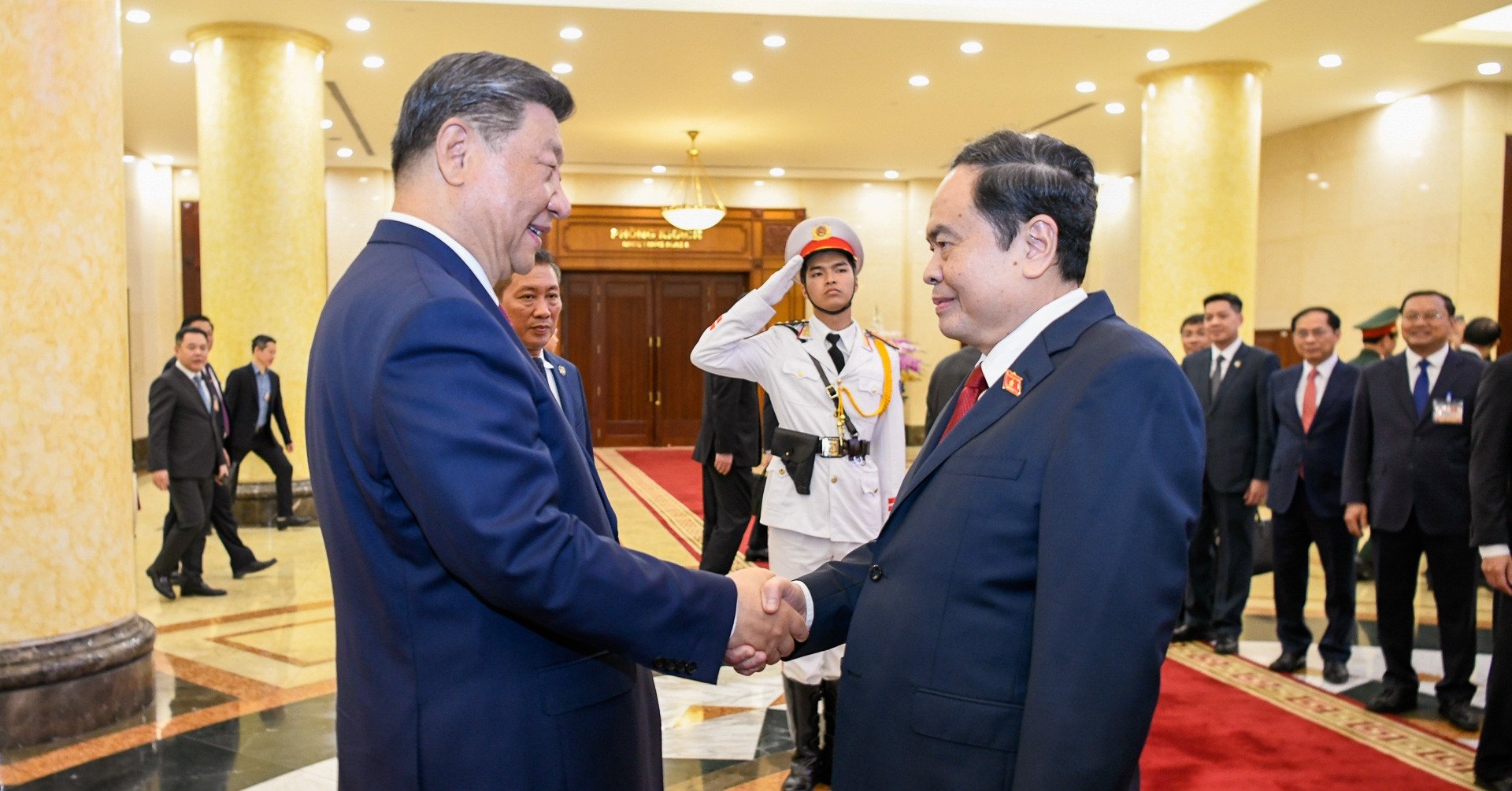

![[Photo] Vietnamese and Chinese leaders attend the People's Friendship Meeting between the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7d45d6c170034d52be046fa86b3d1d62)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

Comment (0)