Understanding how to calculate bank loan interest rates will help customers estimate the amount to be paid and the interest to consider the loan request level according to their financial capacity.

To calculate bank loan interest accurately, customers need to clearly determine the interest calculation period, actual balance, number of days to maintain the actual balance, interest rate and interest calculation formula.

The interest calculation period is determined from the day following the disbursement date of the credit facility until the end of the day of full payment of the credit facility (excluding the first day, counting the last day of the interest calculation period) and the time to determine the balance for interest calculation is the beginning of each day during the interest calculation period.

Actual balance , is the opening balance of the principal balance in due date, overdue principal balance, and actual late interest balance that the credit recipient still has to pay to the credit provider, used to calculate interest according to the agreement and regulations of the law on credit granting.

Actual retention days , is the number of days that the actual opening balance does not change.

Interest rate is calculated as %/year, a year is 365 days.

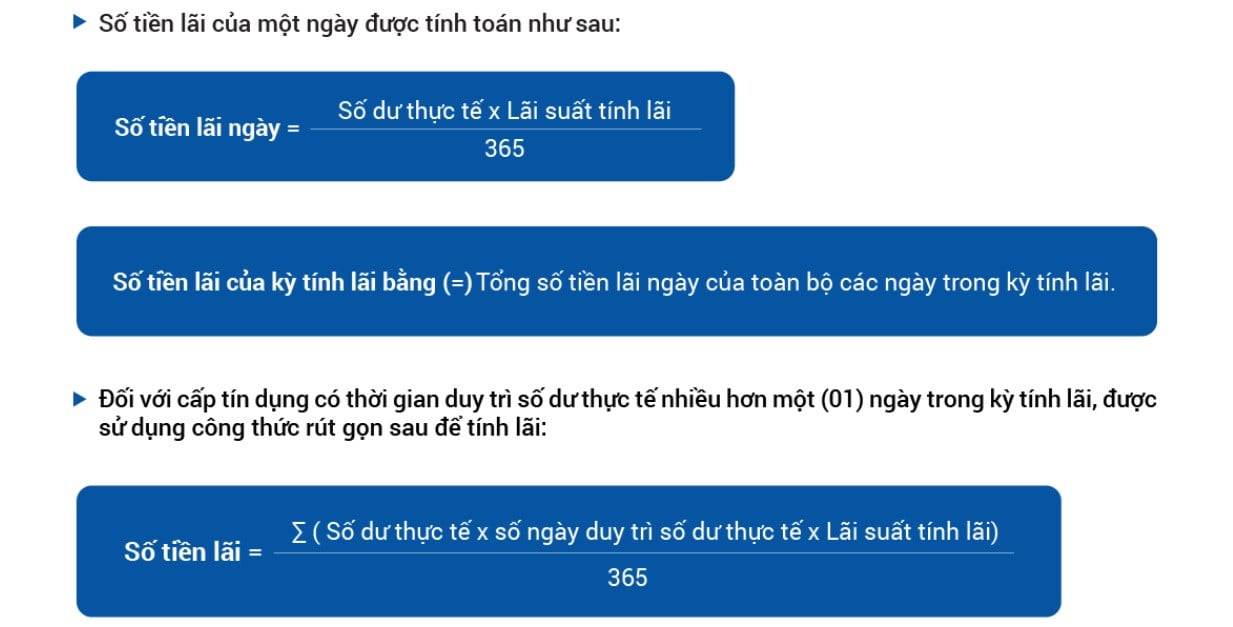

Interest calculation formula , interest amount of each interest calculation period is determined as follows:

How to calculate interest on bank loans paid in installments based on principal balance

When borrowing from a bank in the form of monthly installment loans according to the principal balance, the borrower will pay a fixed amount of money each month, including interest and principal, throughout the loan term as stated in the contract. The special point is that the amount of interest the customer pays each month will not change throughout the loan term.

The formula for calculating bank loan interest is as follows:

Monthly interest = Principal balance x Loan interest rate x Actual number of loan days/365

Monthly bank loan interest rate percentage = (Monthly interest/Loan amount) x 100%.

Payment period can be calculated monthly or annually depending on the agreement specified in the loan contract.

For example: Customer A wants to borrow 36,000,000 VND for 1 year, interest rate is 12%/year, choose to pay equally according to the principal balance every month.

- Principal amount to be paid monthly = 36,000,000/12 = 3,000,000 VND.

- Monthly interest payable = (36,000,000 x 12%)/12 = 360,000 VND.

Thus, the total amount (including principal and interest) A must pay monthly is 3,360,000 VND.

How to calculate bank loan interest based on decreasing balance

The method of calculating interest based on the decreasing balance is quite commonly applied in consumer loan contracts. Accordingly, each subsequent payment period is recalculated based on the principal balance of the previous period.

Thus, the amount payable each period is gradually reduced over time.

The formula for calculating interest on a loan with a decreasing balance is as follows:

Principal per payment period = Loan amount/Loan term

First period interest = Loan amount x Periodic interest rate

Interest for subsequent periods = Remaining principal amount x Loan interest rate

For example: Customer A wants to borrow 100,000,000 VND for 1 year, interest rate is 12%/year, choose to pay equally according to the principal balance every month. The calculation of interest and principal of the loan is as follows:

| Repayment period | Monthly interest and principal payments | Interest | Principal | Current outstanding balance |

| January | 9.3333.333 | 1,000,000 | 8,333,333 | 91,666,667 |

| February | 9,250,000 | 916,667 | 8,333,333 | 83,333,333 |

| March | 9,166,667 | 833,333 | 8,333,333 | 75,000,000 |

| April | 9,083,333 | 750,000 | 8,333,333 | 66,666,667 |

| May | 9,000,000 | 666,667 | 8,333,333 | 58,333,333 |

| June | 8,916,667 | 583,333 | 8,333,333 | 50,000,000 |

| July | 8,833,333 | 500,000 | 8,333,333 | 41,666,667 |

| August | 8,750,000 | 416,667 | 8,333,333 | 33,333,333 |

| September | 8,666,667 | 333,333 | 8,333,333 | 25,000,000 |

| October | 8,583,333 | 250,000 | 8,333,333 | 16,666,667 |

| November | 8,500,000 | 166,667 | 8,333,333 | 8,333,333 |

| December | 8,416,667 | 83,333 | 8,333,333 | 0 |

Source: https://vietnamnet.vn/cach-tinh-lai-suat-vay-ngan-hang-de-khong-bi-nang-no-2382134.html

Comment (0)