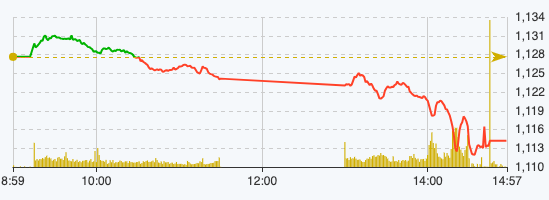

After a slight increase in the opening minutes, the market fell again when selling pressure appeared in the second half of the morning session.

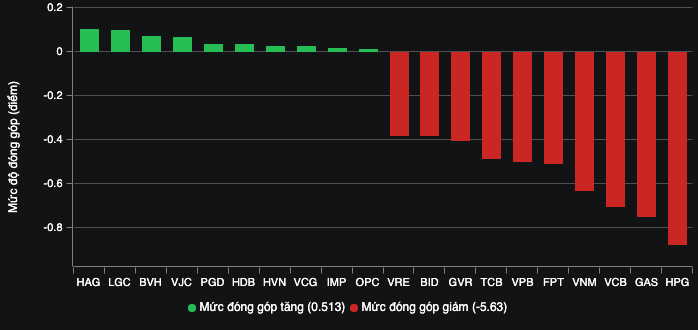

In the large-cap group, only 6 stocks remained green, but the increase was not much, with BVH increasing the most with 1.2%. The stocks GAS, BID, VPB, TCB, VRE, BCM negatively impacted the market by taking away about 2 index points. The banking, securities and real estate groups were in a slight correction trend.

At the end of the morning session on December 13, VN-Index decreased by 3.48 points, equivalent to 0.21% to 1,124.15 points. The entire floor had 145 stocks increasing and 293 stocks decreasing. HNX-Index decreased by 1.27 points to 230.44 points. UPCoM-Index decreased by 0.07 points, equivalent to 0.08% to 85.28 points.

VN-Index performance on December 13 (Source: FireAnt).

Entering the afternoon session, investor sentiment continued to be cautious and short-term profit-taking pressure increased sharply, causing the electronic board to be flooded with red.

At the end of the trading session on December 13, VN-Index decreased by 13.43 points, equivalent to 1.19% to 1,114.2 points. The entire floor had only 89 stocks increasing but 448 stocks decreasing, 70 stocks remaining unchanged.

HNX-Index decreased by 3.29 points, equivalent to 1.42% to 228.42 points. The whole floor had 50 stocks increasing, 113 stocks decreasing and 63 stocks remaining unchanged. UPCoM-Index decreased by 0.26 points to 85.09 points.

In the VN30 basket alone, 27 stocks decreased in price, only BVH, HDB and VJC reversed the trend and ended the session with an increase. The large-cap group was the burden of the market in today's session when HPG, GAS, VCB, VNM, FPT, VPB, TCB, GVR, BID, and VRE took away 5.63 points.

Most industry groups ended the session in red, especially steel stocks that fell the most with HPG down 2.15%, HSG down 2.99%, NKG down 2.78%, POM down 5.34%, VGS down 349%, HSV down to the floor 14.29%.

The oil and gas group was also not very positive when PVS decreased by 3.81%, PVD decreased by 3.68%, PVC decreased by 3.18%, BSR decreased by 1.58%, PLX decreased by 2.12%, OIL decreased by 0.99% and PVO decreased by 3.7%.

This decline is likely to have occurred as the US consumer price index (CPI) in November increased by 0.1% and increased by 3.1% compared to the same period last year. Immediately after the CPI news, world oil prices returned to their lowest level in the past 2 years. At the end of the session on December 12, WTI crude oil fell 3.8% to 68.61 USD/barrel, Brent crude oil fell 3.67% to 73.24 USD/barrel.

Red continued to cover the group of securities stocks, in which VIX decreased by 2.92%, VND decreased by 2.04%, SSI decreased by 1.84%, SHS decreased by 2.15%, HCM decreased by 2.05%, VCI decreased by 2.5%, MBS decreased by 2.23%,...

In the real estate group, DXG decreased by 1.8%, NVL decreased by 3.95%, DIG decreased by 2.09%, CEO decreased by 3.36%, PDR decreased by 2.59%, TCB decreased by 2.32%, KBC decreased by 2.33%, VHM decreased by 0.73%, ITA decreased by 2.8%, LDG decreased by 1.65%, VRE decreased by 2.75%, VIC decreased by 0.79%. Only VHG reversed the trend and hit the ceiling, while HQC, VPI, CCL, NBB, and SNZ ended the session slightly up.

Stocks that impact the general market.

The total value of orders matched in today's session reached VND21,430 billion, up 28% compared to the previous session, of which the value of orders matched on the HoSE floor reached VND18,447 billion, up 26%. In the VN30 group, liquidity reached VND6,816 billion.

Foreign investors continued to net sell with a value of VND906.7 billion, of which this group disbursed VND1,473.9 billion and sold VND2,380.6 billion.

The codes that were sold strongly were VNM 130 billion VND, FUEVFVND 114 billion VND, STB 82 billion VND, HPG 65 billion VND, VHM 47 billion VND,... On the contrary, the codes that were mainly bought were IDC 77 billion VND, VCB 31 billion VND, VHC 24 billion VND, BCM 21 billion VND, VJC 18 billion VND,... .

Source

Comment (0)