The transaction value on the three exchanges was approximately VND24,000 billion. Cash flow on the stock exchange continued to be high in the last 5 sessions of increase.

VN-Index increased for the 5th consecutive session, liquidity continued to be active

The transaction value on the three exchanges was approximately VND24,000 billion. Cash flow on the stock exchange continued to be high in the last 5 sessions of increase.

After 4 sessions of maintaining green, the market recorded some mixed developments when entering the morning session of March 12 with a clear differentiation between stock groups. Investor sentiment remained relatively good, helping the index start positively. However, profit-taking pressure quickly appeared when the VN-Index hit the resistance level and caused the index to narrow its increase.

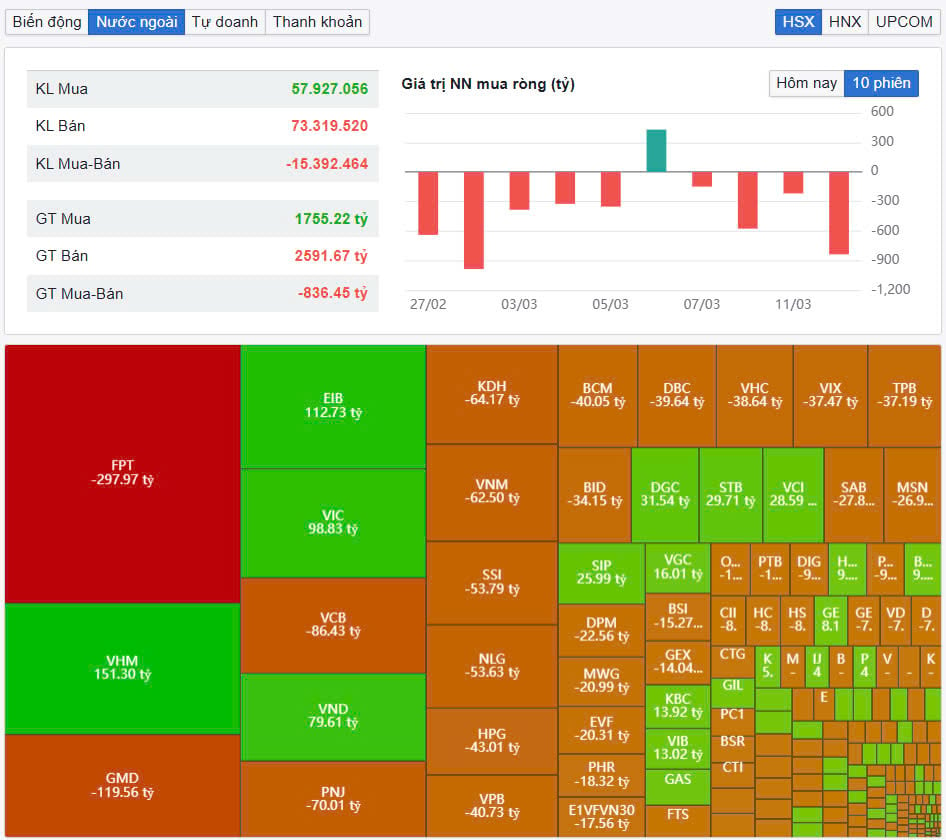

Cash flow mainly flowed into some large-cap stocks, helping the index maintain its green color, although the increase was not too strong. Meanwhile, most stocks on the market were trading in a state of slight correction. Foreign investors continued to have a strong net selling session, creating some pressure on the general index. However, the selling volume did not increase dramatically but mainly came from the decline in buying money flow.

In the afternoon session, market fluctuations were stronger. Investor sentiment became more cautious as selling pressure increased and at times pushed the VN-Index back below the reference level. Notably, the VN30-Index ended the session in the red. Pressure from foreign capital flows was still very high, significantly affecting investor sentiment.

At the end of the trading session, VN-Index increased by 1.87 points (0.14%) to 1,334.41 points. VN30-Index decreased by 1.18 points to 1,392.39 points. HNX-Index increased by 1.29 points (0.54%) to 241.87 points. UPCoM-Index decreased by 0.08 points (-0.08%) to 99.32 points.

|

| The trio of VCB, VHM and VIC support the market |

The number of stocks that decreased in price was more than the number that increased. However, the decrease was not too deep, showing the balance between supply and demand. Specifically, the market had 359 stocks increased, while 395 stocks decreased and 828 stocks remained unchanged/no trading. The whole market recorded 19 stocks increased to the ceiling while 9 stocks decreased to the floor.

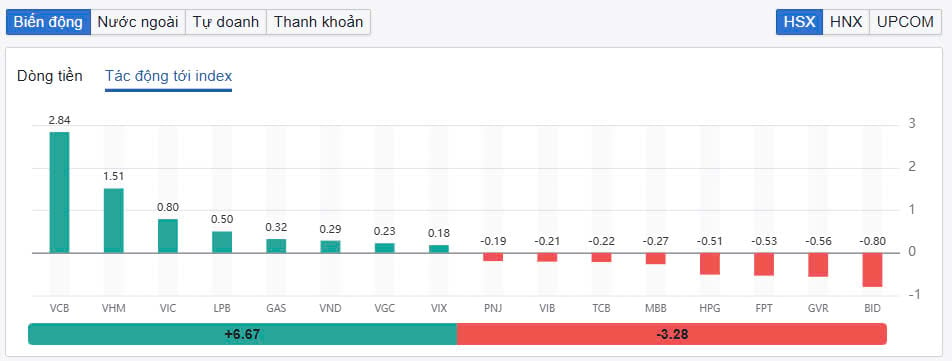

The market focus today is on three stocks including VCB, VHM and VIC. Of which, VCB increased sharply by 3.1% on the trading day without the right to pay a dividend of 49.5%. The number of shares expected to be issued is nearly 2.77 billion shares. After the issuance, the number of outstanding shares of VCB will increase to nearly 8.36 billion units, the largest on the whole floor. VCB's price increase has contributed greatly to maintaining the pace of the VN-Index at 2.84 points.

Following that, VHM and VIC increased by 3.2% and 1.7% respectively. VHM contributed 1.51 points to the VN-Index while VIC contributed 0.8 points. In addition, stocks such as LPB, GAS, VND, VGC... also increased in price well.

Stocks were strongly differentiated with many VND codes increasing by more than 5%. In addition, some stock stocks such as VIX or SHS also had good gains with closing prices at the end of the trading session increasing by 4.2% and 2.7%, respectively. However, the green color did not cover the entire stock market. Stocks FTS, BSI, HCM, MBS... were all in red. Recently, the State Securities Commission (SSC) said that it has proposed amending and supplementing legal documents, and actively coordinating with relevant ministries and branches to drastically implement solutions to gradually meet the criteria of market rating organizations towards the goal of upgrading the Vietnamese stock market from frontier to emerging.

Pillar stocks such as GVR, BID, FPT, HPG, MBB… were also in red and put great pressure on the general market's growth. BID fell 1.2% and took away 0.8 points from the VN-Index. GVR fell 1.8% and also took away 0.56 points.

|

| Foreign investors continue to net sell |

Market liquidity remained high with total trading volume on HoSE reaching 942 million shares, equivalent to a trading value of VND21,937 billion, up 2.8% compared to the previous session, of which matched transactions reached VND19,548 billion, up 3.2%. Trading values on HNX and UPCoM reached VND1,334 billion and VND689 billion, respectively. VIX Securities (VIX) shares achieved the highest liquidity with a trading value of nearly VND1,100 billion with nearly 87.9 million shares transferred during the session.

Foreign investors increased net selling by more than VND925 billion in the whole market, in which, this capital flow continued to net sell the most FPT code with VND298 billion. GMD and VCB were net sold by VND120 billion and VND86 billion respectively. In the opposite direction, VHM was net bought the most with VND151 billion. EIB and VIC were net bought by VND113 billion and VND99 billion respectively.

Source: https://baodautu.vn/vn-index-tang-phien-thu-5-lien-tiep-thanh-khoan-tiep-tuc-soi-dong-d253002.html

Comment (0)