Gold price today March 1, 2025: Domestic gold price is forecasted to fall below 90 million VND/tael next week. However, many experts believe that world gold is still in a strong position to surpass the 3,000 USD/ounce mark in the next 1-2 months. This depends on the market's reaction to US President Donald Trump's tariffs.

| 1. PNJ - Updated: 01/01/1970 08:00 - Website time of supply source - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| HCMC - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Hanoi - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| Hanoi - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Da Nang - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| Da Nang - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Western Region - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| Western Region - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Jewelry gold price - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| Jewelry gold price - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Jewelry gold price - Southeast | PNJ | 89,800 ▼500K |

| Jewelry gold price - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 89,800 ▼500K |

| Jewelry gold price - Jewelry gold 999.9 | 88,000 ▼600K | 90,500 ▼600K |

| Jewelry gold price - Jewelry gold 999 | 87,910 ▼600K | 90,410 ▼600K |

| Jewelry gold price - Jewelry gold 99 | 87,200 ▼590K | 89,700 ▼590K |

| Jewelry gold price - 916 gold (22K) | 80,500 ▼550K | 83,000 ▼550K |

| Jewelry gold price - 750 gold (18K) | 65,530 ▼450K | 68,030 ▼450K |

| Jewelry gold price - 680 gold (16.3K) | 59,190 ▼410K | 61,690 ▼410K |

| Jewelry gold price - 650 gold (15.6K) | 56,480 ▼390K | 58,980 ▼390K |

| Jewelry gold price - 610 gold (14.6K) | 52,860 ▼360K | 55,360 ▼360K |

| Jewelry gold price - 585 gold (14K) | 50,590 ▼350K | 53,090 ▼350K |

| Jewelry gold price - 416 gold (10K) | 35,300 ▼250K | 37,800 ▼250K |

| Jewelry gold price - 375 gold (9K) | 31,590 ▼220K | 34,090 ▼220K |

| Jewelry gold price - 333 gold (8K) | 27,520 ▼190K | 30,020 ▼190K |

Update gold price today 3/1/2025

World gold prices fell to their lowest in more than two weeks as the USD strengthened and investors continued to take profits after the market hit a new peak.

The gold price surge to an all-time high of nearly $3,000 an ounce has pushed the market into overbought territory, raising the risk of short-term selling pressure. Prices hit a new high of $2,965 for the 11th time earlier this week, driven by increased demand for safe havens.

According to the World and Vietnam Newspaper at 8:45 p.m. on February 28 (Hanoi time), the world gold price listed on the Kitco electronic floor was at 2,857.30 USD/ounce , continued to decrease sharply by 20.2 USD/ounce compared to the previous trading session.

The world gold price has fallen nearly 2.5% from the record high the market set at the beginning of the week. The market is under pressure from investors selling to take profits. On February 24, the gold price also fell nearly 40 USD. In total, compared to the peak of 2,956 USD/ounce set at the beginning of the week, the world gold price has evaporated 94 USD/ounce, equivalent to 2.92 million VND/tael. Another reason for the precious metal's decline is the stronger USD. The Dollar Index increased by 0.7%, making gold more expensive for buyers using other currencies.

"The direction of gold is very clear. Short-term ups and downs and profit-taking are normal developments in a cycle," said Alex Ebkarian, chief operating officer of Allegiance Gold.

Despite gold prices falling well below the $2,900 an ounce mark, some market analysts say the precious metal remains well supported. Rising inflationary pressures and turmoil over potential global trade wars have raised the risk that problems with government and central bank economic policies could impact global economic activity.

Domestic gold price may fall below 90 million VND/tael next week?

Domestic gold prices continue to fall following the downward trend of the world market, however, domestic gold prices fall more slowly. A notable point in the domestic market is that the gap between buying and selling gold prices has narrowed significantly, the gap is now only under 1 million VND and the price of 9999 gold rings has returned to parity with the price of gold bars.

According to analysts, physical gold prices always lag behind world gold prices. Therefore, if world gold prices continue to maintain a downward trend in the coming days, domestic gold prices may fall sharply next week.

The price of SJC gold bars continued to decrease on the last day of February (February 28), currently many big brands such as Saigon Jewelry Company (SJC), Phu Nhuan Jewelry Company (PNJ), Doji Group listed at 88.9 - 90.9 million VND/tael (buy - sell).

The price of 9999 plain gold rings closed the trading session on February 28th, slightly decreasing by around 100,000 VND/tael. SJC Company anchored the price of plain gold rings around 90 - 90.9 million VND; Doji anchored it around 90.1 - 91.2 million VND; PNJ at 90 - 90.9 million VND/tael; Bao Tin Minh Chau 89.95 - 91.4 million VND/tael.

|

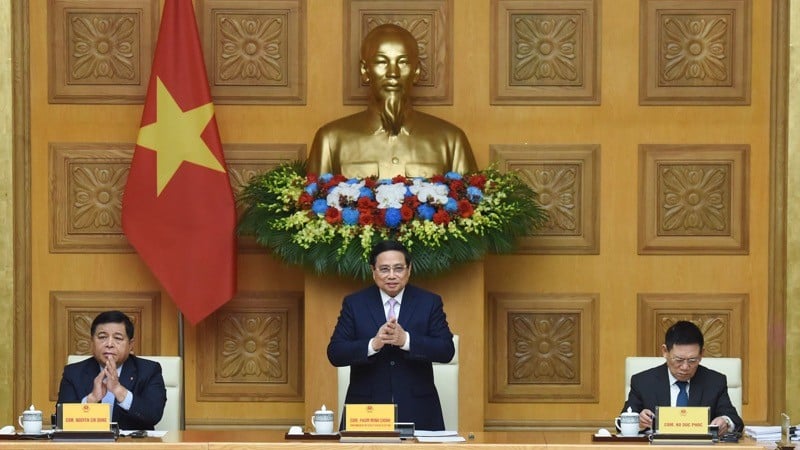

| Gold price today March 1, 2025: Gold price is still 'falling', profit taking is still strong, solid position for gold to surpass the $3,000/ounce mark in the next 1-2 months. (Source: Kitco) |

Summary of SJC gold bar prices and 9999 gold ring prices at major domestic trading brands at the closing time of the last trading session of February (February 28):

Saigon Jewelry Company SJC: SJC gold bars 88.9 - 90.9 million VND/tael; SJC gold rings 90 - 90.9 million VND/tael.

DOJI Group: SJC gold bars 88.9 - 90.9 million VND/tael; 9999 round rings (Hung Thinh Vuong) 90 - 90.9 million VND/tael.

PNJ system: SJC gold bars 88.9 - 90.9 million VND/tael; PNJ 999.9 plain gold rings at 90 - 90.9 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars: 88.9 - 90.9 million VND/tael; Phu Quy 999.9 round gold rings: 89.70 - 91.20 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at 88.9 - 90.9 million VND/tael; round gold ring price is 89.95 - 91.20 million VND/tael.

Converted according to the USD exchange rate listed at Vietcombank, the world gold price is currently equivalent to 88.78 million VND/tael. The domestic gold price is about 1.72 million VND/tael higher.

New impetus for gold price to reach $3,000 peak

In a recent interview with Kitco News , Nitesh Shah, Head of Macroeconomics and Commodities Research, Europe at WisdomTree, noted that his model shows that gold is overvalued by about 15%. However, he added that the model is not convincing at the moment, as the traditional drivers behind the precious metal have been replaced by more dynamic factors. Therefore, his assessment that gold is overvalued is only about 65% correct.

“Central bank demand, China’s broader role in the market and other factors haven’t been around long enough to be properly modeled right now, but emerging factors are driving gold prices higher,” said researcher Nitesh Shah.

One of the most difficult factors to measure is geopolitical uncertainty. Although the US Federal Reserve has shifted to a neutral monetary policy stance as inflation risks remain high, he said that increased geopolitical turmoil will continue to support gold prices.

“President Donald Trump wants to use tariffs as a bargaining chip to achieve a number of other goals. But the risk of an accident is very high,” said Nitesh Shah. Specifically, after a month of delay, the US President officially announced (February 27) that he would impose a 25% tariff on imported goods from Canada and Mexico, while an additional 10% tariff would be applied to imports from China.

The tariffs are expected to spark a trade war as both Canada and Mexico have said they will impose retaliatory tariffs on US products.

Economists have warned investors that a global trade war could push inflationary pressures higher and weaken economic activity. “If we do get into a recessionary scenario combined with inflation, that could be a big boon for gold,” said analyst Shah.

“In that view, gold prices could go significantly higher than they are today and that 15% gap is just nonsense.”

Meanwhile, solid demand from China, coupled with central bank buying, will support gold’s long-term uptrend, said WisdomTree’s Head of Macroeconomics and Commodities Research, Europe. While higher gold prices are weighing on physical demand, Chinese demand is currently significantly less resilient than other trading hubs.

“Even if prices continue to rise, Chinese consumers will continue to buy gold because they still don’t have enough viable investment options,” said Nitesh Shah. “Unless the Chinese government comes up with some really strong stimulus plans, retail investors will continue to look to gold.”

Looking at central bank gold demand, Shah noted that official reserves remain low by historical standards. He noted that China’s gold holdings account for only about 5% of its total reserves. “That’s a small amount,” he said. “I don’t think the central bank has any choice but to buy more gold.”

Source: https://baoquocte.vn/gia-vang-hom-nay-132025-gia-vang-van-tut-doc-chot-loi-van-manh-day-la-ly-do-vang-vuot-moc-3000-usdounce-trong-1-2-thang-toi-305847.html

Comment (0)