Domestic gold price today March 21, 2025

As of 4:30 a.m. on March 21, the price of SJC gold bars at Saigon Jewelry Company was listed at VND97.8 - 99.8 million/tael (buy - sell). The buying price decreased by VND200,000/tael, while the selling price increased by VND300,000/tael. The difference between the buying and selling prices has now widened to VND2 million/tael.

DOJI Group also adjusted according to the same trend, listing SJC gold price at 97.8 - 99.8 million VND/tael.

Bao Tin Minh Chau kept the buying price at 98 million VND/tael, but raised the selling price to 99.8 million VND/tael, causing the difference between buying and selling prices to fall to about 1.8 million VND/tael.

At 4:30 a.m., the price of 9999 round gold rings at DOJI increased to 98.5 - 100.2 million VND/tael, while Bao Tin Minh Chau listed it at 98.55 - 100.3 million VND/tael. The buying price increased by 200,000 VND/tael, while the selling price increased by 300,000 VND/tael.

The latest gold price list today, March 21, 2025 is as follows:

| Today (March 21, 2025) | Yesterday (March 20, 2025) | |||

| Purchase price | Selling price | Purchase price | Selling price | |

| SJC | 97,800 ▼200 | 99,800 ▲300 | 98,000 | 99,500 |

| DOJI HN | 97,800 ▼200 | 99,800 ▲300 | 98,000 | 99,500 |

| DOJI SG | 97,800 ▼200 | 99,800 ▲300 | 98,000 | 99,500 |

| BTMC SJC | 98,000 | 99,800 ▲300 | 98,000 | 99,500 |

| Phu Quy SJC | 98,000 | 99,800 ▲300 | 98,000 | 99,500 |

| PNJ HCMC | 98,100 | 99,900 | 98,100 | 99,900 |

| PNJ Hanoi | 98,100 | 99,900 | 98,100 | 99,900 |

| 1. DOJI - Updated: March 21, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 97,800 ▼200K | 99,800 ▲300K |

| AVPL/SJC HCM | 97,800 ▼200K | 99,800 ▲300K |

| AVPL/SJC DN | 97,800 ▼200K | 99,800 ▲300K |

| Raw material 9999 - HN | 98,500 ▲200K | 99,300 ▲300K |

| Raw material 999 - HN | 98,400 ▲200K | 99,200 ▲300K |

| AVPL/SJC Can Tho | 97,800 ▼200K | 99,800 ▲300K |

| 2. PNJ - Updated: March 21, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 98,100 | 99,900 |

| HCMC - SJC | 97,800 ▼200K | 99,800 ▲300K |

| Hanoi - PNJ | 98,100 | 99,900 |

| Hanoi - SJC | 97,800 ▼200K | 99,800 ▲300K |

| Da Nang - PNJ | 98,100 | 99,900 |

| Da Nang - SJC | 97,800 ▼200K | 99,800 ▲300K |

| Western Region - PNJ | 98,100 | 99,900 |

| Western Region - SJC | 97,800 ▼200K | 99,800 ▲300K |

| Jewelry gold price - PNJ | 98,100 | 99,900 |

| Jewelry gold price - SJC | 97,800 ▼200K | 99,800 ▲300K |

| Jewelry gold price - Southeast | PNJ | 98,100 |

| Jewelry gold price - SJC | 97,800 ▼200K | 99,800 ▲300K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 98,100 |

| Jewelry gold price - Jewelry gold 999.9 | 97,400 | 99,900 |

| Jewelry gold price - Jewelry gold 999 | 97,300 | 99,800 |

| Jewelry gold price - Jewelry gold 99 | 96,500 | 99,000 |

| Jewelry gold price - 916 gold (22K) | 89,110 | 91,610 |

| Jewelry gold price - 750 gold (18K) | 72,580 | 75,080 |

| Jewelry gold price - 680 gold (16.3K) | 65,580 | 68,080 |

| Jewelry gold price - 650 gold (15.6K) | 62,590 | 65,090 |

| Jewelry gold price - 610 gold (14.6K) | 58,590 | 61,090 |

| Jewelry gold price - 585 gold (14K) | 56,090 | 58,590 |

| Jewelry gold price - 416 gold (10K) | 39,210 | 41,710 |

| Jewelry gold price - 375 gold (9K) | 35,110 | 37,610 |

| Jewelry gold price - 333 gold (8K) | 30,620 | 33,120 |

| 3. SJC - Updated: 3/21/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 97,800 ▼200K | 99,800 ▲300K |

| SJC 5c | 97,800 ▼200K | 99,820 ▲300K |

| SJC 2c, 1c, 5 phan | 97,800 ▼200K | 99,830 ▲300K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 98,400 ▲500K | 99,700 ▲300K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 98,400 ▲500K | 99,800 ▲300K |

| Jewelry 99.99% | 97,700 ▼200K | 99,400 ▲300K |

| Jewelry 99% | 95,415 ▲297K | 98,415 ▲297K |

| Jewelry 68% | 64,748 ▲204K | 67,748 ▲204K |

| Jewelry 41.7% | 38,603 ▲125K | 41,603 ▲125K |

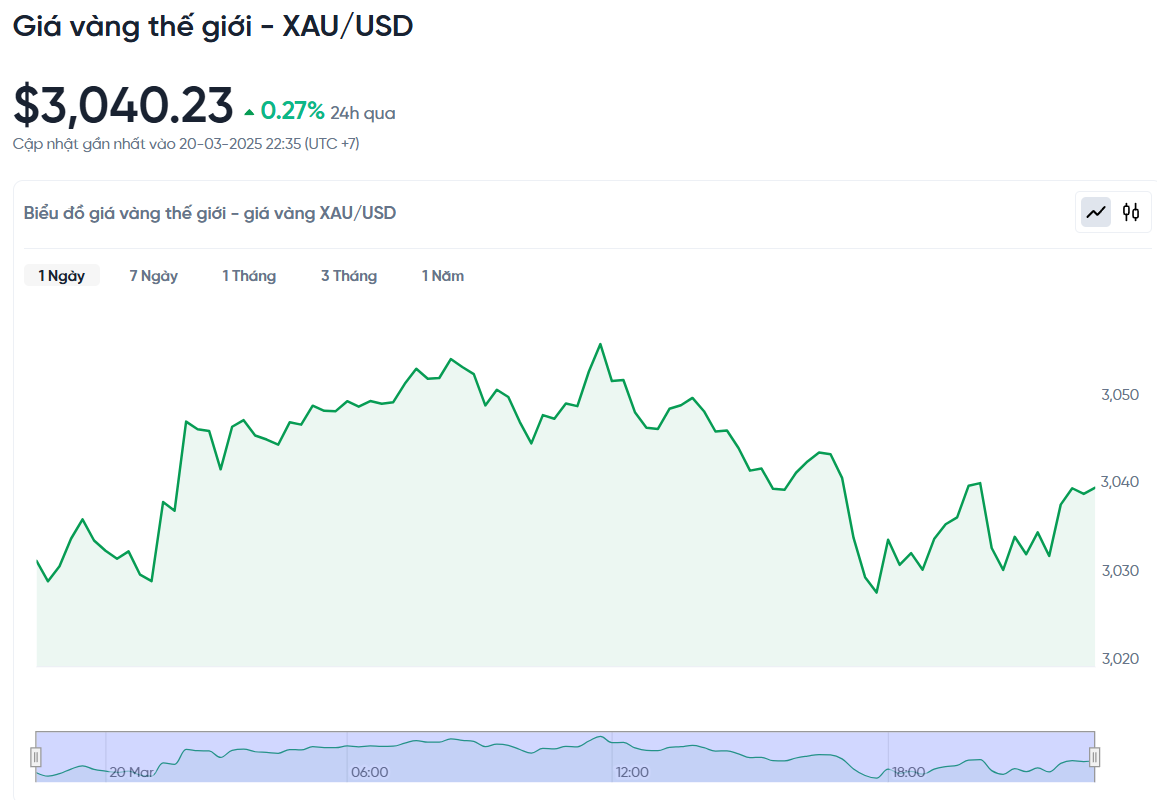

World gold price today 3/21/2025

In the international market, the world spot gold price reached 3,040.23 USD/ounce, up 8.3 USD/ounce compared to the previous session. The gold price still maintained an upward trend near the record high of 3,057 USD/ounce set earlier.

The adjustment comes amid continued gains for the US dollar. The US Dollar Index, which measures the greenback's strength against a basket of major currencies, rose 0.44% to 103.550.

Currently, gold prices are facing a strong wave of profit-taking from investors after many consecutive days of setting record highs. Meanwhile, the US Federal Reserve (FED) still kept interest rates at 4.25 - 4.50%, and did not provide further guidance on monetary policy.

According to the FED's forecast, interest rates will fall to 3.9% by the end of 2025, continue to fall to 3.4% in 2026 and reach 3.1% in 2027. Although not in a hurry to cut interest rates, the FED has decided to slow down the pace of shrinking its balance sheet.

Starting in April, the Treasury bond purchase rate will be reduced from $25 billion to $5 billion per month, while the limit on corporate debt and mortgage-backed securities will remain at $35 billion per month.

Despite signs of a correction, many experts remain positive about the outlook for gold prices. Jeffrey Gundlach, CEO and founder of DoubleLine, predicts that gold prices could reach $4,000 an ounce. According to him, the main driver is the strong pace of gold purchases by central banks around the world.

Data from the World Gold Council (WGC) shows that central banks have been consistently buying more than 1,000 tonnes of gold per year for the past three years and this trend is expected to continue through 2025. This highlights the importance of gold in official foreign exchange reserves, especially in times of heightened geopolitical risks.

A typical example is China, which has continuously increased its gold reserves for four consecutive months since November 2024.

Gold Price Forecast

According to Daniel Ghali, commodity strategist at TD Securities, if the main driver of gold's rise last year was central banks, this year the driver is gradually shifting to currency depreciation and investor risk aversion.

Ghali said the trend of central banks buying gold has been going on since 2010, and the motivations for buying gold may vary from country to country, but they all stem from concerns about global economic and financial risks.

Although gold prices may experience some short-term corrections, in the long term, gold remains one of the important investment assets in the context of increasing political, economic and monetary instability.

Source: https://baoquangnam.vn/gia-vang-hom-nay-21-3-2025-gia-vang-trong-nuoc-va-the-gioi-tiep-tuc-tang-nhe-3151042.html

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

Comment (0)