No longer the preferred choice of investors, rough diamond prices have fallen nearly 20% in just over a year.

Diamond prices have fallen 6.5% since the start of the year and are down more than 18% from their all-time high in February, according to the Global Rough Diamond Price Index. Analysts say the value of diamonds could continue to fall.

“Last year, a 1-carat natural diamond of slightly better quality was selling for $6,700, and now that same diamond is selling for $5,300,” Paul Zimnisky, CEO of Paul Zimnisky Diamond Analytics, told CNBC .

Diamonds, along with other jewelry, saw a surge during the pandemic, peaking early last year. “Consumers were ready to spend. They were flush with cash from investment returns and economic stimulus programs, and were ready to spend on meaningful gifts for loved ones,” consulting firm Bain & Company said in a report last February.

As people were unable to travel or spend money outside, that extra money was poured into jewelry and luxury goods, said Ankur Daga, CEO of online jeweler Angara.

But as the economy began to reopen, diamond prices also fell and fell into a sell-off, according to Daga.

According to industry experts, continued competition from synthetic diamonds, China's slower economic recovery and an uncertain macroeconomic backdrop are also factors that are causing the market to weaken.

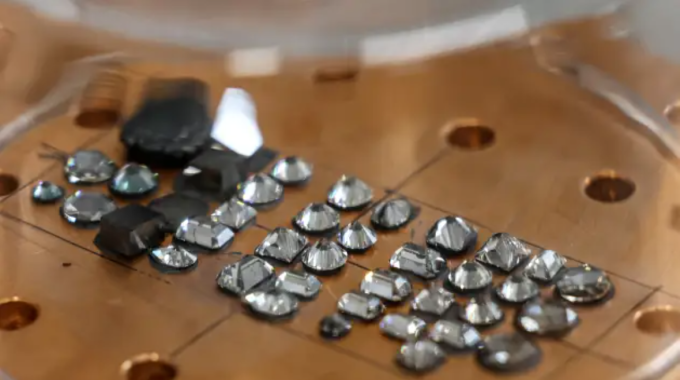

Synthetic diamonds at the Diam Concept laboratory in Paris, France, on March 16, 2023. Photo: Bloomberg

More and more consumers are switching to synthetic diamonds, with prices falling 59% over the past three years, said Edahn Golan, CEO of Edahn Golan Diamond Research & Data.

"The ratio of synthetic diamond sales to natural diamonds is increasing. In 2020, this product accounted for only 2.4% of total market sales. By 2023, this ratio will reach 9.3%," said Golan.

Synthetic diamonds are created in a lab in a controlled environment using extreme pressure and heat to replicate the way natural diamonds are formed. Daga says the synthetic and natural products are chemically, physically and optically identical. But more importantly for most consumers, they are much cheaper.

And more and more people are looking to lab-grown diamonds for their engagement rings.

"Man-made diamonds are indistinguishable from natural diamonds, and if I can get a bigger diamond for the same price, why not?" said Jonathan Lok, 29, a Singaporean who proposed with a 0.76-carat lab-grown diamond ring.

Edahn also said that the price of synthetic diamonds has dropped sharply in recent years. "Three years ago, you could buy synthetic diamonds for 20-30% less than the price of natural diamonds. Now it's 75% to 90% less," Daga said, adding that modern production technology and machinery are the reasons for the decreasing production costs.

Angara's CEO predicts natural diamond prices could fall 20% to 25% from current prices over the next 12 months, marking a 40% drop from their February peak.

"Prices are likely to continue to fall, especially as retailer margins on synthetic diamonds are very high, around 60% compared to 34% for natural diamonds," predicts Edahn Golan, CEO of Diamond Research & Data.

Labor costs are still rising, he said, and it is a very important part of the diamond production process. “So there is still a natural floor somewhere,” Daga said, adding that the market could bounce back after a 25% drop.

Diamond production also involves cutting and polishing the rough diamond before it is turned into jewelry, which is the "most complex" and most expensive part of the value chain, according to Bain & Company.

Additionally, diamond market watchers do not expect sanctions against Russia - the world's top producer, with concerns that this could lead to a spike in prices.

In early May, the G7 economies convened a discussion on imposing sanctions on Russian diamonds, with Britain taking the lead in sanctioning state-owned company Alrosa.

“Russians have increased diamond sales in recent months in an effort to regain market share lost last year,” said Zimnisky, CEO of Paul Zimnisky Diamond Analytics.

Russia is the world's largest diamond producer, followed by Botswana and Congo, according to the Diamond Registry.

Edahn believes Russia will have no problem selling diamonds despite the sanctions, especially if buyers continue to value Moscow's gems. "Countries like India, the UAE and even the European Union do not impose sanctions on the import of rough diamonds. So again, there will be no real shortage," he said.

Minh Son ( according to CNBC )

Source link

![[Photo] Prime Minister Pham Minh Chinh attends conference on ensuring security and order in the Northwest and surrounding areas](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/933ce5c8b72e4663bd6c6cd8be908f23)

![[Photo] Prime Minister Pham Minh Chinh dialogues with Vietnamese youth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/7fd8b4735134417cbaf5be67ee9f88b1)

![[Photo] Overcoming the sun to remove temporary and dilapidated houses for poor households](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/824ba71165cc4f8fb6a3903ca0323e5d)

![[Photo] Vietnam team's strength guaranteed for match against Laos](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/1e739f7af040492a9ffcb09c35a0810b)

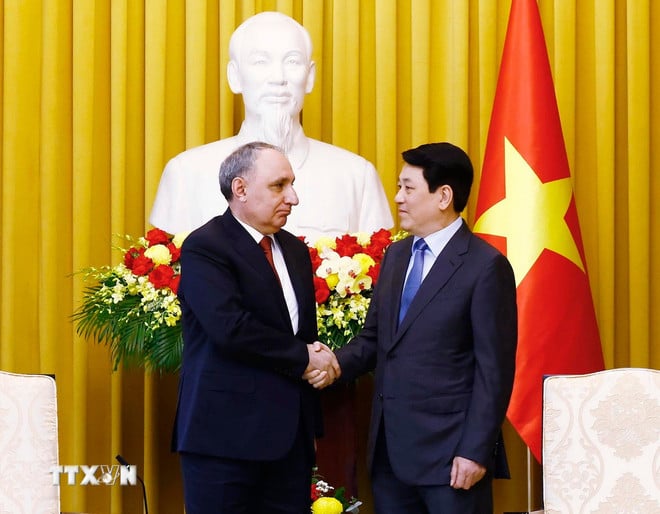

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/a9ac668e1a3744bca692bde02494f808)

![[Photo] The flavors of Southern Vietnamese traditional cakes](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/b220c9f405b945d798738ea0a94b29b8)

Comment (0)