| Commodity market today June 20, 2024: Raw material market quiet on US holiday Commodity market today June 21, 2024: Commodity market bustling again after US holiday |

The agricultural and industrial raw materials group suffered the strongest selling pressure, pulling the MXV-Index down 0.73% to 2,278 points, hitting its lowest level in two weeks.

Soybean prices fall sharply on positive supply outlook

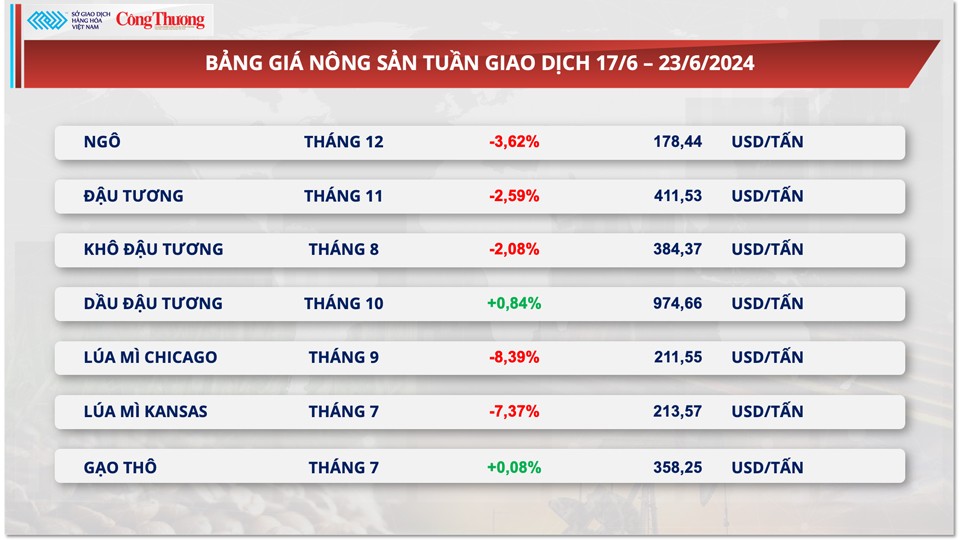

At the end of the trading week of June 17-23, soybean prices fell nearly 3% to $411.53/ton, extending the decline to the fourth consecutive week, reaching the lowest level since November 2020. Positive signals surrounding the supply outlook in Brazil and the US caused sellers to dominate the market last week.

|

| Agricultural product price list |

In its Crop Progress report, the USDA said soybeans are good/excellent at 70 percent, down slightly from last week but up from 54 percent a year ago. Soybean quality remains high this year and the current decline has not had much of an impact on yield potential. Rain is forecast for the central United States, with the heaviest rainfall in the northwest Midwest over the next two weeks, according to the Commodity Weather Group. This should provide some relief to drought-stricken areas, putting pressure on the market.

Brazil is ramping up exports to make room for its second corn crop, which is harvesting at its fastest pace in a decade. The National Association of Cereal Exporters (ANEC) raised its June soybean export forecast to 14.88 million tonnes, up about 1 million tonnes from last week and the highest for the month of June. It is also 1 million tonnes higher than the same period last year and 1.5 million tonnes higher than in May. Farmers in the state have sold 77.9% of their expected 2023-24 crop, up from 72.1% a year ago, according to the Mato Grosso Institute of Agricultural Economics (Imea). This factor also boosted selling pressure on soybeans last week.

Iron ore prices fall for fourth consecutive week due to sluggish consumption

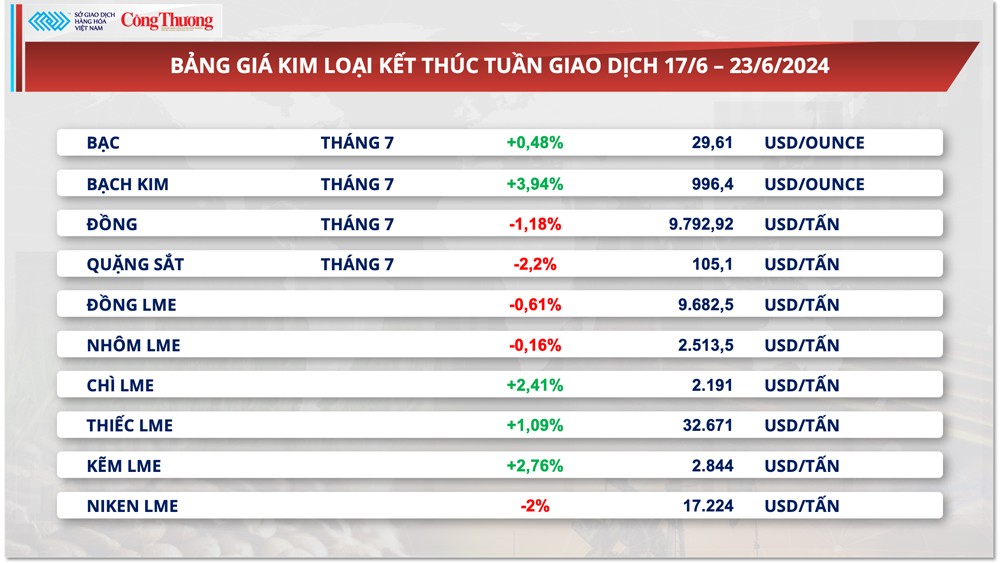

The metal market was mixed last week. For precious metals, silver and platinum prices both rose again amid market optimism about the US Federal Reserve’s interest rate cut expectations. Platinum prices jumped nearly 4% to $996.4 an ounce. Silver prices also rose 0.48% to $29.61 an ounce.

|

| Metal price list |

According to data from the US Department of Commerce, US retail sales rose just 0.1% in May, lower than the forecast of 0.3%, reflecting a slowdown in US consumer spending. Meanwhile, the labor market cooled as the number of people applying for unemployment benefits was higher than expected. This series of data shows that the world's largest economy is showing signs of slowing down after a period of good growth at the beginning of the year. This has indirectly boosted expectations that the FED will need to cut interest rates soon to avoid a "hard landing" of the economy, and precious metal prices have also benefited.

Among base metals, iron ore led the group’s decline, falling 2.2% to $105.10 a tonne, marking its fourth consecutive weekly decline. Iron ore prices continued to face pressure as the market grew increasingly concerned about weakening demand in China, the world’s largest consumer of iron and steel. Data showed that iron ore inventories at major Chinese ports had risen to more than 147 million tonnes, up about 27% from the beginning of the year and the highest level in more than two years.

Moreover, concerns that the country will continue to implement its plan to limit steel output have put further pressure on the price of raw material iron ore. Last week, the government of Fujian province, one of China’s major steel-producing regions, discussed with local steel mills about output restrictions this year.

In other developments, COMEX copper prices also fell 1.18% to $9,792.92/ton. Copper prices are under pressure again as the market has seen some more positive signs about supply, helping to ease concerns about copper shortages.

Specifically, mining giant Vale said its copper production could rise to 394,000 to 431,000 tonnes by 2026, about 5% higher than its estimate in December last year. In addition, according to the June supply-demand report released by the International Copper Study Group (ICSG), the global refined copper market had a surplus of 13,000 tonnes in April.

Prices of some other goods

|

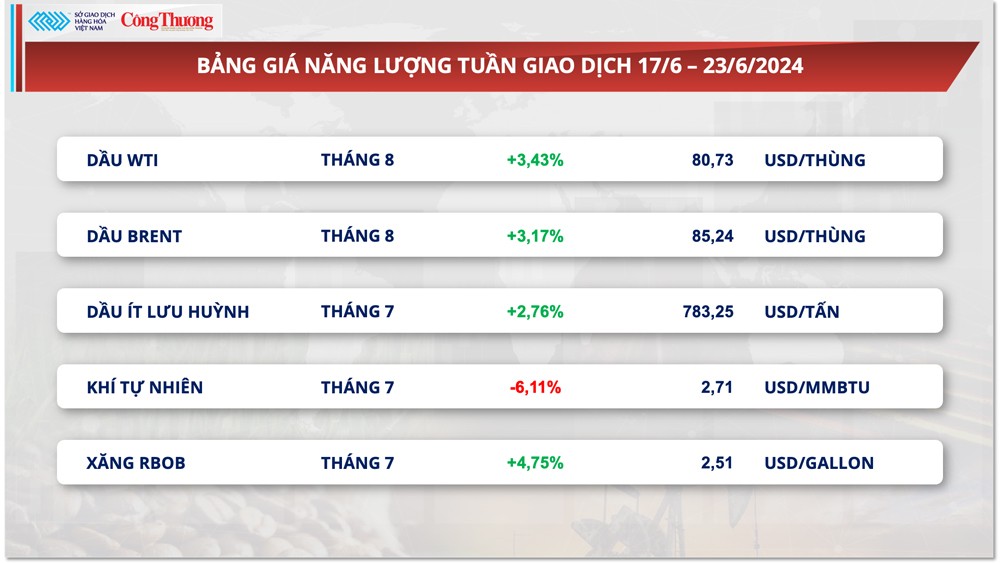

| Energy price list |

|

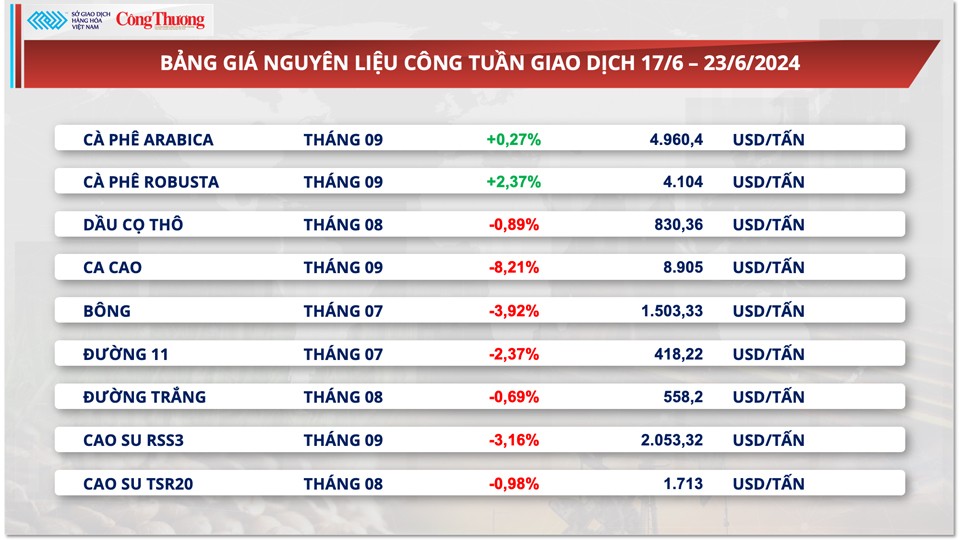

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-2462024-gia-hang-hoa-nguyen-lieu-the-gioi-giam-manh-327814.html

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] President Luong Cuong receives Ambassador of the Dominican Republic Jaime Francisco Rodriguez](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/12c7d14ff988439eaa905c56303b4683)

Comment (0)