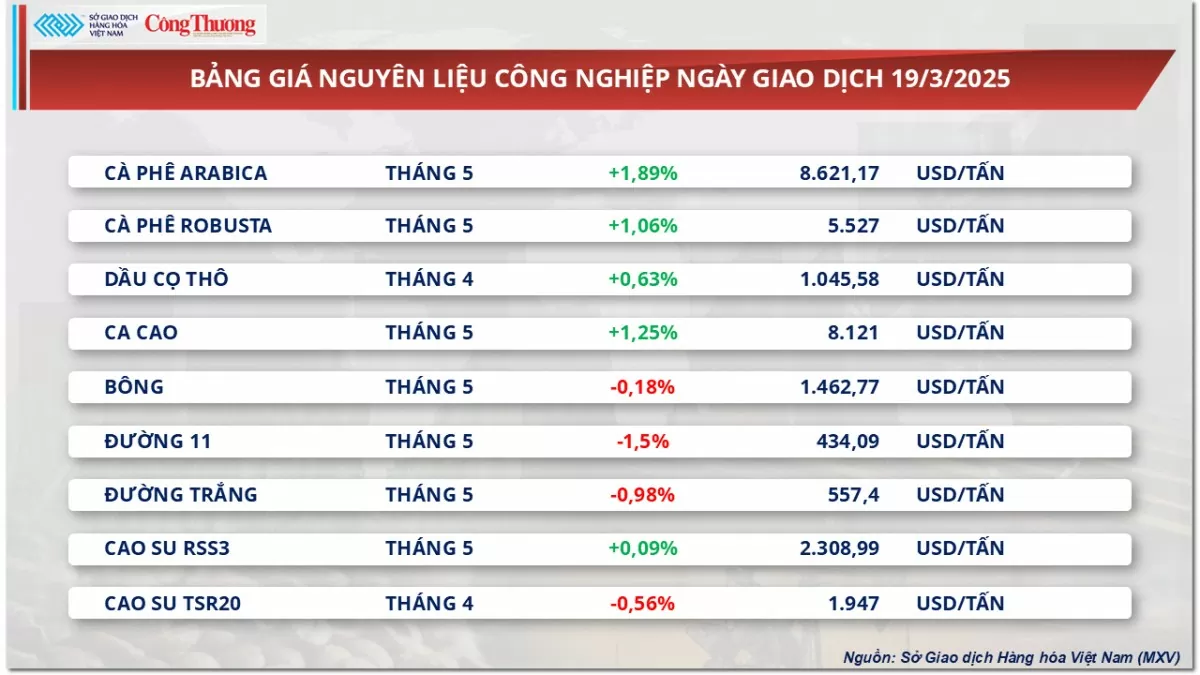

According to MXV, Arabica coffee prices recorded an increase of 1.89% compared to the reference price of 8,621 USD/ton, while Robusta coffee prices also increased by 1.06% to 5,527 USD/ton.

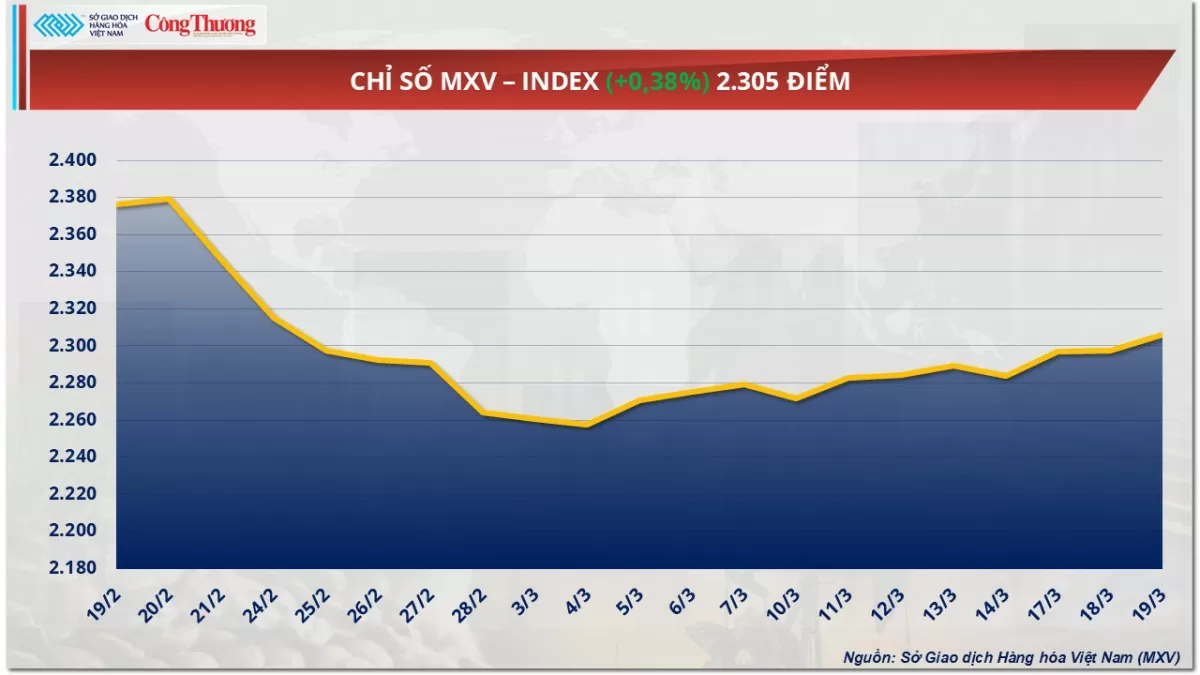

According to the Vietnam Commodity Exchange (MXV), green dominated the world raw material market in yesterday's trading session (March 19). At the close, the dominant buying force pushed the MXV-Index up nearly 0.4% to 2,305 points. The decision to continue keeping the interest rate unchanged by the US Federal Reserve (FED) has pulled investment cash out of the precious metal group. Meanwhile, negative weather conditions continued to support coffee prices in yesterday's trading session.

|

| MXV Index - Index |

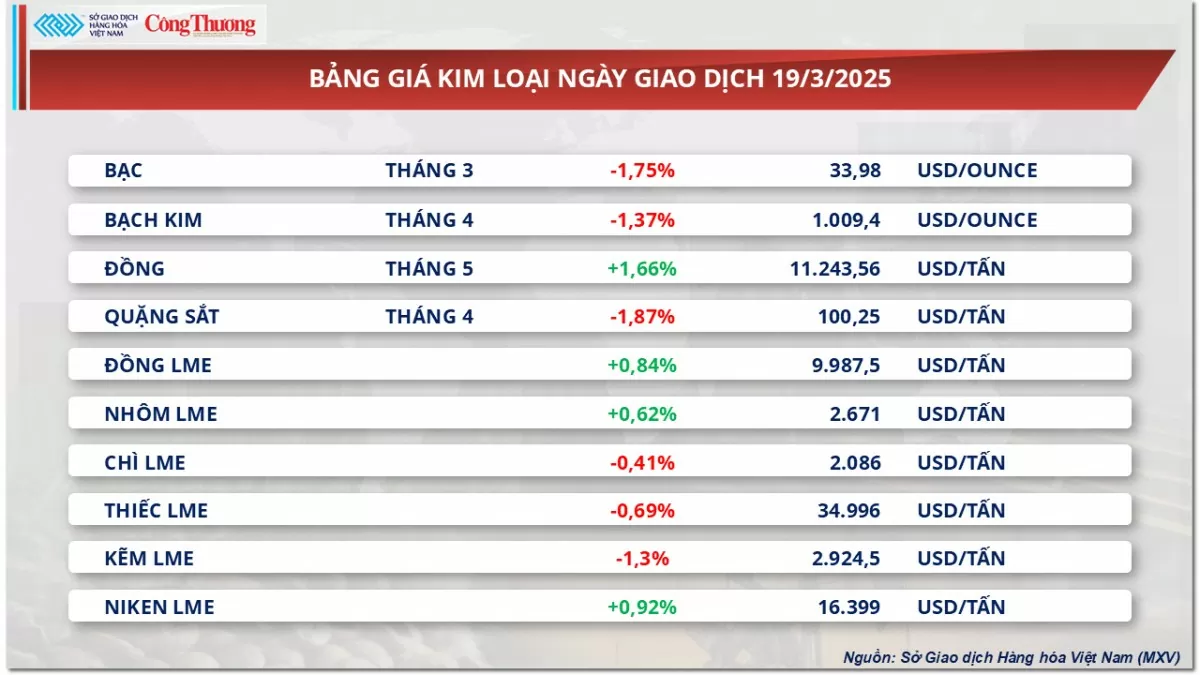

Precious metal prices fall sharply after FED decision

The trading session on March 19 saw the prices of many metals fall simultaneously. The latest decision by the US Federal Reserve (FED) has caused money to leave the precious metal group, while concerns about future demand for iron ore are also negatively affecting the market.

Among precious metals, silver prices recorded the biggest drop since the beginning of the month, down 1.75% to $33.98/ounce. Similarly, platinum prices fell 1.37%, ending the trading session at $1,009.4/ounce.

|

| Metal price list |

All the market's attention is focused on the Fed's decision on interest rates, announced early this morning Vietnam time. As expected by the market, the FED decided to keep interest rates unchanged at 4.5%. In the context of continued geopolitical instability and rising global trade tensions, FED Chairman Jerome Powell said this decision is aimed at reducing the inflation rate to 2% by 2027.

The wave of money flowing into high-yield bonds following this decision caused the price of precious metals to fall sharply. At the same time, after phone calls between US President Donald Trump, Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky, global political tensions showed positive signs.

In the base metal group, iron ore continued to be under great pressure when it decreased by 1.87%, down to 100.25 USD/ton, similar to the development of the session on March 17. Meanwhile, copper was the only commodity that recorded a positive increase on the base metal price list, continuing to set a new record on the COMEX floor, reaching 5.1 USD/ounce, equivalent to 11,243 USD/ton, up 1.66%.

On the other hand, the copper market is still not over the heat. The new record price level set yesterday continues, due to market concerns about global supply. In the latest developments, after withdrawing from the ceasefire negotiation table, the M23 rebel group continues to expand its territory in the eastern Democratic Republic of Congo, one of the world's largest copper exporters. These latest fluctuations are accompanied by previous concerns about the impact of the White House's tariff barriers, which continue to inflate copper prices.

As for iron ore, the market’s concern is the sharp decline in demand for this commodity and the steel industry as a whole. The EU, home to many of the world’s largest steel importers such as Germany and Italy, is planning to cut steel imports by 15%. Investors are not optimistic about the ability to resolve the excess steel supply, which has negatively affected iron ore demand.

Coffee market continues to fluctuate

At the end of the trading session on March 19, the industrial raw material market was mixed with green and red. In particular, the price of Arabica coffee recorded an increase of 1.89% compared to the reference price of 8,621 USD/ton, while the price of Robusta coffee also increased by 1.06% to 5,527 USD/ton. In contrast, the price of sugar 11 decreased by 1.5% to 434 USD/ton.

|

| Industrial raw material price list |

Coffee prices turned higher after the weather forecast in Brazil, the country's largest coffee growing region - Minas Gerais - received only 30.8 mm of rain in the week ending March 15, at 71% of the historical average. Not only Brazil, major coffee growing countries such as Vietnam and Colombia are also facing the impact of global climate change, raising concerns about future supplies.

Robusta prices were limited, however, as ICE-monitored inventories rose to a one-week high of 4,336 lots, while Arabica stocks fell to a three-and-a-half-week low of 782,648 bags.

The average coffee price in the domestic market on March 19 remained unchanged from the previous session, at VND134,000/kg.

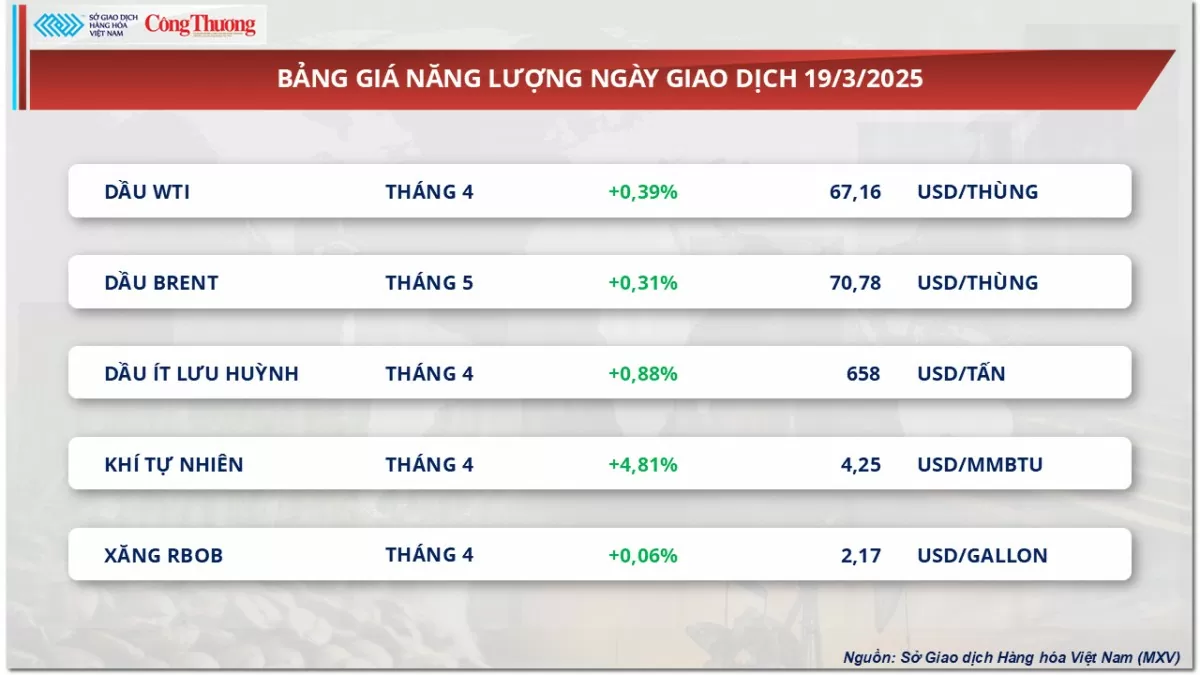

The DXY index ended the trading session on March 19 up slightly by 0.25% after the FED decided to keep interest rates unchanged as expected, while forecasting two 25 basis point cuts by the end of 2025.

In another notable development in the industrial raw material market, sugar prices fell 1.5% due to concerns about consumption demand. China - one of the world's largest sugar consuming markets, announced that sugar imports in February fell sharply by 97% compared to the same period last year, to only 20,000 tons. Sugar exports from Brazil in February also fell 5.6% compared to the same period last year, to 39.822 million tons.

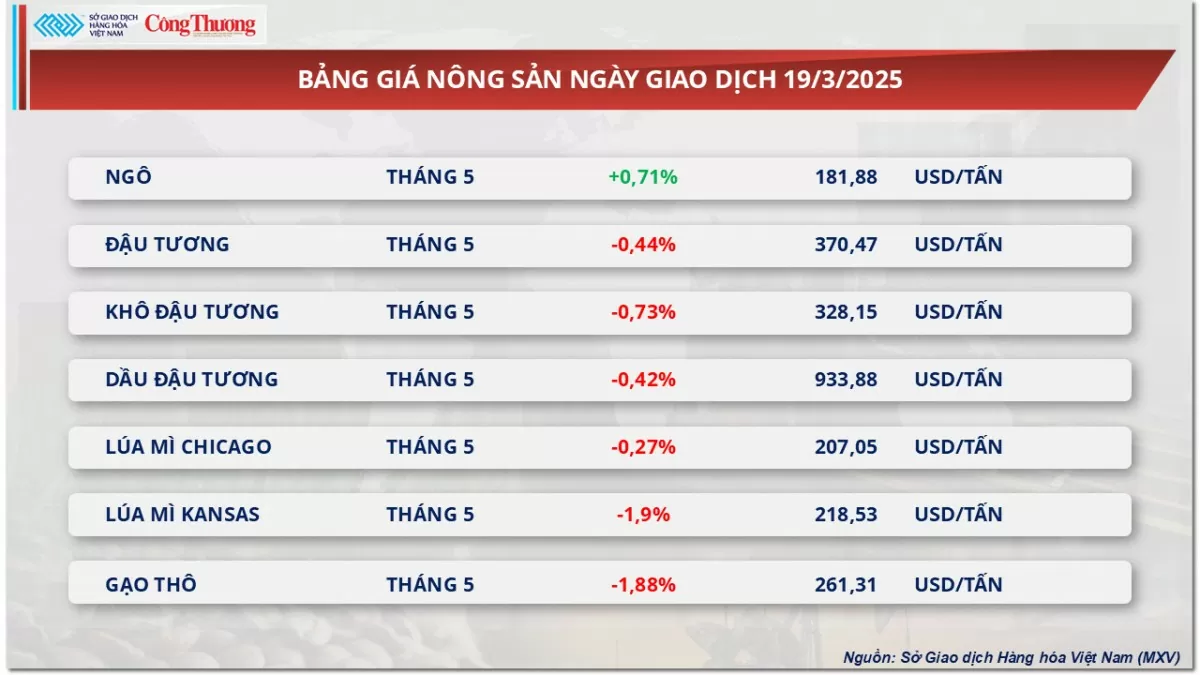

Prices of some other goods

|

| Energy price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/gia-ca-phe-robusta-tang-len-muc-5527-usdtan-379108.html

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)