| Coffee export prices continue to hit new highs due to supply concerns Coffee export prices plummet after hitting a 28-year high, domestic prices skyrocket |

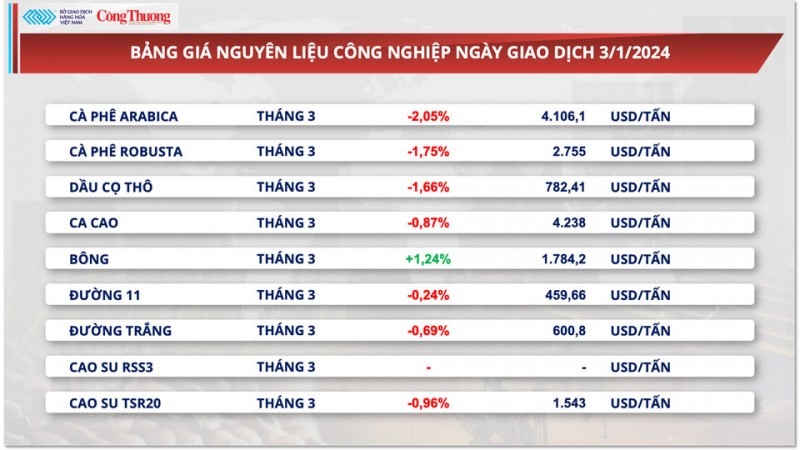

According to the Vietnam Commodity Exchange (MXV), at the end of the trading session on January 3, Arabica prices fell 2.05% and Robusta prices lost 1.75%, reaching their lowest levels in three weeks. This is also the third consecutive session of decline for Robusta prices. Concerns about supply shortages are no longer strong enough to support prices.

In the closing report on January 2, the total number of Arabica certified on the ICE-US was 251,224 60kg bags, recovering from the lowest level in more than 24 years. However, the recovery rate is still quite slow and uncertain. Therefore, it cannot be assessed as the main factor putting pressure on prices.

|

| Coffee export prices continue to fall |

In addition, the International Coffee Organization (ICO) said in its monthly coffee market report that global coffee exports in November reached 10.6 million 60kg bags, up 11.3% month-on-month and 3.6% year-on-year. Analysts said the increase in export volume in November was seasonal, but the current export volume is larger than usual.

In its monthly coffee report, the International Coffee Organization (ICO) said that global coffee exports in November 2023 reached 10.6 million bags, up 11.3% compared to October 2023 and up 3.6% compared to November 2022.

Analysts say the increase in November exports is seasonal, but current exports are larger than usual. This also raises questions about the ability to boost coffee exports in the following months, as Brazil is almost halfway through the 2023/24 crop year with available coffee gradually decreasing, while Vietnam has exported a new crop but sales are still lower than the same period last year.

In addition, the fall of the Brazilian real to a two-week low against the dollar was negative for coffee prices. A weaker real encourages export sales by Brazilian coffee producers.

In its December 2023 coffee market report, the US Department of Agriculture (USDA) estimated that global coffee inventories are at their lowest level in 12 years. In the 2022/2023 crop year, inventories will be only 26.5 million 60kg bags, down 16.7% from the previous report and 4% from the estimated figure for the crop year.

|

In forecasts for 2024, many experts and organizations believe that the coffee shortage will continue to recur due to many reasons.

Major suppliers in Southeast Asia are experiencing a decline in output due to unfavorable weather conditions, the complex El Nino phenomenon and low coffee prices in recent years, forcing farmers to switch to other crops with higher economic efficiency. Robusta coffee output in Vietnam is forecast to decrease by 3.8 million bags and Indonesia by 2.15 million bags.

South Korea will extend the value-added tax exemption on coffee and cocoa until 2025 to ease the burden on consumers amid persistently high inflation, the Ministry of Agriculture, Food and Rural Development said on January 3.

Previously, South Korea applied a 10% value-added tax exemption policy on imported coffee and cocoa from July 2022 to December 2023.

South Korea's consumer prices rose 3.2% year-on-year in December 2023, marking the fifth consecutive month that consumer prices have increased above 3%, although the pace of increase has slowed for two consecutive months. Agricultural prices rose 15.7%, the highest increase since April 2021.

This extension is a beneficial policy for Vietnamese coffee and cocoa exporting enterprises.

According to the Vietnam Coffee and Cocoa Association, at the end of the 2022-2023 crop year (from October 2022 to September 2023), coffee exports reached 1.66 million tons, down 4.5% compared to the 2021-2022 crop year, but the turnover reached 4.08 billion USD, up 3.4% thanks to high selling prices.

This is the highest turnover in all crop years so far, the average coffee export price reached 2,451 USD/ton, up 5.5% compared to the previous crop year.

Of which, coffee export turnover to Korea increased by 17.1% and maintained its position as one of the 10 largest markets for Vietnamese coffee.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)