Responding to questions from shareholders at the 2024 Annual General Meeting of Shareholders (AGM) held on the morning of April 20, Mr. Ho Hung Anh said that Techcombank is considering opportunities to find a foreign strategic partner.

Techcombank Chairman Ho Hung Anh answers shareholders

According to Mr. Ho Hung Anh, issuing shares to strategic partners will usually have a higher price than the market price of the shares, which will bring many common benefits to all remaining shareholders.

“Like VPBank last year when it issued shares to its Japanese partner SMBC, this brought great value to their shareholders. Techcombank is also looking for such an opportunity,” shared the Chairman of Techcombank’s Board of Directors. He also emphasized that when the market becomes vibrant again, it will bring better opportunities to seek cooperation opportunities with partners, while also bringing better value to shareholders.

A shareholder asked a question to Techcombank's board of directors.

Regarding the business results of the first quarter of 2024, on April 24, Techcombank will officially announce the financial report of the first quarter. However, in response to the "impatient" of shareholders, Mr. Ho Hung Anh revealed some basic information.

“Techcombank’s business is proceeding according to plan, the first quarter profit is very good and certainly exceeds the set plan. With the carefully set plans for this year, we are fully confident that this year Techcombank will exceed the plan.”

The General Meeting of Shareholders approved the 2024 business plan with important targets such as: Outstanding credit balance of VND 616,031 billion, up 16.2% (according to the approval of the State Bank); total customer deposits in line with actual credit growth, to optimize the balance sheet (in 2023, reaching VND 507,157 billion, up 34.3%); pre-tax profit of VND 27,100 billion (up 18.4%); bad debt ratio lower than 1.5%.

According to Mr. Ho Hung Anh, this is a prudent plan in the context of many difficulties in the domestic and foreign economies in 2024. To achieve the above plan, Techcombank will focus on accelerating in 3 priority areas: Increasing CASA non-term deposits; diversifying credit portfolio; strengthening main banking transaction relationships (MOA) for individual and institutional customers.

Techcombank Board of Directors members for the 2024-2029 term introduced to shareholders

Techcombank has a major advantage over other banks in that it is always leading in CASA ratio, which gives the bank access to cheap capital. To continue the momentum of CASA development, the bank will accelerate the launch and application of unique and differentiated customer value propositions.

Since the beginning of 2024, Techcombank has widely deployed the Auto Earning product to all customers, a highly innovative product that allows customers to optimize idle cash and receive better interest rates by agreeing to automatically transfer current account balances to the CDBL product.

The bank will continue to expand its innovative one-touch payment solution T-Pay, available at more than 3,600 Winlife stores nationwide for customers in Winlife's "all-in-one" ecosystem.

Individual businesses will also benefit from new offerings such as digital-based payment and collection solutions, including a new QR code payment service that allows them to receive money via their customers’ mobile banking apps. For business owners, Techcombank will offer an integrated customer value proposition.

To further diversify its corporate lending portfolio beyond real estate, Techcombank will launch new integrated services that combine supply chain financing and dynamic discounting to optimize liquidity across the integrated value chain.

Source: https://vietnamnet.vn/chu-tich-techcombank-chung-toi-dang-tim-kiem-doi-tac-ngoai-2273150.html

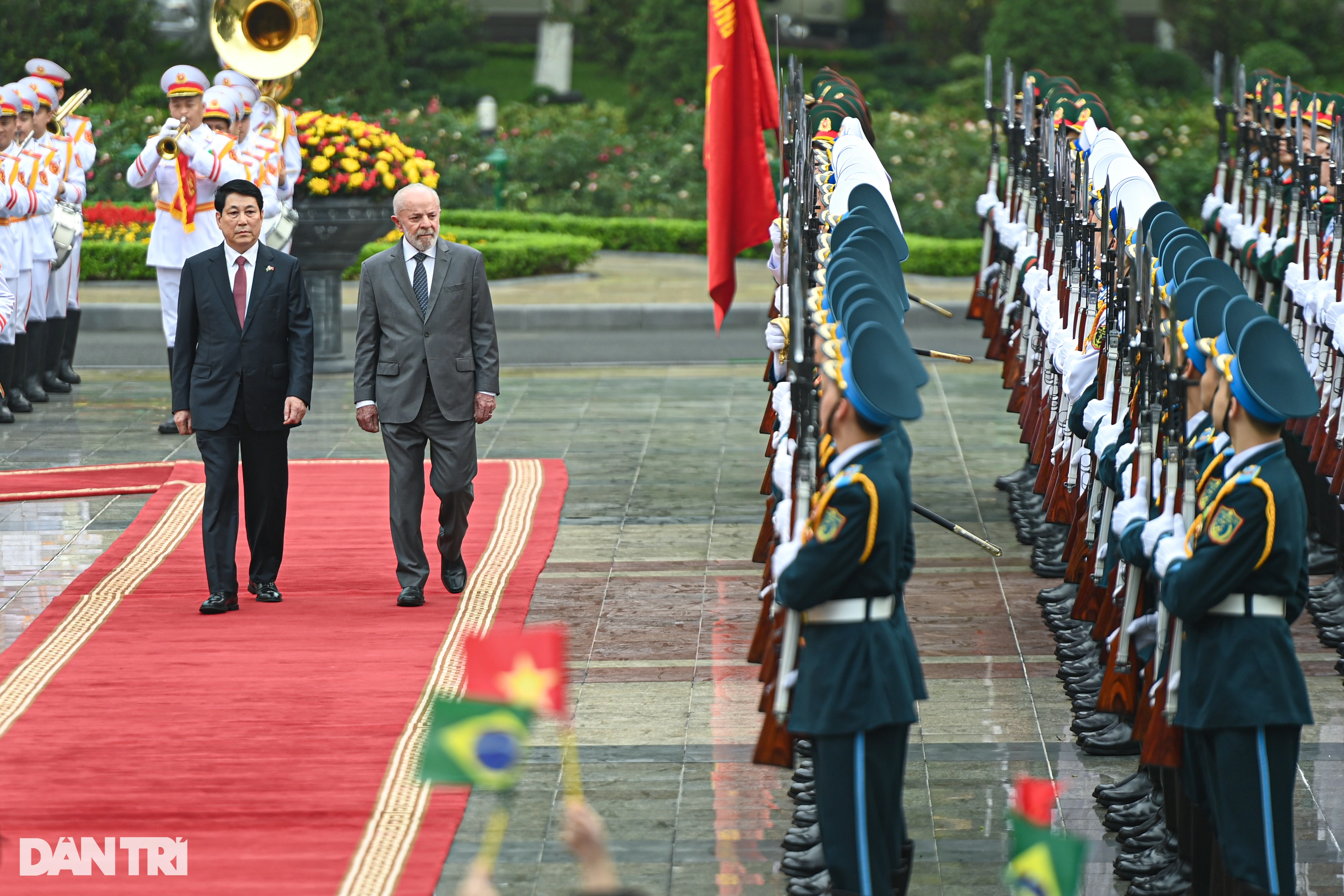

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

Comment (0)