Proactively deployed on many channels and service methods, as of early December 2024, Vietcombank recorded nearly 8.5 million customers successfully updating biometrics, this number continues to increase, ranking among the top in the market.

1/1/2025 - deadline for biometric update

Updating biometric information and identification documents is now a mandatory requirement for customers based on important regulations of the State Bank of Vietnam (SBV) and current laws. According to Decision 2345/QD-NHNN (Decision 2345) dated December 18, 2023, the SBV has required that from July 1, 2024, some types of online transactions of individual customers must be authenticated by biometric identification.

In addition, Circular 17/2024/TT-NHNN (Circular 17) and Circular 18/2024/TT-NHNN (Circular 18) issued on June 28, 2024 also require financial institutions to check the validity of identification documents, authenticate biometric information and update customer residence information. Accordingly, from January 1, 2025, payment account holders/bank cardholders will not be able to conduct online transactions and transfer/withdraw money at ATMs if they fall into the following situations: Not completing the change of the declaration number and correct biometric information; Not updating or adding new information to replace expired identification documents.

In addition, the 2023 Law on Identification (Law No. 26/2023/QH15) stipulates that all 9-digit and 12-digit identity cards (ID cards) will expire from December 31, 2024, requiring people to switch to chip-embedded citizen identification cards (CCCD). This requires customers to update new CCCD information in their records to avoid transaction interruptions.

These regulations ensure the safety and security of online payments, thereby creating a healthy cyberspace, promoting sustainable development of cashless payments and protecting customers' rights.

Vietcombank organizes good service for customers with biometric authentication needs

Understanding the importance of biometric authentication for customer benefits, Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) has proactively implemented a series of measures to support the information update process to take place smoothly and quickly.

Since June 2024, Vietcombank has been one of the first banks to proactively communicate to customers about the regulations of Decision 2345, the 2023 Law on Identification and Circulars 17 and 18 of the State Bank on updating biometrics and identification documents through many channels including: Placing notice boards at transaction points; bank communication channels such as social networks, websites; sending emails, OTT; notifications (pop-ups) when customers log in to VCB Digibank; information through newspapers; on ATM screens nationwide; notifying businesses that pay salaries to inform employees, coordinating with businesses to organize biometric information updates for employees. In some localities, Vietcombank coordinates with government agencies to announce biometric updates via loudspeakers.

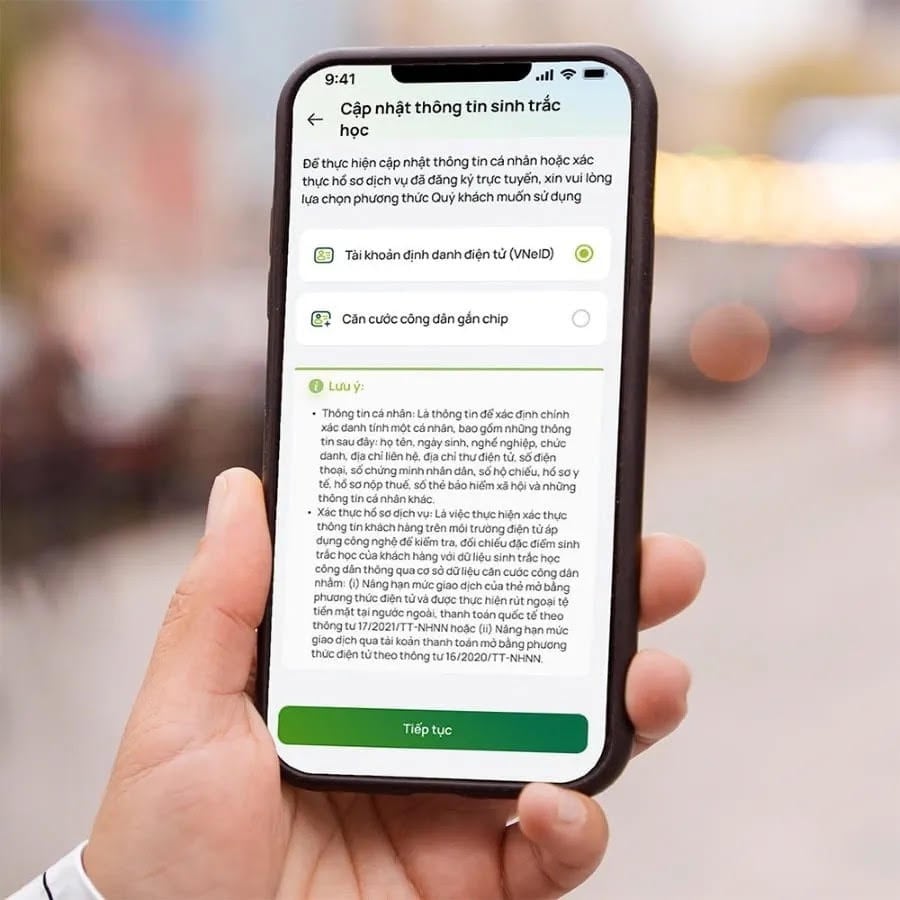

Since Decision 2345 took effect on July 1, 2024, Vietcombank has quickly deployed two forms of online information update on VCB Digibank digital banking for customers, including online registration via VCB Digibank application using NFC "scanning" technology; Online registration using App-to-App connection with Electronic Identification Account (VNeID). In addition, customers can update biometric information at nearly 600 Vietcombank transaction points nationwide.

Realizing the increasing demand for biometric updates, Vietcombank has quickly organized overtime and weekend work to serve customers. Specifically, from November 23, 2024 to January 15, 2025, Vietcombank's transaction points will serve customers from 8:00 a.m. to 6:30 p.m. from Monday to Friday and from 8:00 a.m. to 5:30 p.m. on weekends to support customers in registering information. In particular, customers do not need to return to the branch where they opened their account but can go to any Vietcombank transaction point to carry out this procedure. In addition, the staff at the transaction points are well trained to support customers with any questions during the process.

After implementing overtime, the number of customers successfully updating their biometrics doubled compared to before. In some industrial zones, the number of customers who are factory and company employees coming to update their biometrics increased dramatically, especially on weekends. These Vietcombank branches mobilized all employees to work overtime to serve customers.

Vietcombank also cooperates closely with the Ministry of Public Security to exploit the national population database, ensuring that authentication is quick, accurate and secure. Since July 2024, Vietcombank has signed a service contract with the Center for Research and Application of Population Data and Citizen Identification (RAR) to apply the Ministry of Public Security's Electronic Authentication Service to collect, clean information and authenticate Biometrics for customers on digital banking channels. This is an important step to improve security, prevent fraud, and promote digital transformation in the financial sector.

Vietcombank's proactive organization of overtime work and application of modern technology in biometric authentication has received high appreciation from customers, demonstrating the great efforts of the entire system in serving and supporting customers in updating information according to the regulations of the State Bank of Vietnam, thereby contributing to enhancing the bank's reputation in the financial sector.

Thuy Nga

Source: https://vietnamnet.vn/gan-8-5-trieu-khach-hang-vietcombank-cap-nhat-sinh-trac-hoc-thanh-cong-2351125.html

Comment (0)