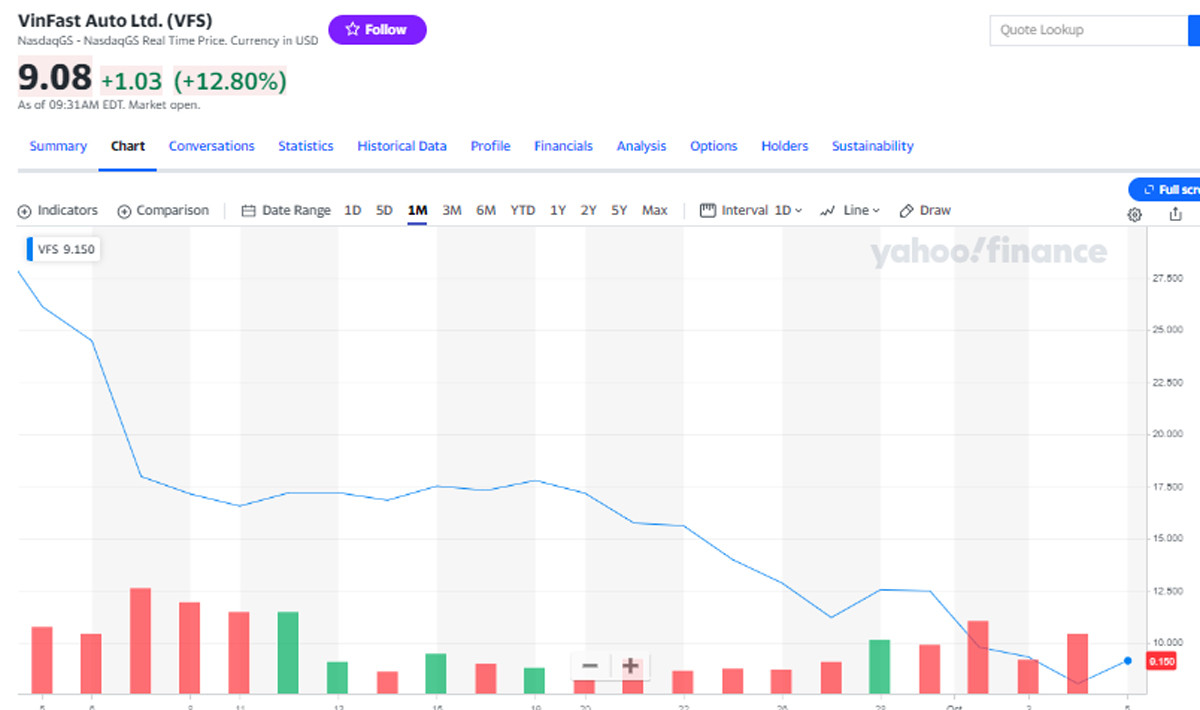

Opening the official trading session on October 5 on the US Nasdaq stock exchange (October 5 evening Vietnam time), VinFast Auto (VFS) shares of billionaire Pham Nhat Vuong turned around and increased strongly again after 4 previous sessions of deep decline.

Specifically, as of 8:32 p.m. on October 5 (Vietnam time), VFS shares increased nearly 13% compared to the previous session, to 9 USD/share.

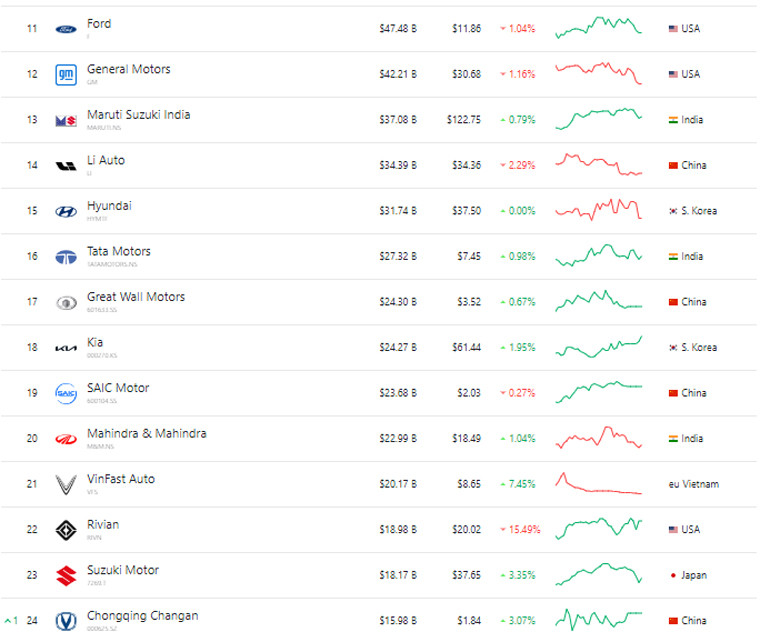

At the current price, VinFast Auto's (VFS) capitalization has increased to 21.5 billion USD, although it has not reached the initial valuation of 23 billion USD.

Currently, the capitalization of billionaire Pham Nhat Vuong's electric car company is ranked below India's Tata Motors, China's SAIC Motor and Korea's Kia.

VinFast regained its 21st position among the world's car manufacturers. If only counting electric car manufacturers, VinFast ranked 4th after billionaire Elon Musk's Tesla (as of October 5, capitalization was 836 billion USD), China's BYD (91.8 billion USD) and China's Li Auto (34.6 billion USD).

VinFast stock liquidity on the Nasdaq recently improved sharply compared to mid-September.

In the session on October 4, VinFast recorded liquidity of more than 5.62 million units after the number of freely circulating shares increased sharply since the session on October 2 when the US Securities and Exchange Commission (SEC) announced the effective offering of more than 75.7 million common shares of the VinFast shareholder group.

Previously, VinFast had only 4.5 million listed VFS shares (out of a total of more than 2.3 billion outstanding VFS shares).

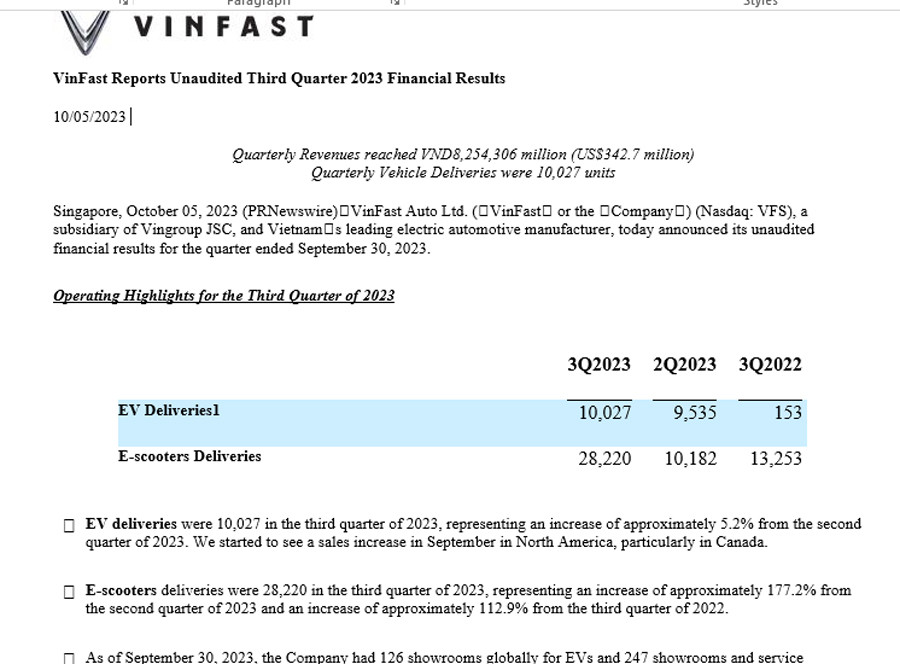

At the beginning of the trading session on October 5 (October 5 evening Vietnam time), VinFast submitted its unaudited third quarter financial report to the SEC with a net loss of 622.9 million USD, an increase of 33.7% over the same period last year and an increase of 19.7% compared to the loss in the second quarter of 2023.

In the third quarter of 2023, VinFast recorded total revenue of 342.7 million USD, an increase of 159.3% over the same period and an increase of 3.8% compared to the second quarter of 2023. Of which, money from car sales reached 319.5 million USD, an increase of 185.2% over the same period and an increase of 2.8% compared to the previous quarter.

In Q3/2023, VinFast delivered 10,027 electric cars, compared to 9,535 in Q2/2023 and 153 in Q3/2022. VinFast also delivered 28,220 electric motorbikes, compared to 10,182 in Q2/2023 and 13,253 in Q3/2022.

Also according to the report sent to the Nasdaq stock exchange, VinFast recorded increased sales in September in North America, especially in Canada.

By the end of the third quarter of 2023, VinFast will have 126 electric vehicle showrooms worldwide and 247 showrooms and service centers for electric motorbikes, including both VinFast and dealers.

Also in the report, VinFast announced its development orientation for the coming time. Accordingly, VinFast plans to develop its business in at least 50 new markets globally by the end of 2024.

VinFast also informed about the plan to build an assembly plant in India with a total investment of about 150-200 million USD, with a phase 1 capacity of 50,000 vehicles/year.

Previously, on July 28, VinFast started construction of an electric vehicle factory in the Triangle Innovation Point industrial park, Chatham County, North Carolina (USA) with an expected capacity of 150,000 vehicles/year in phase 1.

Earlier, according to Reuters, VinFast wanted to invest 1.2 billion USD in the Indonesian market.

Also in the report, in the US, VinFast has received letters of interest/applications from 27 dealers with more than 100 points of sale across US states such as Florida, Texas, North Carolina, Virginia, New Jersey and Arkansas.

In 2023, VinFast expects to sell 40,000 to 50,000 cars. Tesla expects sales of 1.8 million cars.

Source

Comment (0)