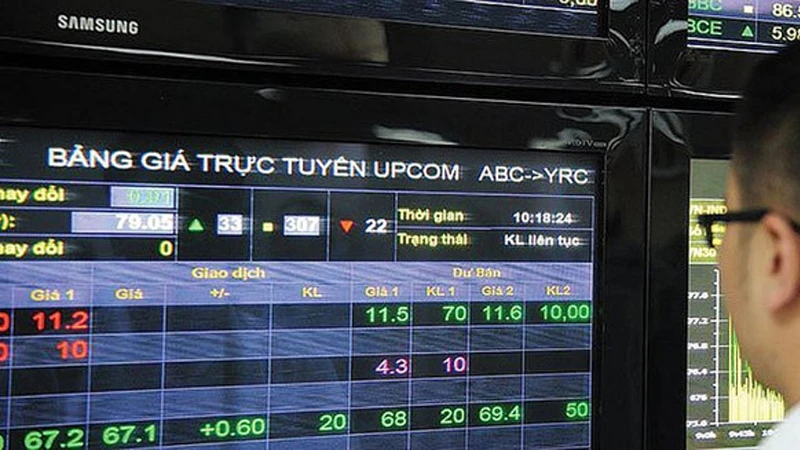

NDO - In the trading session on January 7, strong selling pressure in the afternoon caused the VN-Index to drop sharply, but the return of demand at the end of the session pushed stocks in many industry groups up, especially banking stocks with strong increases such as BID, MBB, NAB, CTG, STB... contributing positively to help the VN-Index close in the green, up 0.60 points, to 1,246.95 points.

Market liquidity this session increased slightly compared to the previous session, with the total trading volume of the three floors reaching more than 641.02 million shares, equivalent to a total trading value of more than VND 14,571.62 billion.

Foreign investors returned to net sell slightly, worth more than 116.12 billion VND, focusing on codes NLG (more than 63 billion VND), VNM (more than 62 billion VND), SSI (more than 58 billion VND), HPG (more than 42 billion VND), VRE (more than 38 billion VND)...

On the contrary, the stocks with the most net purchases in this session included FPT (over 98 billion VND), VGC (over 37 billion VND), STB (over 32 billion VND), DHT (over 27 billion VND), KBC (over 26 billion VND)...

On the HoSE floor, the matched order value this session decreased compared to the previous session, reaching more than 11,754.86 billion VND.

In this session, the codes that contributed positively to the VN-Index increased by more than 5.93 points include: BID, BCM, MBB, NAB, CTG, STB, FPT, LPB, ACB, KBC.

On the contrary, the stocks that negatively impacted the VN-Index by more than 3.65 points included: GVR, VCB, VNM, GAS, KDH, HDB, VPB, PNJ, SSI, PDR.

In terms of industry groups, energy stocks had a negative performance this session, down 3.07%, mainly from codes PVS, PVD, TMB, CST, PVC, PVB, AAH, NBC, PSB...

The group of raw material stocks leaned towards red, with a decrease of 0.98%, mainly from codes GVR, DGC, KSV, DCM, DPM, MSR, PHR, TVN, HT1, NKG, AAA, DPR, DHC, GDA, HGM... The increase direction included VGC, BMP, VCS, NTP, ACG, VIF, CSV...

Similarly, the retail stock group also decreased by 0.75%, mainly from codes PLX, PNJ, FRT, OIL, DGW, VFG, HHS, PET, CTF... Some codes increased including MWG, SAS, HAX...

Banking stocks were in the green, with an increase of 0.65%, mainly from codes BID, CTG, TCB, MBB, ACB, LPB, STB, VIB, SSB, TPB... Declining were VCB, VPB, HDB, MSB, OCB, SHB, EIB, NVB...

On the contrary, the group of securities stocks was in red, with a decrease of 0.82%, mainly from codes SSI, VCI, HCM, VND, MBS, VIX, BSI, SHS, CTS, AGR... On the contrary, some codes increased including VDS, ORS, VFS...

Software stocks were mixed this session, with an increase of 0.44%, mainly from FPT code (+0.54%)... CMG code fell sharply by 1.73% this session.

Real estate stocks also varied and decreased slightly by 0.05%, mainly from VRE, KDH, SSH, NVL, PDR, NLG, TCH, HDG, DIG, DXG... Increasing stocks included BCM, KBC, VPI, IDC, SIP, KOS...

* The Vietnamese stock market index reversed sharply at the end of the session but still closed in red, VNXALL-Index closed down 1.32 points (-0.06%), stopping at 2,066.03 points. Liquidity with a trading volume of more than 526.20 million units, equivalent to a trading value of more than VND 12,970.19 billion. In the whole market, there were 139 stocks increasing in price, 88 stocks remaining unchanged and 228 stocks decreasing in price.

* At the Hanoi Stock Exchange, the HNX-Index closed at 220.98 points, down 1.97 points (-0.88%). Liquidity reached a total of more than 48.47 million shares transferred, with a corresponding trading value of more than VND839.72 billion. In the whole market, there were 56 stocks increasing in price, 64 stocks remaining unchanged and 84 stocks decreasing in price.

The HNX30 index closed down 8.50 points (-1.83%) to 457.15 points. Trading volume reached over 26.03 million units, equivalent to over VND580.71 billion. In the whole market, 7 stocks increased in price, 7 stocks remained unchanged and 16 stocks decreased in price.

On the UPCoM market, the UPCoM-Index closed at 93.00 points, down 0.62 points (-0.66%). Market liquidity, total trading volume reached more than 30.50 million shares, corresponding trading value reached more than 365.09 billion VND. In the whole market, there were 97 stocks increasing in price, 82 stocks remaining unchanged and 146 stocks decreasing in price.

* At the Ho Chi Minh City Stock Exchange, the VN-Index closed up 0.60 points (+0.05%), to 1,246.95 points. Liquidity reached over 560.05 million units, equivalent to a trading value of VND13,188.92 billion. The entire floor had 156 stocks increasing, 62 stocks remaining unchanged and 252 stocks decreasing.

The VN30 Index increased by 2.24 points (+0.17%) to 1,315.28 points. Liquidity reached over 179.92 million units, equivalent to a trading value of over VND5,881.45. The VN30 group of stocks ended the trading day with 14 stocks increasing, 3 stocks remaining unchanged and 13 stocks decreasing.

The 5 stocks with the highest trading volume are SSI (over 18.56 million units), NAB (over 14.73 million units), HPG (over 14.39 million units), DXG (over 12.52 million units), DIG (over 12.23 million units).

The 5 stocks with the highest price increase are NAB (+6.96%), CIG (+6.93%), HAP (+6.88%), PSH (+6.83%), TMT (+6.69%).

The 5 stocks with the biggest price decrease were MBB (-11.27%), VCA (-6.99%), BTT (-6.91%), TV2 (-6.87%), YEG (-6.87%).

* Today's derivatives market had 174,545 contracts traded, worth more than VND 23,087.66 billion.

Source: https://nhandan.vn/cau-manh-cuoi-phien-vn-index-dao-chieu-lay-lai-sac-xanh-post854838.html

Comment (0)