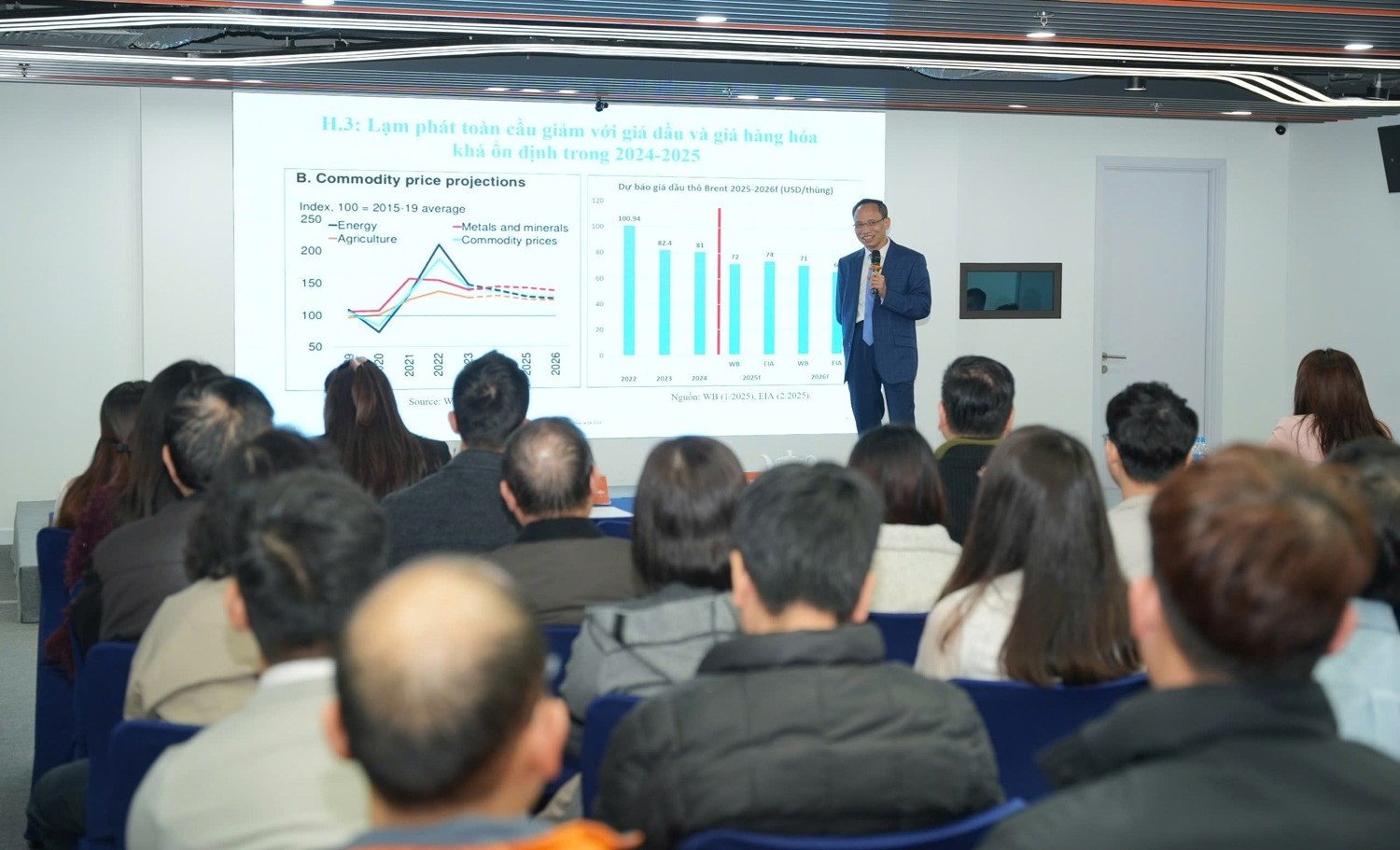

On March 10, 2025, Nhat Viet Securities Joint Stock Company (VFS) organized a seminar on the topic "Stock market prospects 2025 - Rebound from new expectations", with many positive comments from experts.

At the workshop, Dr. Can Van Luc - Chief Economist and Director of BIDV Training and Research Institute - forecasted that GDP growth in 2025 will reach 8% for the base scenario (7.09% in 2024), higher than the world and regional average thanks to the main driving forces coming from retail sales of goods and consumption recovering by 9-10%, export growth of 8-10%, and realized FDI increasing strongly by 10-12%. In addition, according to Dr. Luc, the recovery of private investment, the growth of remittances, and the promotion of public investment planning will also contribute to helping Vietnam's economy accelerate in 2025. With a growing economy, inflation, and exchange rates under control, interest rates maintained at low levels, creating the premise for the stock market to maintain its upward momentum.

According to Mr. Nguyen Minh Hoang - Director of VFS Analysis, in 2024, the stock market will not be able to make a strong breakthrough due to many unfavorable factors, also known as "headwinds". However, in 2025, when these barriers gradually weaken, the market can welcome positive growth drivers.

“The liquidity of the stock market is expected to be boosted by the upgrading process, expected to take place in September 2025, as well as the decline in net selling pressure from foreign investors. With the above dynamics, I believe that the VN-Index is expected to increase to the 1,450 point area, corresponding to an expected P/E of 12 times, when the growth of after-tax profits of listed enterprises on the market can reach 14 - 16% YoY,” Mr. Hoang commented.

Based on the macro outlook and market developments, Mr. Hoang believes that real estate and public investment will be two potential stock groups in 2025, benefiting directly from the economic recovery trend and support policies from the Government.

Taking a deeper look at the Real Estate sector, Ms. Do Hong Van - Head of Data Analysis at FiinGroup Vietnam Joint Stock Company - forecasts that the real estate sector's after-tax profit in 2025 could continue to recover by about 17.2% year-on-year in the baseline scenario. The main driving force comes from the improvement in the supply of residential real estate, especially in the mid-range segment, and the return of vibrant real estate transaction demand. With the above prospects and attractive valuations, this sector has recorded signs of attracting cash flow again. However, Ms. Van noted some remaining risks, including pressure on corporate bond maturity, refinancing needs, as well as the trend of net selling of real estate stocks by foreign investors. Ms. Van also provided a list of potential real estate stocks, focusing on businesses with clean land funds, transparent legal status, and projects expected to be implemented in 2025.

The workshop also mentioned solutions for the Vietnamese stock market such as: continuing to implement solutions for stock market development on the Financial Strategy and Stock Market Development until 2030; promoting equitization and divestment of state-owned enterprises; drastically implementing solutions to upgrade the stock market; developing investor platforms and upgrading IT infrastructure; building and implementing the Digital Transformation Strategy for the securities industry until 2030...

Bich Dao

Source: https://vietnamnet.vn/da-tang-tich-cuc-cua-thi-truong-chung-khoan-viet-2379771.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

Comment (0)