On the afternoon of November 20, the National Assembly discussed the draft Resolution on the application of additional corporate income tax according to the regulations against global tax base erosion (commonly known as global minimum tax). Expressing his opinion, delegate Vu Tien Loc (Hanoi delegation) highly agreed with the issuance of the resolution, but said that this would have a huge impact, reducing the attractiveness of the investment and business environment in our country, especially for strategic investors.

To reduce adverse impacts, Mr. Loc said that the National Assembly also needs to issue preferential and supportive policies to "reassure" strategic investors and assign the Government to study specific policies.

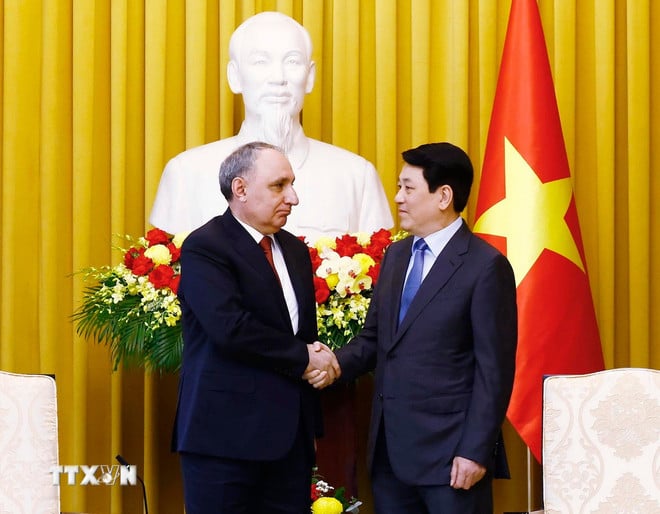

Delegate Vu Tien Loc (Hanoi delegation) gave his opinion in the discussion.

According to Mr. Loc, this ensures maintaining an attractive investment environment while not violating international commitments and not going against the integration trend. To do so, issuing new investment support policies is not a measure to compensate investors for losses due to having to pay additional taxes.

"Investment support policies need to ensure a principle of fairness, targeting all businesses that meet the specific criteria that our policies aim for, regardless of whether they are subject to additional taxes or not," Mr. Loc suggested.

Delegate said it is entirely possible to sue.

Regarding the issue that many delegates are concerned about when applying the global minimum tax, whether investors can file a lawsuit or not and how to control this, Mr. Loc said that businesses currently investing in Vietnam can absolutely file a lawsuit.

However, in case of lawsuits, multinational companies also have difficulty proving damages caused by tax policies. Because if they do not pay additional taxes in Vietnam, they will have to pay taxes in other countries.

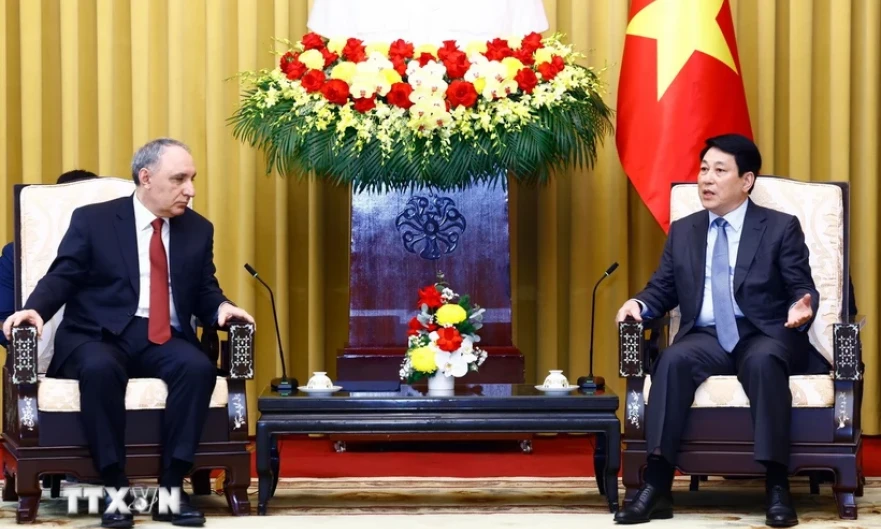

Delegate Hoang Thi Thanh Thuy (Tay Ninh delegation) said that the possibility of lawsuits by enterprises subject to global minimum tax is entirely possible.

"That means when businesses file lawsuits to pay additional taxes in Vietnam, they immediately risk having to pay that tax abroad, whether they win or lose. This will reduce the number of lawsuits for multinational companies," Mr. Loc analyzed.

Delegate Hoang Thi Thanh Thuy (Tay Ninh delegation) said that tax-paying enterprises can completely file a lawsuit to continue enjoying incentives under the current Investment Law.

Ms. Thuy said that according to the investment guarantee regulations in the current Investment Law, if the government has a lower incentive policy, the investor will enjoy the incentive for the remaining period of the project. This means that when the global minimum tax policy is applied, there is a possibility that the enterprise will file a lawsuit to apply the investment guarantee regulations.

From there, Ms. Thuy suggested that the resolution should provide detailed regulations to reduce the possibility of lawsuits by taxable enterprises; at the same time, determine the principles for resolving lawsuits when they occur, ensuring that the State does not suffer losses.

Delegate Truong Trong Nghia (HCMC delegation) also wondered: if a dispute or complaint arises, which law will be applied, which agency will handle it? And then, will it be resolved according to Vietnamese law or international law, Vietnamese court or international court?

From there, Mr. Nghia suggested that detailed instructions should be issued soon when the resolution is passed by the National Assembly so that taxable enterprises can arrange their investments, financial and accounting books, and state agencies can also arrange to access the new things of the resolution.

Finance Minister: Very unlikely to file a lawsuit

Explaining at the end of the discussion session, Finance Minister Ho Duc Phoc affirmed that when issuing a resolution on global minimum tax, it is to determine the State's right to tax and bring benefits to the country.

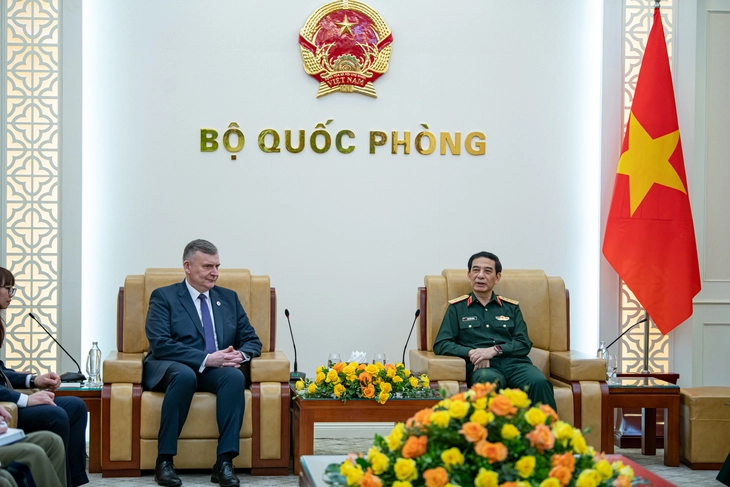

Minister of Finance Ho Duc Phoc explains at the National Assembly

Regarding concerns about the possibility of businesses filing lawsuits when the tax is applied, the Minister of Finance said that when the National Assembly issues a resolution, the Ministry of Finance will work with 122 businesses subject to the tax to "prepare mentally".

"I think it is very unlikely that a lawsuit will result. Because if a business does not pay taxes in Vietnam, it must pay taxes abroad. Paying taxes abroad is much more complicated because foreign tax authorities must also come to Vietnam to collect taxes...", Mr. Phuc said.

Regarding incentives stated in the investment certificate, Mr. Phuc said that the investment certificate cannot state tax incentives because tax incentives must be implemented according to the provisions of tax law.

"Recently, some localities and the Department of Planning and Investment issued investment certificates that included tax incentives, which is incorrect. We have responded in writing and instructed the Department of Planning and Investment to implement it correctly and consistently," said Mr. Phoc.

Regarding the new investment incentives along with the addition of the global minimum tax, Mr. Phoc said that the Government has assigned the Ministry of Planning and Investment and this ministry has reported to the National Assembly Standing Committee. "The National Assembly Standing Committee is requesting revisions within a very short time of promulgation to ensure the rights of investors," Mr. Phoc said.

Concluding the discussion session, Vice Chairman of the National Assembly Nguyen Duc Hai said that the National Assembly Standing Committee agreed that the National Assembly would approve preferential policies in parallel with the issuance of a resolution on global minimum tax and record it in the Resolution of the 6th session approved at the end of the session.

The global minimum tax is an agreement reached by G7 countries in June 2021 to combat tax avoidance by multinational corporations, effective from January 1, 2024. The tax rate will be 15% for multinational enterprises with a total consolidated revenue of 750 million euros (about 800 million USD) or more in 2 of the 4 most consecutive years.

If Vietnam does not internalize the global minimum tax regulations, capital exporting countries will be able to collect additional corporate income tax (up to 15%) from multinational companies with foreign investment projects in Vietnam that are currently enjoying an effective tax rate of less than 15%.

According to the Ministry of Finance, in Vietnam there are 122 enterprises subject to global minimum tax, with revenue of about 14,600 billion VND per year.

Source link

![[Photo] The flavors of Southern Vietnamese traditional cakes](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/b220c9f405b945d798738ea0a94b29b8)

![[Photo] Overcoming the sun to remove temporary and dilapidated houses for poor households](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/824ba71165cc4f8fb6a3903ca0323e5d)

![[Photo] Renovating the "green gem" in the heart of the capital](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/e5a1627db4504cd88b6b81163df1b18b)

![[Photo] Prime Minister Pham Minh Chinh attends conference on ensuring security and order in the Northwest and surrounding areas](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/933ce5c8b72e4663bd6c6cd8be908f23)

Comment (0)