The BRICS group, of which Russia and China are members, was established to promote global economic integration, countering the hegemony of the US and the West in the financial sector.

|

| In recent years, the BRICS nations have been looking to break away from a world dominated by the US dollar. (Source: Shutterstock) |

The US dollar is the world’s reference model, serving as the international reserve currency and the yardstick for global export markets. However, this monopoly is gradually being challenged, especially with the rise of the BRICS. At the same time, changes in the global economy mean a shift from a greenback-centric financial system to a more pluralistic and multipolar financial system with the emergence of the BRICS.

BRICS currently consists of nine members: China, India, Russia, Brazil, the United Arab Emirates (UAE), Egypt, South Africa, Iran and Ethiopia. Notably, the bloc has four of the world’s 11 largest economies, with China and Russia holding permanent seats on the United Nations Security Council.

The power of BRICS is reflected in impressive numbers. With a population of more than 3.5 billion people, accounting for 45% of the world's population, BRICS far exceeds the G7 - representing only 715 million people. BRICS's total GDP reaches 27,000 billion USD, accounting for about 1/4 of global GDP. Notably, BRICS controls 45% of global oil reserves, along with abundant fresh water and agricultural land.

US Privileges from USD Position

Since the Bretton Woods Agreement of 1944, the US dollar has been the international currency. After the Bretton Woods system collapsed in 1971, the US abandoned the “gold standard”, but the US dollar remained dominant. There are many reasons for Washington’s dominance, including the current strength of its economy, the US dollar’s status as the world’s reserve currency, and its role in the oil trade, known as the petrodollar system.

The dominance of the US dollar gives the US some important privileges. The hegemony of the greenback has given the US a major advantage. It allows the country to borrow at cheaper interest rates because demand for foreign currency assets, especially US Treasury bonds, remains high.

Moreover, the position of the USD also gives the US the leverage to basically control most organizations such as the International Monetary Fund (IMF) and the World Bank (WB). However, the existence of a unipolar structure of the financial world has not been without criticism.

The main objective of BRICS

The BRICS group was founded in the early 2000s with the primary goal of promoting economic integration and countering the financial hegemony of the United States and Europe. Over the years, the group has grown into a major trade and investment bloc, in terms of its share of total world trade and investment.

The BRICS countries have many strengths: China is a manufacturing giant, Brazil is endowed with natural resources, Russia is a major energy supplier and South Africa is a key player in Africa.

Another major reason why BRICS formed the alliance is because most of these countries rely heavily on the US dollar. Some of them, most notably China and Russia, have already faced the impact of economic sanctions.

Therefore, when it was founded, BRICS focused on finding ways to limit the role of the greenback and introduce functions that could allow trade in the national currencies of the bloc's member countries.

|

| The BRICS countries are starting to diversify away from the greenback, which means the move will have a major impact on global trade and finance. (Source: Reuters) |

Specific actions

In recent years, the BRICS nations have sought to move away from a world dominated by the greenback. A number of factors have driven this shift: political rivalries, economic sanctions imposed by the United States, and efforts to exert greater control over the banking sector.

The highlight of this shift was the establishment in 2014 of the New Development Bank (NDB), headquartered in Shanghai, China. Its main objective is to provide local currency development financing solutions to member countries instead of the USD-dominated systems of its Western counterparts.

The two major economies, China and Russia, have been very active in promoting de-dollarization, which is evident in the increase in bilateral trade volumes that are now settled in more yuan and rubles. India has also expressed a growing desire to use rupees for overseas purchases, especially oil purchases from Russia.

By engaging in transactions with members of this group, they hope to achieve the goal of using local currencies to avoid the greenback-based system, reduce business costs, and attempt to eliminate volatility in the foreign exchange market.

The countries are also considering the idea of a common BRICS currency. Although still in its early stages, the concept stems from the group’s strategic thinking about creating a new global financial architecture after the crisis. The addition of a common currency or even a more coherent financial architecture among the BRICS countries would contribute to the weakening of the US dollar.

The BRICS countries are beginning to diversify away from the greenback, which will have a significant impact on global trade and finance. As more countries look for ways to diversify their foreign exchange reserves and consider options away from accumulating the dollar, the use of the currency is likely to decline.

Emerging economies have not been affected much by the US Federal Reserve’s recent interest rate hikes because they have switched to trading in local currencies. Meanwhile, most developing countries have suffered capital flight and inflation as the greenback has risen because their debt is often denominated in US dollars.

The BRICS countries’ holdings of USD expose their foreign accounts to fluctuations in the currency, so they need to diversify further to improve their economic stability. Furthermore, global financial diversification can promote a relatively equitable distribution of power in the world. In the past, the US has used its manipulative control over the USD-based international financial system as a way to negotiate with other countries, or to impose sanctions on those who do not agree.

Source: https://baoquocte.vn/bat-chap-lenh-trung-phat-tu-my-va-su-ba-quyen-cua-dong-usd-day-la-cach-nga-trung-quoc-brics-lua-chon-doi-dau-294482.html

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

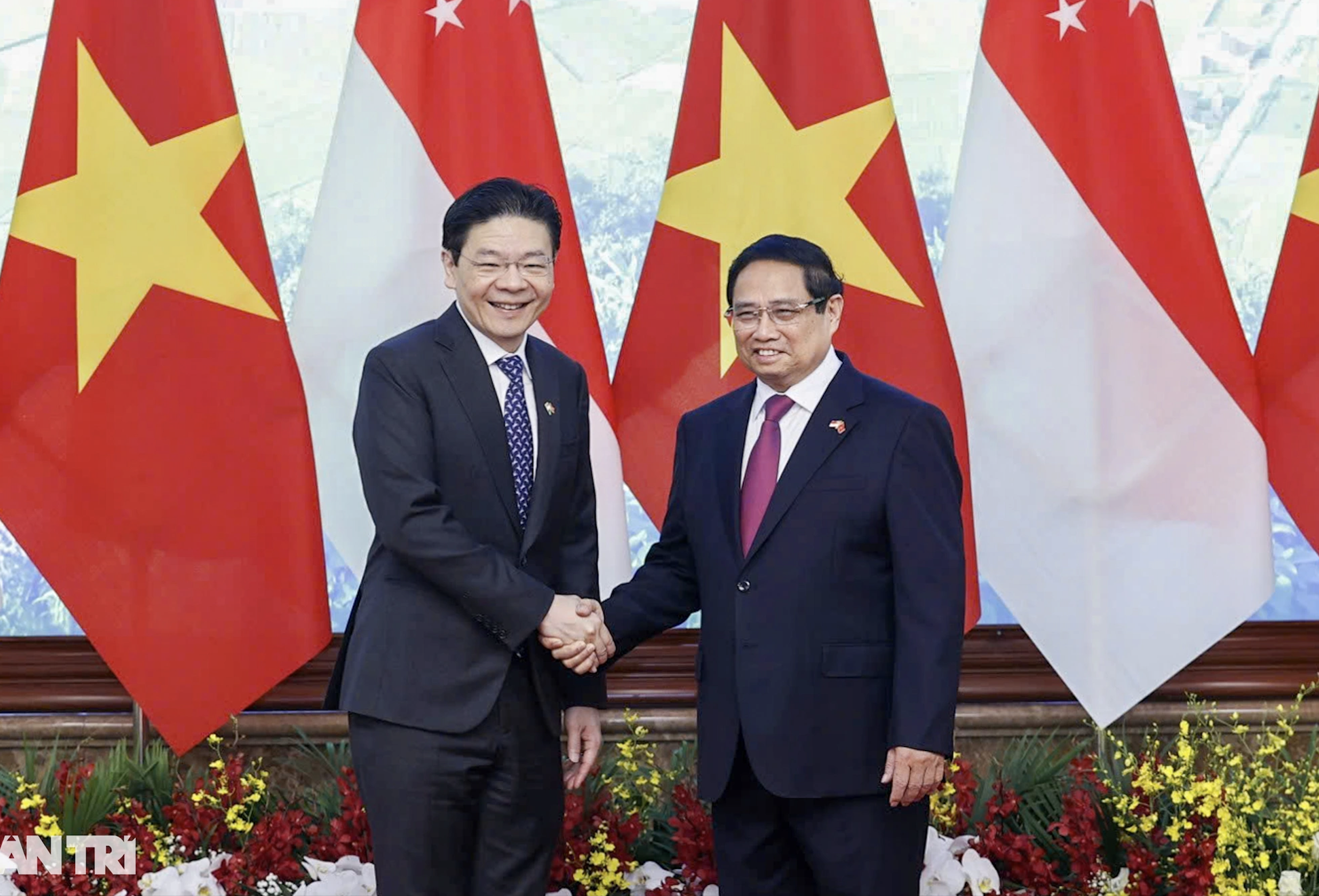

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

Comment (0)