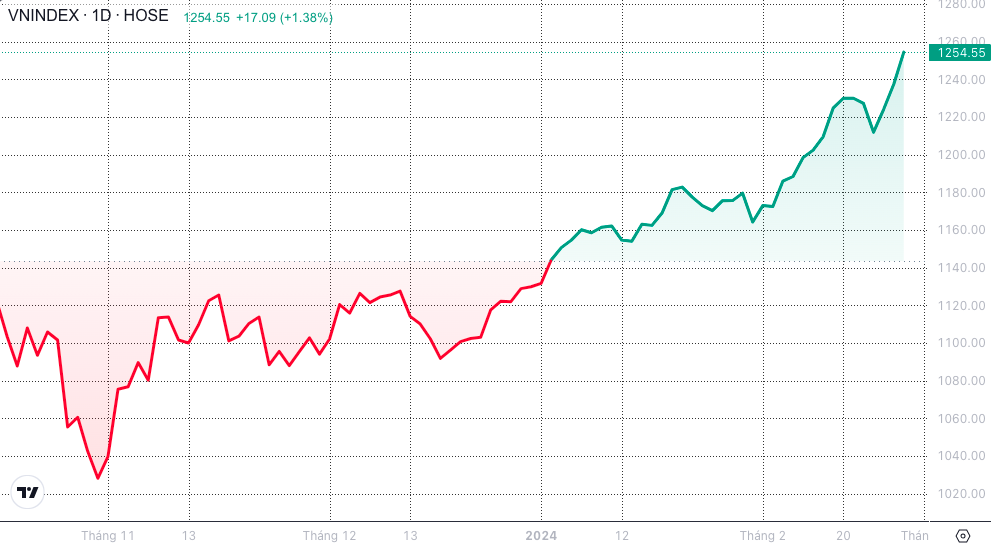

VN-Index jumped 17 points today, surpassing the 1,250-point mark after 17 months, but liquidity was not too active. Many investors expressed concern about this increase.

The market jumped more than 17 points in today's session, surpassing the resistance level of 1,250 points to the surprise of investors. This is also a level that has never appeared on the VN-Index in the past 17 months.

Closing the session at 1,254.5 points, the strong increase started after the lunch break, with 309 stocks increasing, 180 stocks decreasing and 67 stocks remaining unchanged.

At the same time, on the HNX floor, the score decreased slightly by 0.22 points, down to 235.16 points, while UPCoM increased slightly by 0.14 points, up to 90.54 points.

Despite the strong increase in points, liquidity was not too exciting, even somewhat gloomy compared to previous sessions. Total transactions on the three floors reached about VND25,500 billion. HOSE alone reached VND22,700 billion, with a trading volume of nearly 900 million shares.

The market is still mainly led by the VN30 group of stocks with large capitalization and oil and gas stocks.

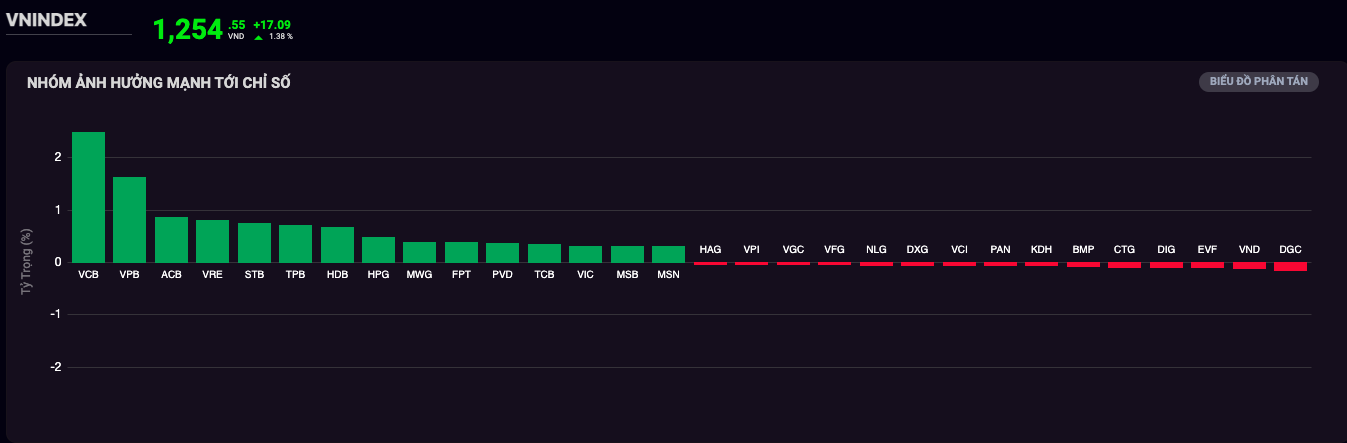

Group of stocks strongly affecting the index

Blue-chip stocks led the market growth, with banking stocks dominating (Source: SSI iBoard)

Banking stocks have strongly attracted cash flow again, as more than half of the stocks that strongly influence the index come from this industry. At the same time, banking is the industry group with the largest market capitalization.

VCB shares increased "purple" in today's session (Source: SSI iBoard)

Notably, VCB (Vietcombank, HOSE) increased to the ceiling price of nearly 7%, to VND97,400/share, which is also the highest price in the history of this stock.

Next is VPB (VPBank, HOSE) increased by 2.84%, ACB (Asia Commercial Bank, HOSE) increased by 1.45%...

Going against the market trend, CTG (Vietinbank, HOSE) was the only stock in the BIG4 group to decrease by 0.55%, followed by SGB (Saigon Bank, HOSE) down 2.22%, PGB (PGBank, HOSE) down 1.9%...

TPB (TPBank, HOSE), VPB (VPBank, HOSE), SHB (SHB Bank, HOSE) and MBB (MB Bank, HOSE) are stocks with transactions of approximately 20 million to 26 million units, contributing to increasing liquidity for the market.

It can be seen that recently, the cash flow into the banking group has helped push many stocks in this group to surpass historical peaks or maintain at peaks after a series of consecutive increases, including: BID (BIDV Bank, HOSE), HDB (HDBank, HOSE), NAB (Nam A Bank, HOSE),...

In addition, PVD stock (Petroleum Drilling and Services Corporation, HOSE) also increased to the maximum limit of 7%, returning to the 30,000 VND/share range since July 2015, leading the group of oil and gas stocks, creating a highlight for the market.

After a "shaky" session of 15 points decrease at the end of last week, VN-Index has continuously increased strongly in the past 3 sessions, increasing 11, 13 and 17 points respectively. In this context, many investors expressed more concern than joy.

Ms. Nguyen Minh Thu (40 years old, in Hanoi), a long-time stock investor, shared : "The market is increasing rapidly but the liquidity is not too large, which makes me more worried, especially the banking group has increased strongly for quite a long time, I wonder if this industry group will be promoted in the future?".

VN-Index surpasses 1,250 points after 17 months, confusing many investors (Source: SSI iBoard)

According to many analysts, bank stocks have been on a long upward trend since the end of last year, so buying now could potentially pose a risk of "buying at the top".

VCBS Securities recommends that the market's increase is mainly due to support from large-cap groups, but has not yet spread to the rest of the market. Investors should gradually switch to stocks that show signs of building a solid foundation and have stable cash flow signals, belonging to a number of industry groups: securities, oil and gas, banking.

Beta Securities believes that the market is likely to retest the 1,250-point mark. Investors should be cautious in limiting the purchase of stocks in an overheated state to avoid profit-taking pressure, leading to the risk of correction. Investors who own stocks in an overheated state or have achieved their goals can consider taking partial profits to ensure investment performance.

Source

Comment (0)