Dragon Capital Securities Company (VDSC) decided to increase its weight in the banking group, with VCB shares in its strategic investment portfolio.

VDSC: Waiting for positive news about market upgrade, placing expectations on banking group

Dragon Capital Securities Company (VDSC) decided to increase its weight in the banking group, with VCB shares in its strategic investment portfolio.

Assessing the stock market outlook for March 2020, Dragon Capital Securities Company (VDSC) forecasts that the market will maintain positive momentum and revaluation trend in March, with a P/E target of 13.3x.

VDSC said that this March the market will wait for positive information about upgrading Vietnam's stock market from FTSE when Vietnam has fully met the criteria.

In addition, information about the operation of the KRX trading system has positive signals when the Ho Chi Minh City Stock Exchange (HoSE) has just issued an official dispatch to related securities companies on February 26, 2025 regarding the preparation of data for system testing. VDSC believes that the long holiday period of April 30 and May 1 is a long enough time gap (5 days) and the earliest for testing before Go-live to take place.

The government is aggressively targeting 8% economic growth by 2025. This means that the credit and regulatory environment will be managed in a supportive manner to facilitate private investment expansion. In addition, the AGM season of listed companies will bring new information on expansion plans, business and dividend budgets, which can boost stock prices.

On the market side, there is still increased risk from the trade war tensions between the US and China and its long-time allies. This could affect global markets, especially inflation, growth and monetary policy expectations. Compared to last month, the situation has escalated somewhat as agreements with the parties have not been reached, leading to the imposition of tariffs between the US, Canada, Mexico and China to take effect. Global markets could witness a period of strong volatility similar to what happened in 2018 when the parties have not reached a common voice.

However, the downside risk of Vietnam's stock market is considered lower than that of global markets thanks to attractive market valuations and growth prospects compared to the region and the world, and the low possibility of tariffs on Vietnam this year and the possibility of benefiting from superpower competition.

|

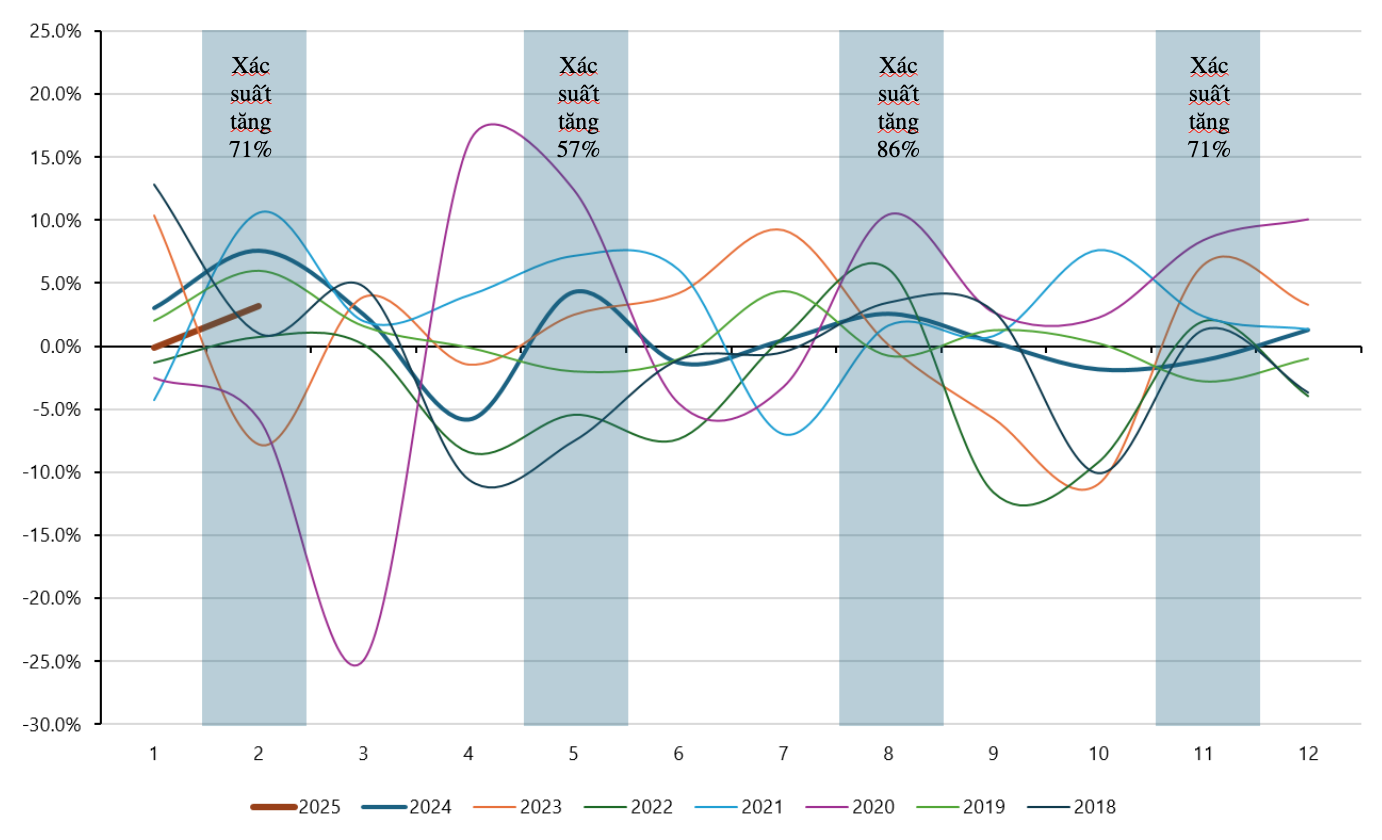

| Variable VN Index movement month (2020-2025). Source : Bloomberg, Rong Viet Securities Company match |

VDSC expects the VN-Index to fluctuate between 1,280 and 1,350 points. The above positive factors will help achieve the P/E target of 13.3x, but risks from the trade war or FTSE not upgrading Vietnam could cause the market to correct.

With the current P/E of 12.7x, the opportunity for accumulation still outweighs the downside risk. However, investors should focus on diversifying their portfolios, focusing on industries with positive prospects and choosing stocks with reasonable valuations to minimize risks, especially during periods of strong market volatility due to headwinds.

In this context, VDSC has decided to increase the proportion of the banking group, with VCB shares in the strategic investment portfolio. The reason for increasing the proportion of the sector comes from the fact that the banking sector continues to play a major role in promoting economic growth, especially in the context of the Government's ambition to set a very high economic growth rate, and the banking group continues to be the locomotive leading the market's profit growth.

Source: https://baodautu.vn/vdsc-cho-tin-tich-cuc-ve-nang-hang-thi-truong-dat-ky-vong-vao-nhom-ngan-hang-d251243.html

Comment (0)