(NLĐO) – Falling interest rates could boost the stock market's upward momentum next week, even though the VN-Index has risen for seven consecutive weeks.

The Vietnamese stock market had a strong week. The VN-Index closed the week at 1,326.05 points, up 20.69 points from the previous week; the HNX Index stopped at 238.41 points, down slightly by 0.78 points from the previous week.

Last week, the market's upward momentum slowed in the first three sessions due to profit-taking pressure and conflicting developments surrounding the US imposition of tariffs on Mexico, Canada, and China. However, the VN-Index surged in the last two sessions of the week thanks to positive domestic news.

Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDIRECT Securities Company, analyzed that the State Bank of Vietnam announced it would cease issuing treasury bills after a long period of using this tool to regulate liquidity. This move demonstrates a strong commitment to supporting liquidity in the system to lower market interest rates as directed by the Government . At the same time, the State Bank of Vietnam is also implementing additional solutions to provide longer-term liquidity support for the banking system.

The VN-Index has a seven-week winning streak and is projected to perform positively next week.

These steps helped to significantly lower interbank interest rates, with overnight rates falling to around 4%, boosting the stock market, especially banking and securities stocks. Furthermore, the news that Vinpearl submitted its listing application to the HOSE (Ho Chi Minh Stock Exchange) was a very noteworthy development after a long period without initial public offerings (IPOs) or listings by large companies. Following this news, VIC shares surged to their ceiling price at the end of the week.

"Next week, with positive sentiment spreading, the market may reach the strong resistance zone of 1,340 - 1,360 points, and volatility will appear. Investors may consider selling to take partial profits and reducing leverage to a safe level to avoid a short-term correction that may occur in this area," Mr. Hinh said.

The stock market is at its highest level since May 2022.

Experts at Pinetree Securities also stated that the stock market has seen seven consecutive weeks of gains, ending at its highest level since May 2022, with liquidity increasing each week. The VN-Index has been one of the best-performing markets in Asia over the past few weeks.

"It is highly likely that the upward trend will continue into the beginning of next week, especially given the unofficial information regarding the KRX system and the State Bank's monetary policy easing. The VN-Index may experience a correction next week, but capital will shift to other stock groups. In a positive scenario, the VN-Index could reach 1350 points," – a Pinetree Securities expert predicted.

Although the market is projected to continue rising, many securities companies recommend that investors who missed the rally or have low portfolio allocations should patiently wait for corrections to invest in order to secure a better position and cost basis.

Kien Thiet Vietnam Securities Company stated that, at the resistance level of 1,327 points, there is a high probability of a correction to the support zone of 1,290 - 1,310 points. Investors should limit new purchases and may even continue to sell shares to take profits in the short term, only buying back when the market corrects downwards.

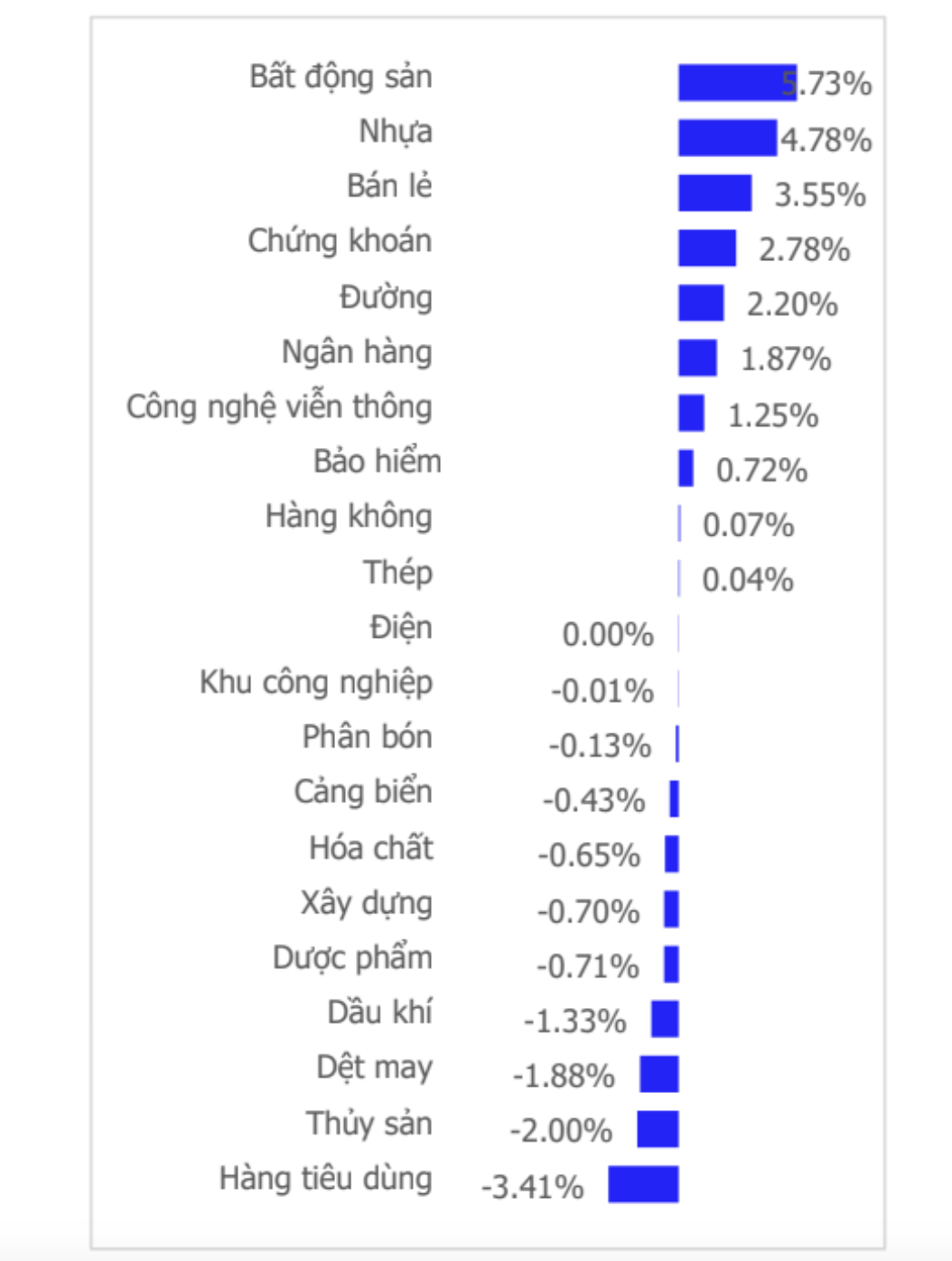

Real estate stocks were the best performing group last week.

Source: https://nld.com.vn/chung-khoan-tuan-toi-10-den-14-3-lai-suat-giam-vn-index-se-tang-tiep-196250309143708587.htm

Comment (0)