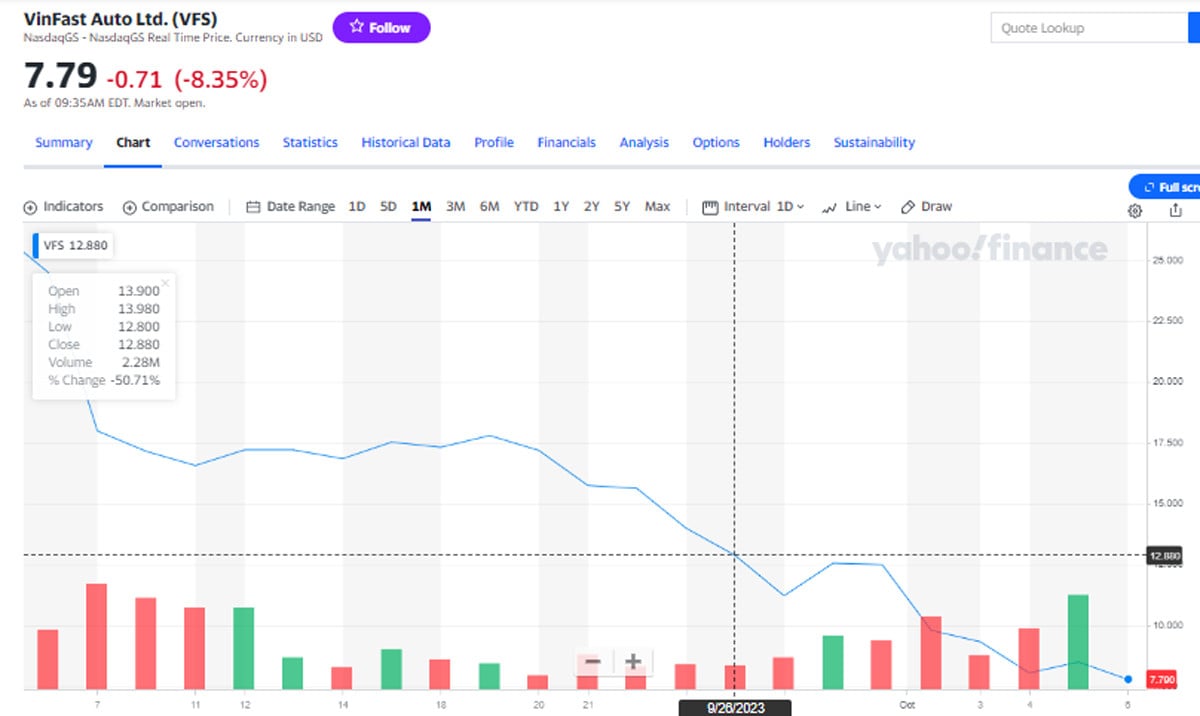

Opening the official trading session on October 6 on the US Nasdaq stock exchange (October 6 evening Vietnam time), VinFast Auto (VFS) shares of billionaire Pham Nhat Vuong fell sharply to the threshold of 8 USD after a previous recovery session.

Specifically, as of 8:40 p.m. on October 6 (Vietnam time), VFS shares decreased by more than 8% compared to the previous session to 7.8 USD/share.

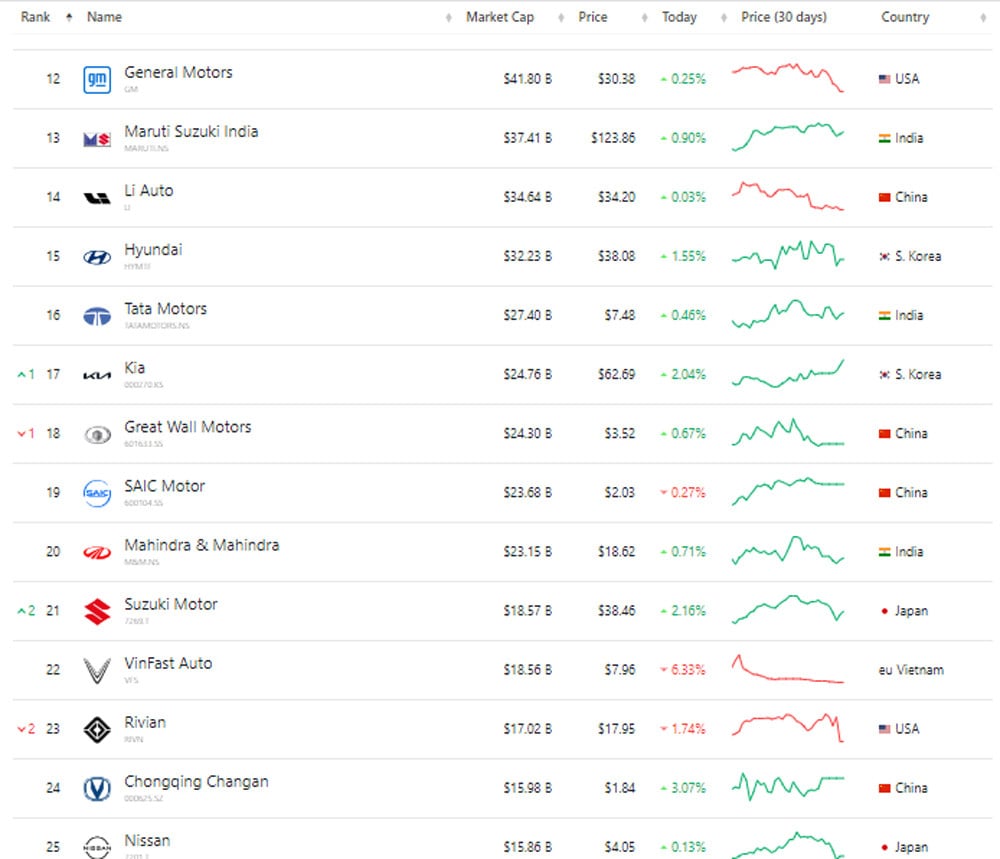

At the current price, the capitalization of VinFast Auto (VFS) of billionaire Pham Nhat Vuong is 18.5 billion USD, much lower than the initial valuation (23 billion USD).

Currently, the capitalization of billionaire Pham Nhat Vuong's electric car company is behind most famous car companies in the world, but is still above some small electric car startups in the US and China, including: Rivian, NIO, Xpeng, Lucid.

VinFast dropped to 22nd place among car manufacturers in the world. If only counting electric car manufacturers, VinFast ranked 4th after billionaire Elon Musk's Tesla (as of October 6, capitalization was 799 billion USD); China's BYD (91.8 billion USD) and China's Li Auto (34.6 billion USD).

According to the third quarter 2023 report, VinFast delivered an additional 10,027 electric cars.

In the world, Tesla of the US and BYD of China are considered two giants, surpassing other electric car manufacturers.

In the second group, China's Li Auto sold more than 100,000 vehicles per quarter. China's NIO and Xpeng sold 55,000 and 40,000 vehicles per quarter, respectively. These are automakers that benefit from the billion-people Chinese market and the large demand for electric vehicles.

In the third group, VinFast is near the bottom, behind the US Rivian (more than 15,500 cars) and Polesta (13,900 cars). VinFast is only above Lucid (with sales of about 1,400 cars/quarter).

VinFast is now worth more than $18 billion. NIO and Xpeng are worth $15.2 billion and $15.1 billion, respectively. Lucid is worth $11.6 billion.

In recent sessions, VinFast stock liquidity on the Nasdaq floor has improved sharply compared to mid-September.

In the session of October 5, VinFast recorded liquidity of more than 8.87 million units. On October 2, the US Securities and Exchange Commission (SEC) announced that the offering of more than 75.7 million common shares by VinFast shareholders group was effective.

According to the report updating information for VinFast's stock offering, the common stock price sold on October 4 was 8.05 USD/share.

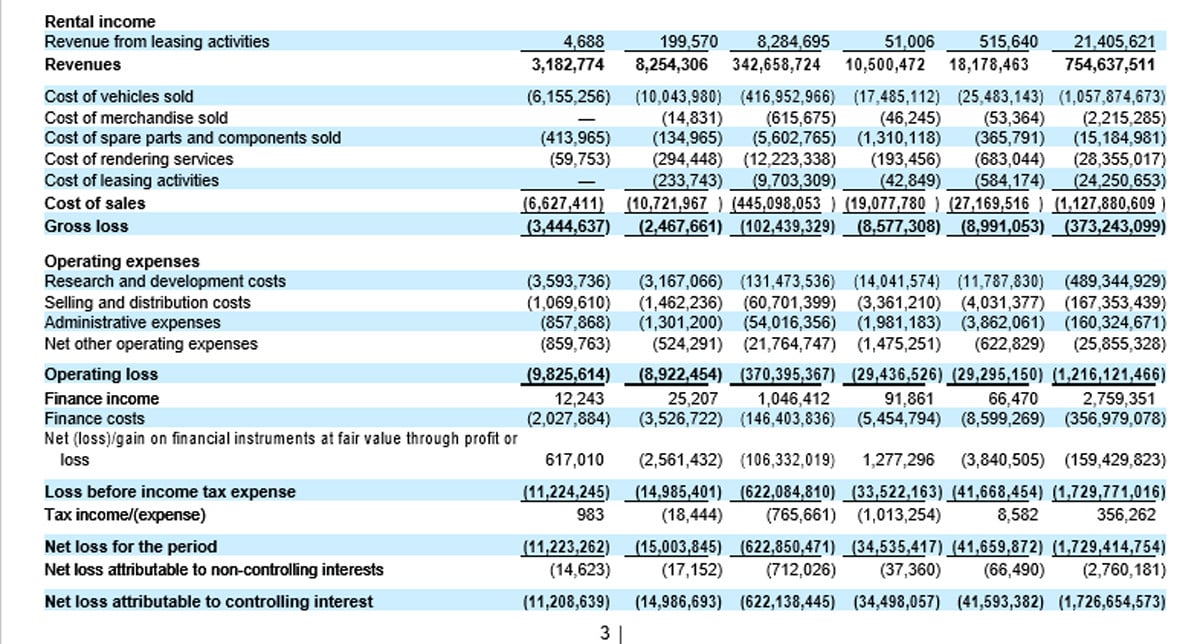

According to this newly announced update, VinFast has total assets of more than 5.18 billion USD. This car company lost nearly 1.73 billion USD in the first 9 months of 2023. In 9 months, VinFast recorded revenue of nearly 755 million USD but operating expenses were more than 1.2 billion USD. Financial expenses were nearly 357 million USD.

Source

Comment (0)