In the consolidated financial report for the fourth quarter of 2024, Vicostone JSC (HNX: VCS) recorded net revenue of VND 1,102 billion, down 4.4% year-on-year. Gross profit decreased from VND 340.7 billion to more than VND 286.7 billion, leading to a decrease in gross profit margin from 29.5% to 26%.

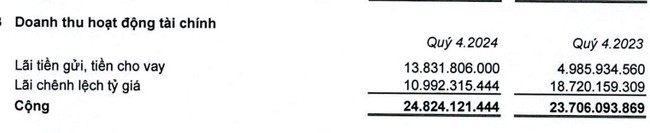

Screenshot: Notes to Vicostone's consolidated financial statements for the fourth quarter of 2024

During the period, financial revenue increased slightly by 4.6% to over VND24.8 billion. Of which, the items that recorded an increase were interest on deposits and loans, from nearly VND5 billion to VND13.8 billion. However, interest on exchange rate differences recorded a decrease from VND18.7 billion to nearly VND11 billion.

Financial expenses recorded a decrease from 21.6 billion to 16.3 billion VND, but other expenses such as sales expenses and business management expenses recorded an increase, to 51.1 billion and more than 19.6 billion VND, respectively.

Finally, Vicostone reported pre-tax and after-tax profits of VND222.6 billion and VND189.1 billion; down 21% and 23.5% respectively compared to the same period last year.

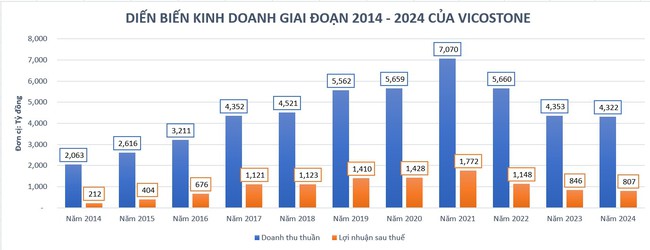

Data: Financial reports of each year published by Vicostone on the website

Accumulated for the whole year of 2024, Vicostone recorded net sales revenue of VND 4,322 billion, almost unchanged compared to 2023.

Profit after tax decreased by 4.6% to more than VND 807 billion. This is also the lowest profit result of the Company in 9 years, from 2016 to present.

Compared to the annual business plan, the Company has only achieved nearly 94% of the annual revenue plan (expected to reach VND 4,602 billion) and 92% of the annual profit plan by the end of fiscal year 2024.

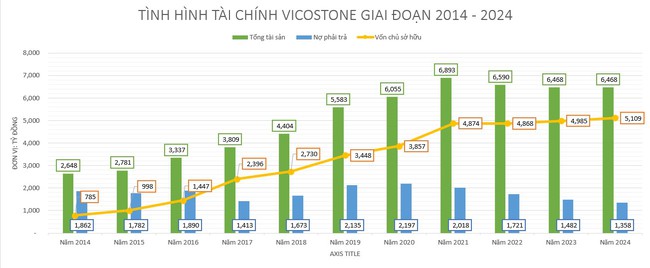

Data: Financial reports of each year published by Vicostone on the website

As of December 31, 2024, Vicostone's total assets remained almost unchanged compared to the beginning of the year at VND6,468 billion. Of which, cash and cash equivalents increased by 13% to over VND1,584 billion. Inventories recorded over VND1,816 billion. Other items fluctuated insignificantly.

On the other side of the balance sheet, liabilities recorded a decrease of 8.4% to VND1,358 billion. Of which, more than 97% came from short-term debt with more than VND1,328 billion and only more than VND30.7 billion came from long-term debt.

In 2024, Vicostone recorded more than VND 965 billion in loans and financial leasing debts (accounting for 71% of total debts). However, the details of the loans were not explained in detail by the Company.

Vicostone JSC, with Mr. Ho Xuan Nang currently serving as Chairman of the Board of Directors. These are two names that caused a “fever” in the listed business community in 2014 with the legendary reverse acquisition. Not only does Mr. Nang have assets worth tens of thousands of billions of VND, he is also a self-made Vietnamese billionaire who is respected by many people for his business talent, wisdom and intelligence. The business community calls this tycoon “Jewish Nang”.

Looking back at the legendary reverse takeover…

In 2014, Vicostone achieved very impressive business results with revenue of over 2,000 billion and net profit of 212 billion VND, 3 times higher than the same period last year.

With this remarkable growth, Vicostone has been targeted for acquisition by A&A Green Phoenix Group Joint Stock Company (Phenikaa).

At the end of August 2014, Phenikaa completed the purchase of 58% of shares and became the parent company controlling Vicostone. By the end of September 2014, Vicostone had repurchased 20% of outstanding shares as treasury shares, increasing Phenikaa's voting power to 72.5%.

Jewish tycoon Nang, Chairman of Vicostone Board of Directors

However, not long after that, with the proposal of the Phenikaa shareholder group and the approval of Vicostone's board of directors, Mr. Ho Xuan Nang bought back Phenikaa's capital contribution. By December 31, 2014, just over 3 months after Phenikaa acquired Vicostone, Mr. Nang had bought and owned 54 million shares, equivalent to 90% of Phenikaa's charter capital.

Through this, Mr. Nang took over Phenikaa and held enough shares to control Vicostone. This move by Mr. Nang caused shock in the business community at that time.

Before the century acquisition, Mr. Ho Xuan Nang, who was then the Director appointed by Vicostone, did not own any shares.

According to the 2010 Vicostone Annual Report, at the end of 2009, Mr. Ho Xuan Nang only owned 382,904 VCS shares, equivalent to nearly 3% of the equity capital. The number of VCS shares Mr. Nang actually held was not much, by mid-2016, it was only over 513,000 shares.

This made public opinion even more excited when he successfully started from nothing and became the leader of the entire ecosystem.

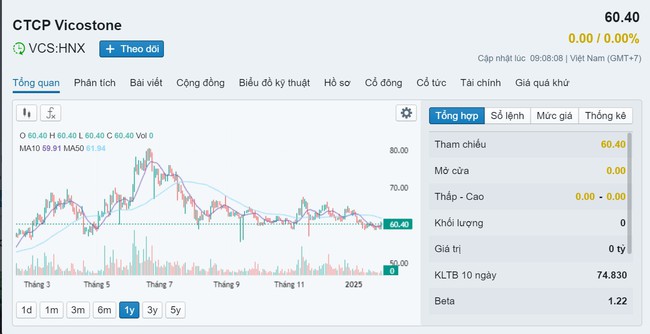

According to the 2024 management report, Mr. Ho Xuan Nang currently directly owns more than 5.9 million VCS shares and more than 134.6 million shares held by Phenikaa. According to the trading price on February 5, VCS shares are currently at 60,400 VND/share, equivalent to the "Jewish" tycoon Nang owning assets of more than 8,400 billion VND.

VCS stock price movement within 1 year. Photo: FireAnt

Source: https://danviet.vn/vicostone-cua-dai-gia-nang-do-thai-bao-lai-thap-nhat-9-nam-20250205092811864.htm

Comment (0)