Ho Xuan Nang was born in 1964 in Nam Dinh, graduated from the University of Technology, successfully defended his PhD thesis and became a scientific researcher at the Institute of Agricultural Mechanics and Agricultural Product Processing under the Ministry of Agriculture and Rural Development.

But then, he stepped into business, becoming Production Director of FORD Vietnam Automobile Factory.

In 1999, Mr. Nang joined Vietnam Construction Import-Export Corporation Vinaconex as Secretary of the Chairman of the Board of Directors.

Jewish tycoon Nang once owned assets of up to 17 trillion at his peak.

At Vinaconex, Mr. Nang has held many positions from Secretary of the Chairman of the Board of Directors to Director of Vinaconex High-end Stone Company. In 2007, Mr. Ho Xuan Nang was elected Chairman of the Board of Directors and General Director of this company. This is also the predecessor of Vicostone after the company was listed and fully equitized in 2013. In 2014, Mr. Ho Xuan Nang was elected Chairman of the Board of Directors and General Director of Vicostone (VCS).

From a salaried employee, Mr. Ho Xuan Nang became the owner of one of the largest enterprises on the stock market. Vicostone's capitalization is now up to nearly 16.3 trillion VND, while Vinaconex's capitalization is still around 9 trillion VND.

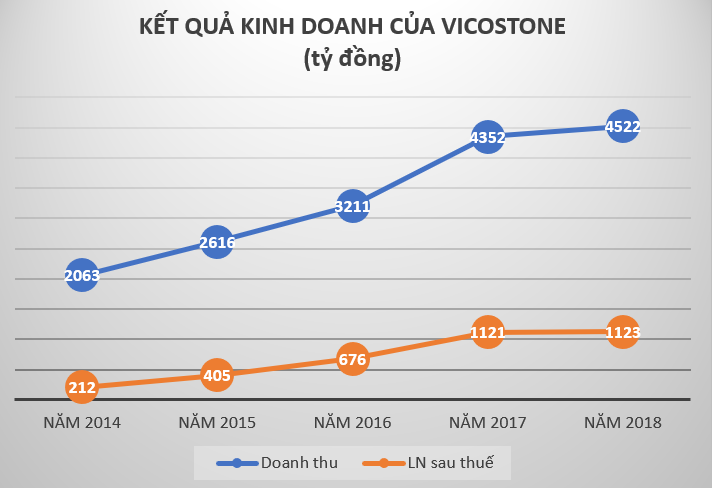

Vicostone is currently one of the world's largest companies in high-end artificial stone with revenue reaching thousands of billions of VND.

According to VCS's Q4.2018 financial report, in 2018 VCS achieved 4,522 billion in revenue, an increase from 4,352.5 billion last year. However, pre-tax profit reached 1,318 billion VND, not meeting the expectation of 1,355 billion VND. After-tax profit was almost the same as the same period at 1,123.5 billion VND, 2 billion VND higher than the same period last year.

On the stock market, since 2014, Vicostone’s VCS shares have grown steadily. In 2017, the market price of this stock increased by 143% and continued to increase in the first 3 months of 2018.

As of March 29, 2018, VCS has set a new peak at VND 262,500/share, up 4% compared to the beginning of the year, surpassing SAB and VCF, becoming the stock with the highest price on the Vietnamese stock market. Mr. Nang became the 5th richest person on the Vietnamese stock market with an asset value of over VND 14,000 billion (direct and indirect).

With about 133 million VCS shares directly and indirectly held by tycoon Nang Do Thai, if calculated at the price of 140,000 VND/share (adjusted price) in early April 2018, when the VN-Index of the stock market was at its historical peak of 1,200 points, this tycoon has assets converted from VCS shares worth an estimated 17,800 billion VND.

Development of Vicostone's stock code MCS

However, at present, Mr. Ho Xuan Nang's assets are about 8.6 trillion VND when this stock code evaporated by 50% in the second half of 2018 from the price of 140,000 VND/share to about 70,000 VND/share. Although this asset has decreased, it is still enough to help tycoon Ho Xuan Nang enter the Top 10 richest people on the Vietnamese stock market today.

Mr. Ho Xuan Nang is considered one of the fastest-growing businessmen on the Vietnamese stock market. Although at the 2018 Shareholders' Meeting, Mr. Ho Xuan Nang said, "I never wanted to appear on the list of dollar billionaires. I just want to be an ordinary person."

The "reverse" acquisition deal shook the market

Vicostone was established in late 2002. Right from the first days of its establishment, Vicostone's exclusive position in the field of artificial stone production and trading was soon determined by the founding shareholders from Vietnam Construction and Import-Export Joint Stock Corporation (Vinaconex).

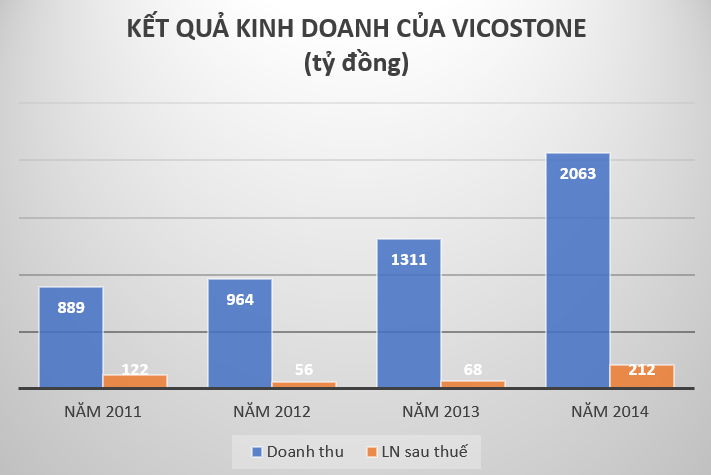

From the initial charter capital of VND22.93 billion in 2005, this figure has increased more than 23 times and reached nearly VND530 billion by the end of the second quarter of 2014. Total revenue has also increased year by year with an average growth rate of over 34% in the period 2005-2013. However, Vicostone's profit did not meet expectations and gradually decreased in the period 2011-2013.

Accordingly, after-tax profit decreased sharply from nearly 123 billion VND in 2011 to only 56 billion VND in 2012 and 68 billion in 2013.

Furthermore, Vicostone is also threatened in terms of market share, operating efficiency and growth due to the risk of domestic and international competition when more and more large and strong competitors appear: high risk of market share, having to lower selling prices, increase input purchase prices (due to many manufacturers of the same product).

In that context, Vicostone’s shareholders’ meeting approved Phenikaa Company, Vicostone’s competitor, to purchase 51-58% of Vicostone’s shares without going through a public tender offer. By the end of September 2014, Vicostone had repurchased 20% of its outstanding shares as treasury shares, thereby increasing Phenikaa’s voting power to 72.5%.

This deal would not be worth mentioning if the Jewish tycoon Nang "revealed" as the new owner of Phenikaa just over 3 months after Phenikaa acquired Vicostone.

With 90% of Phenikaa's charter capital, Mr. Nang took over Phenikaa and held enough shares to control Vicostone.

This move by Mr. Nang caused a stir in the business community at that time. This was also the turning point that helped Mr. Nang become one of the richest people on the stock market when VCS's profit increased from 2 digits in 2013 to 3 digits in 2014 and by 2018, Vicostone's after-tax profit was over a thousand billion VND.

Source: http://danviet.vn/dai-gia-nang-do-thai-ho-xuan-nang-giau-co-nao-7777954233.htm

Comment (0)