Taiwan Semiconductor Manufacturing Company (TSMC) said it will delay the start of mass production at its Arizona plant until 2025 due to a shortage of skilled workers and technicians needed to install specialized equipment.

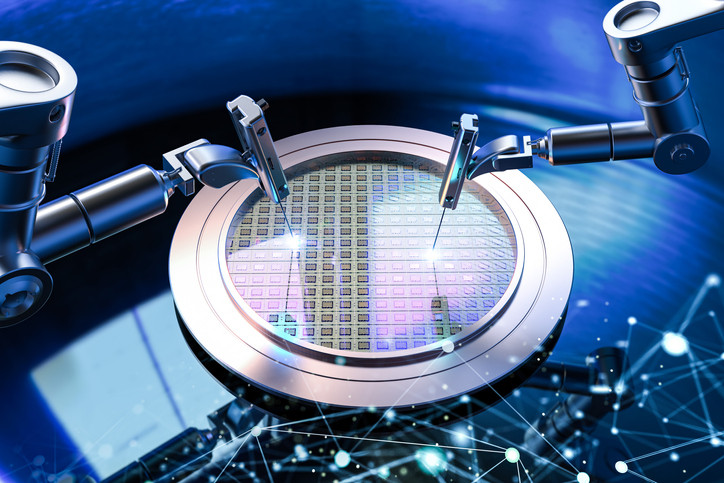

TSMC Chairman Mark Liu said the world's largest contract chipmaker is entering a critical phase of processing and installing some of its "most advanced equipment" at its first state-of-the-art chip manufacturing facility in the U.S. The company had previously planned to begin operating the plant late next year.

“We are facing certain challenges due to the lack of skilled workers with specialized expertise needed to install equipment in a semiconductor facility,” Liu said, adding that TSMC is bringing in experienced technicians from Taiwan to handle the issue.

“We expect the production schedule of N4 process technology to be pushed to 2025,” said the president of the world's largest contract chip foundry, referring to 4-nanometer chip manufacturing technology.

“Barometer” of the technology industry

TSMC, which manufactures chips for global giants like Apple, Qualcomm and Nvidia, is considered a barometer of the broader tech industry. This week, the Taiwanese semiconductor maker again cut its full-year growth outlook due to a slow recovery in the Chinese market and lingering macroeconomic uncertainty.

The company now expects revenue to decline 10% year-over-year in 2022. In April, the company cut its annual revenue target from slight growth to a “mid-single-digit” decline.

In its latest quarterly results, the contract chipmaker reported its first profit decline since 2019 amid a slowdown in the consumer electronics market. Specifically, in the second quarter of 2023, TSMC recorded revenue of $ 15.68 billion, the lowest in the past five quarters and down 10% year-on-year. Net profit also fell 23.3% compared to a year earlier.

“It’s all about the macro economy. In fact, high inflation and rising interest rates are affecting all market segments around the world. China’s recovery is also slower than we expected,” said TSMC CEO CC Wei. “Even the increase in demand for AI cannot offset the overall cost of doing business.”

AI “shoulders” revenue

Despite a prolonged downturn in consumer electronics, TSMC is benefiting from the artificial intelligence boom led by ChatGPT. AI computing requires powerful graphics processors made by Nvidia and Advanced Micro Devices (AMD), both of which are major TSMC customers.

AMD CEO Lisa Su, who is in Taipei this week to visit customers and suppliers, told reporters that AI will be the most important growth driver over the next few years.

“AI is in the early stages of a huge growth, and it’s a key investment area for us,” Su said. “We believe that in the next three to four years this market could be over $150 billion.”

TSMC is the sole manufacturer of AMD's powerful MI300 platform for high-performance computing and large-scale cloud computing, which is seen as a key competitor to Nvidia's H100. Meanwhile, Nvidia CEO Jensen Huang has also pledged a long-term commitment to TSMC around the H100 manufacturing process.

Additionally, Mark Li, an analyst at Bernstein Research, said TSMC could benefit from iPhone processor orders in the current quarter and will see clearer AI-related demand in the final quarter of 2023.

“AI orders spiked in late first quarter and early second quarter,” Li said, adding that “it will take almost six months to turn those orders into revenue.” However, he noted that demand from PCs, Android smartphones and other consumer electronics remains weaker than expected, which has weighed on TSMC’s revenue this year.

(According to Nikkei Asia)

Source

Comment (0)