The Board of Directors of Ho Chi Minh City Infrastructure Investment Joint Stock Company (code: CII) has just passed a resolution approving the sale of nearly 31.8 million treasury shares.

According to CII's calculations, as of March 31, 2023, the above shares are worth VND 737.02 billion. Thus, CII's book value is currently recorded at VND 23,179 per treasury share.

However, at the end of the trading session on May 26, the price of each CII share only reached VND 17,300/share, 75% lower than the peak of VND 57,000/share recorded in January 2022.

If 100% of the above shares are successfully traded at the current market price, CII is expected to earn about VND 550 billion, a loss of VND 187 billion compared to the previously calculated book value.

Notably, CII accepted to sell treasury stocks at a loss in the context that this enterprise is preparing to pay VND 800 billion for the CIIBOND2020-04 bond lot issued on July 28, 2020 and maturing on July 28, 2023. Thus, CII has 2 more months to complete the payment of this bond lot.

Regarding the business results of the first quarter of 2023, CII recorded revenue of VND 748.05 billion, an increase of 5.1% over the same period and profit after tax of VND 34.84 billion, a decrease of 94.9% compared to the performance in the first quarter of 2022.

According to the plan, in 2023, CII sets a revenue target of VND 5,155 billion and net profit of VND 469 billion, down 13% and 36% respectively compared to last year.

CII will pay 2022 cash dividends at a rate of 15% (VND1,500/share). Thus, with more than 252 million shares in circulation, CII is expected to spend more than VND378 billion to pay dividends in 2022.

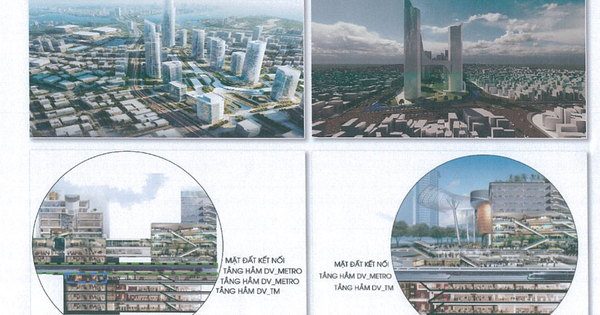

CII is an infrastructure and real estate investment company. This company owns "diamond land" in Thu Thiem area. CII has been assigned about 90,000m2 for long-term stable use and more than 6,000m2 of land for 50-year use (to build offices). These are all beautiful lands, along the riverbank, park, and North-South axis, adjacent to Thu Thiem 1 bridge.

Business News

The stock market has a number of other important events of listed companies.

* HRC: On May 26, 2023, the Board of Directors of Hoa Binh Rubber Joint Stock Company held a regular meeting for the second quarter and issued a resolution approving the first quarter production and business results, as well as approving a number of planning targets for the second quarter of 2023. Accordingly, HRC plans to achieve a total revenue of nearly 22 billion VND and pre-tax profit of 525 million VND in the second quarter of 2023.

* TDP: Thuan Duc JSC announced information on the implementation of receiving the transfer of shares at Thuan Duc Eco JSC and Thuan Duc JB JSC from a number of shareholders who are relatives of the Chairman of the Board of Directors. It is estimated that TDP spent a total of 157.5 billion VND to receive more than 4 million Thuan Duc Eco shares and 3 million Thuan Duc JB shares.

* HU4: On May 25, 2023, the State Securities Commission (SSC) issued a decision to fine HUD4 Investment and Construction JSC VND 85 million for not announcing the last registration date for existing shareholders to exercise their rights to attend the 2021 and 2022 Annual General Meeting of Shareholders.

* CLL: Cat Lai Port JSC announced the Board of Directors' resolution on the business plan as well as the investment plan for 2023. Accordingly, CLL set a target of recording total revenue of more than VND 282 billion and net profit of nearly VND 95 billion in 2023, up 3% and nearly 5% compared to the results of 2022.

* NBB: Nam Bay Bay Investment JSC has just announced the minutes of the 2nd 2023 Annual General Meeting of Shareholders on May 24, after the first failed meeting. Notably, the General Meeting of Shareholders approved the cancellation of the offering of purchase rights to 50 million NBB shares to existing shareholders.

* RTB: Tan Bien Rubber Joint Stock Company has just announced the resolution of the Board of Directors meeting in the second quarter of 2023 related to business activities. Specifically, in the second quarter, RTB estimated revenue of more than 187 billion VND and after-tax profit of nearly 31 billion VND.

Dividend information

* DBM: Dak Lak Pharmaceutical - Medical Supplies JSC announced the closing date for cash dividend payment at a rate of 17%. The ex-dividend date is June 8, 2023. With 1.94 million shares in circulation, it is estimated that DBM will spend VND 3.3 billion to complete this payment.

* XLV: Song Da Construction and Services JSC announces that June 16, 2023 is the last registration date to exercise the right to receive 2022 cash dividends at a rate of 10%. The ex-right transaction date is June 15, 2023.

* SBA: The Board of Directors of Song Ba Joint Stock Company has just approved the decision to pay the second dividend in 2022 in cash at a rate of 18% (the first dividend rate is 10%). The record date is June 19, the expected payment date is July 5, 2023.

* DHA: Hoa An Joint Stock Company announces the closing of the list of shareholders to receive the remaining 2022 cash dividend at a rate of 20%. The ex-right transaction date is June 8, 2023, payment date from June 20, 2023.

* REE: Resolution of the Board of Directors of Refrigeration Electrical Engineering Corporation approved the issuance of an additional 53 million shares to pay dividends in 2022, at a ratio of 100:15 (every 100 shares receive 15 additional shares).

VN-Index

At the end of the trading session on May 26, VN-Index decreased by 0.87 points (-0.08%) to 1,063.76 points. HNX-Index increased by 0.87 points to 217.64 points and UPCoM-Index decreased by 0.13 points to 80.58 points.

According to the perspective of Vietnam Joint Stock Commercial Bank for Foreign Trade Securities Company (VCBS), VN-Index recorded a volatile trading week, accumulating around the 1,060 - 1,070 point area with differentiation, increasing and decreasing intertwined among industry groups.

According to KB Securities Vietnam Joint Stock Company (KBSV), with the main downward trend in the medium term and sideways in the short term, investors are recommended to only participate in trading with a low proportion, buy when the stock price adjusts back to support and avoid chasing buying during peak increases.

Source

Comment (0)