According to FiinGroup's update, in 2024, equity investment funds recorded outstanding performance thanks to positive profits in the first half of the year.

How will equity investment funds in Vietnam perform in 2024?

According to FiinGroup's update, in 2024, equity investment funds recorded outstanding performance thanks to positive profits in the first half of the year.

High performance but lack of stability

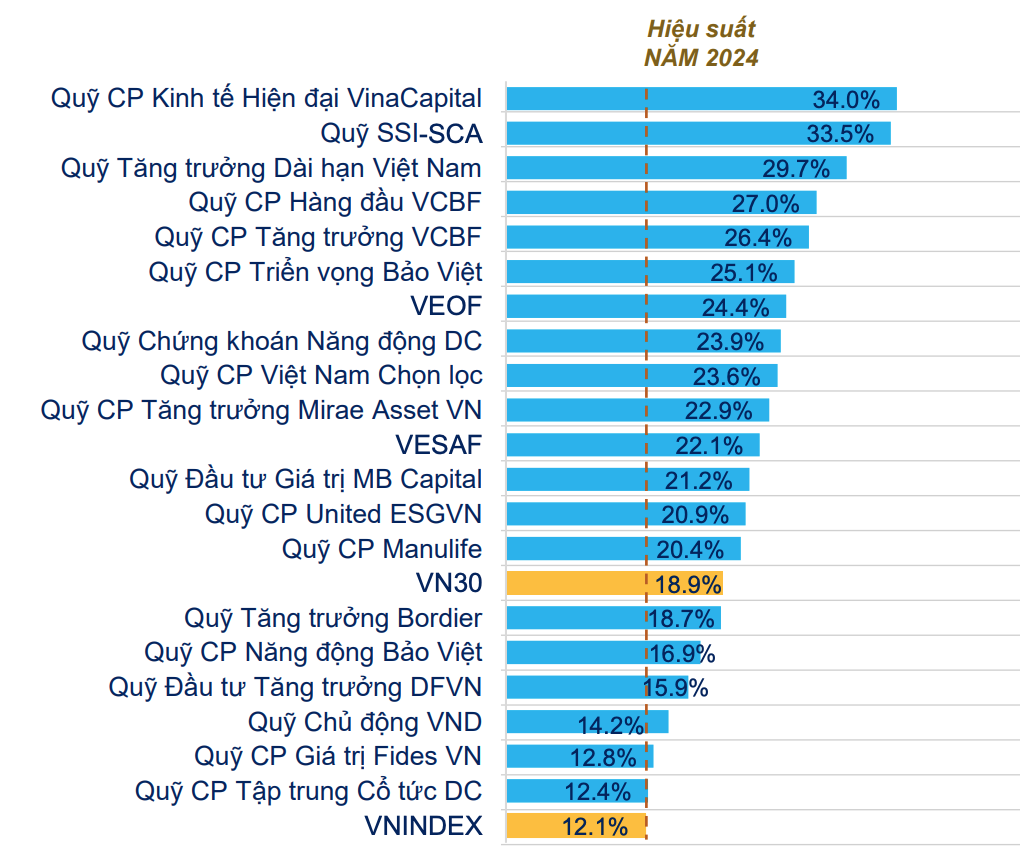

FiinGroup statistics show that in 2024, the average growth rate of equity investment funds is more than 20%, higher than the growth rate of the VN-Index (+12.1%) thanks to positive profits in the first half of the year. The average performance is lower (10.3%) in the 5-year time frame and negative -0.8% in the 3-year period, mainly due to the large loss in 2022. This shows the instability of this fund group in the long term, although the average performance of 10.3% in 5 years is relatively stable.

41/66 equity investment funds recorded outstanding growth compared to VN-Index in 2024 thanks to positive performance in the first half of the year. However, the performance of most funds deteriorated significantly in the second half of 2024, when the market was in a sideways state with reduced liquidity and continued net selling pressure from foreign investors.

|

| Top 20 best performing equity funds in 2024 (only funds with NAV greater than VND 100 billion). Source: FiinPro-X Platform |

VinaCapital Modern Economic Equity Fund (VMEEF) - a new fund established in 2023, led with a growth rate of 34% thanks to a large allocation to Banking and Technology stocks (FPT, FOX).

Next is the Vietnam Long-Term Growth Fund (VFMVSF) with an increase of 29.7% - this is the highest performance of the fund since its establishment and considering the 5-year time frame, this fund has achieved quite high performance with a compound annual growth rate of 15.3%. VinaCapital Market Access Equity Fund (VESAF) and SSI Sustainable Competitive Advantage Fund (SSI-SCA) maintain stable compound annual growth rates in both short and long time frames.

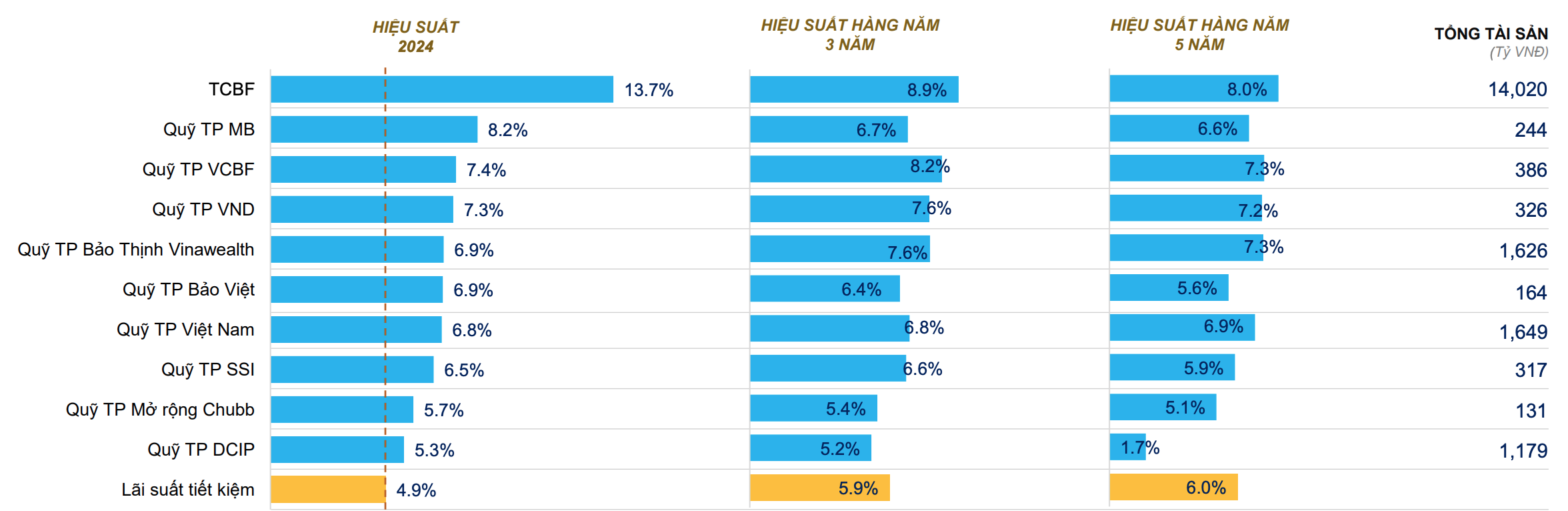

Meanwhile, the bond investment fund group, although not achieving as high growth as the stock fund group, has stable performance in both the medium and long term.

|

| Performance of bond investment funds (only funds with NAV greater than VND 100 billion). Source: FiinPro-X Platform |

Bond investment funds continued to have stable performance in 2024 with 19/23 bond funds having higher returns than Vietcombank's 12-month savings interest rate (4.6%). Of which, TCBF fund continued to lead with outstanding performance compared to the general level (+13.7%), but still lower than the performance in 2023 (+32.16%). Second place was MB Bond Fund (MBBOND) with +8.3%.

In contrast, the HD High Yield Bond Fund (HDBond) was the only bond fund with negative performance (-0.3%) with a portfolio allocated 44.4% to bonds, 13.7% to stocks and the rest mainly to certificates of deposit.

In the long term, the performance of bond investment funds is quite positive when profits are better than the 36-month savings interest rate (5.3%) and 60-month savings interest rate (6.8%) of Vietcombank.

Meanwhile, balanced funds recorded high growth performance in 2024, in which the group with large NAV scale (over VND 100 billion) had better performance than small NAV funds. Leading the way was the VCBF Strategic Balanced Fund with a growth rate of 20.2%. This fund allocated 61.6% to stocks and 23.1% to bonds, holding a large proportion of FPT shares, TPDN of MEATLife (MML) and Coteccons (CTD).

Capital flows reverse into bond funds

In 2024, capital flows into the Vietnamese stock market through investment funds will be net withdrawn for the second consecutive year, with a net withdrawal value of about VND 13.8 trillion, an increase compared to the net withdrawal of VND 10.5 trillion in 2023.

In terms of investment strategy, the cash flow reversed strongly in bond funds (nearly VND 12.9 trillion), mostly belonging to Techcom Bond Investment Fund (TCBF). In contrast, the equity fund group recorded a record net withdrawal (-VND 27.5 trillion), mainly in the passive fund group (ETF DCVFMVN DIAMOND and Fubon FTSE Vietnam ETF). Meanwhile, the balanced fund group recorded insignificant fluctuations in cash flow.

In equity funds, capital flows into open-end funds, especially two open-end funds VFMVSF and VMEEF, have positive cash flows and high performance thanks to their portfolio holding many banking stocks. Specifically, VinaCapital's VMEEF fund has recorded continuous net cash flows since November 2023 (cumulatively reaching more than VND 1.4 trillion). In contrast, funds with large NAV such as VEIL, Fubon FTSE Vietnam ETF, and ETF DCVFMVN DIAMOND have been under strong pressure to withdraw capital from investors, especially in the first months of 2024.

After 3 consecutive years of net withdrawal, net cash flow returned to bond fund groups in 2024. In 2024, the trend of capital flow returning to bond fund groups occurred widely, recorded in 14/23 funds, but mainly concentrated in Techcom Bond Investment Fund (TCBF) of Techcombank and Vietnam Bond Fund (DCBF) managed by Dragon Capital.

2024 is a standout year for bond funds with positive net cash flows returning and stable performance, although some other funds are still under slight withdrawal pressure. This reflects investors' shifting priorities to safe and less volatile products, FiinGroup said.

Source: https://baodautu.vn/cac-quy-dau-tu-co-phieu-tai-viet-nam-lam-an-the-nao-trong-nam-2024-d244760.html

Comment (0)