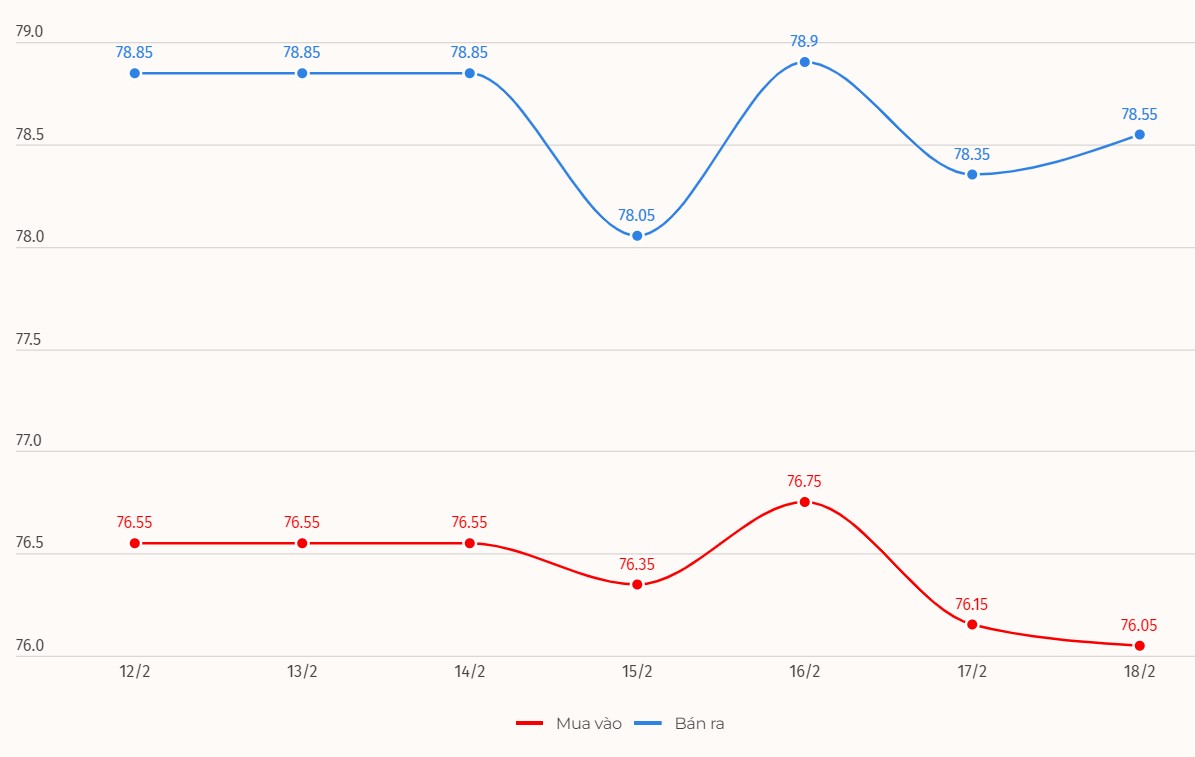

Domestic gold prices are during the Lunar New Year holiday. Currently, the SJC gold price listed by DOJI Group is 76.05 million VND/tael for buying; the selling price is 78.55 million VND/tael.

Compared to the closing price of last week's trading session, gold price at DOJI decreased by 500,000 VND/tael for buying and 300,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI is 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the buying price of gold at 76 million VND/tael; the selling price was 78.6 million VND/tael.

Compared to the closing price of last week's trading session, the gold price at Saigon Jewelry Company SJC decreased by 700,000 VND/tael for buying and decreased by 300,000 VND/tael for selling.

The difference between buying and selling prices of SJC gold decreased from 2.6 million VND/tael to 2.2 million VND/tael.

The plummeting gold price, combined with the very high gold buying and selling spread last week, caused investors to suffer heavy losses.

If you buy gold at DOJI Group on February 11 at VND78.85 million/tael and sell it today (February 18), you will lose VND2.8 million/tael. Meanwhile, those who buy gold at Saigon Jewelry Company SJC will also lose VND2.9 million/tael.

The current difference between buying and selling gold prices is listed at around 2.5-2.6 million VND/tael. This difference is considered very high. Investors face the risk of loss when investing in the short term.

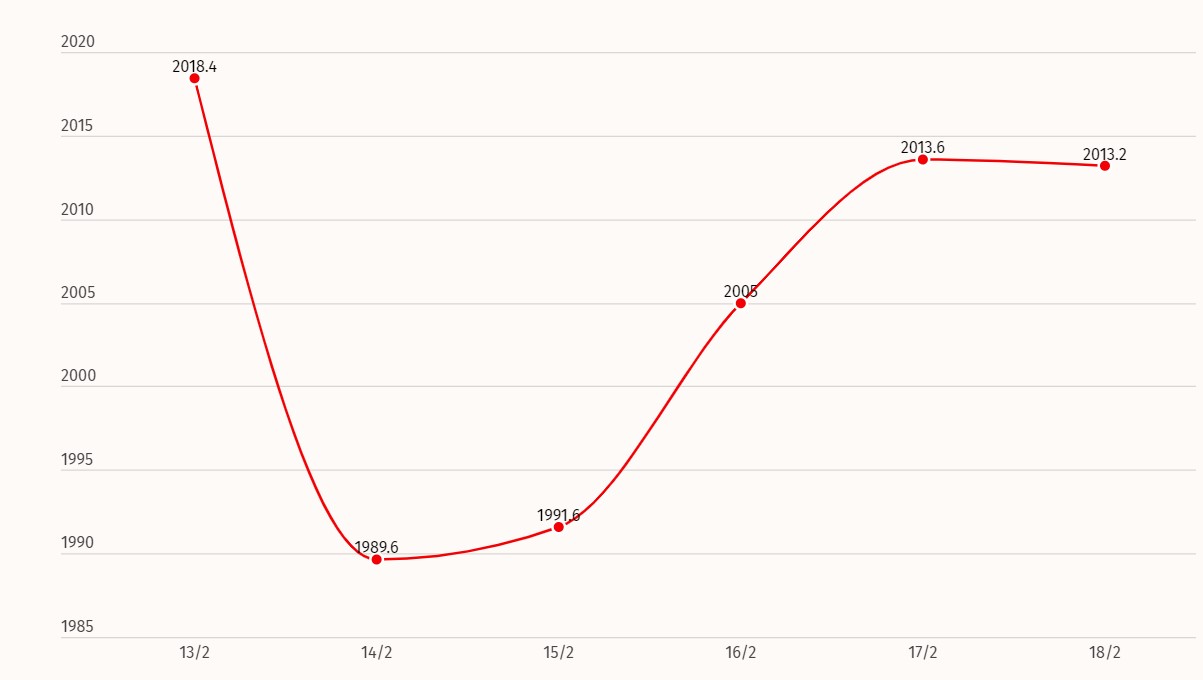

The world gold price opened this morning's trading session listed on Kitco at 2,013.2 USD/ounce, down 11.2 USD/ounce compared to the closing price of last week's trading session.

Gold Price Forecast

The latest Kitco News weekly gold survey shows that experts are bearish. Fourteen analysts participated in the Kitco News Gold Survey and Wall Street seems to see little upside potential for gold in the near term.

Only three experts, or 21%, expect gold prices to be higher next week. Meanwhile, eight analysts, or 57%, predict prices will fall, and another three experts, or 21%, predict gold prices will trade sideways during this time.

Ole Hansen, head of commodity strategy at Saxo Bank, said he would be watching Chinese investors after they return from the Lunar New Year holiday week. “Gold may struggle in the short term as expectations for a rate cut are fading, but overall I look forward to seeing how Chinese investors react to slightly lower prices next week,” he said.

James Stanley, senior market strategist at Forex.com, remains bullish on gold's short-term outlook: "I think we'll see the Fed continue to be dovish, and that's positive for gold. The fact that spot gold has tested below $2,000 this week shows that."

Aside from weekly jobless claims and a handful of Fed spokespeople, next week promises to be a quiet one on the data front, with the release of the FOMC meeting minutes on Wednesday the only major event on the schedule.

Source

Comment (0)