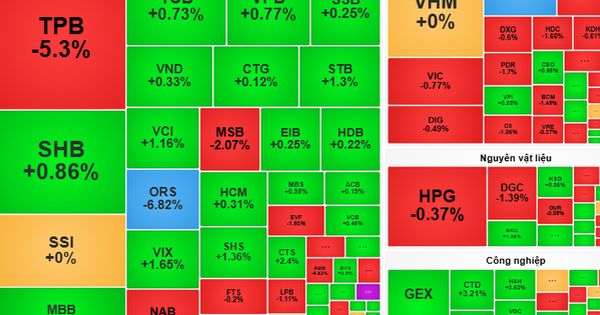

Recently, Techcom Securities Corporation (TCBS) announced its business results for the third quarter of 2023 and the first 9 months of 2023. Accordingly, as of September 30, TCBS's total assets reached nearly VND 38,400 billion, an increase of nearly 50% compared to the beginning of the year. Of which, the largest proportion is available-for-sale financial assets (AFS), up nearly 60% to VND 16,612 billion.

Mainly, unlisted bonds doubled compared to the end of 2022, the bond market has become more stable, accordingly TCBS has invested more than 7,700 billion VND in bonds. In addition, the number of listed stocks also increased to 498 billion VND, while at the beginning of the period this item was only 13 million VND.

Outstanding margin loans and sales advances reached VND12,827 billion, up 37% compared to the beginning of the period, of which VND12,497 billion was margin debt, up 50% compared to the beginning of the year.

TCBS said that the company's capital and bond distribution business segment has had a strong recovery during the period.

In the context of low savings interest rates in the third quarter of 2023, investors are looking for investment channels with higher returns than savings interest rates, so the primary retail bond distribution turnover in this quarter reached more than VND 12,000 billion, an increase of 71% compared to the second quarter of 2023.

TCBS's operating revenue increased by 44% over the same period, reaching more than VND 1,700 billion. The largest contribution to the revenue increase came from the proprietary trading segment with nearly VND 670 billion, 2.5 times higher than the same period, followed by revenue from consulting activities, up 88% to VND 37 billion.

On the contrary, TCBS's securities brokerage segment recorded lower results than the same period last year. Specifically, brokerage revenue decreased by 35% to nearly VND150 billion, however, compared to the previous second quarter, revenue from this segment has improved.

According to TCBS, the average liquidity in this period continued to increase significantly, reaching about VND 24,500 billion/day, an increase of more than 90% compared to the second quarter of 2023, accordingly, the value of stock transactions through the company increased by 88%, leading to a better brokerage revenue level.

Along with the increase in liquidity, interest income from margin loans and sales advances also increased, reaching VND424 billion, up 15% over the same period in 2022. In addition, TCBS's total operating expenses also decreased by 15% to VND146 billion. Therefore, at the end of the third quarter, TCBS reported a profit after tax of VND914 billion, up 58% over the same period.

Accumulated in the first 9 months of 2023, TCBS recorded revenue and profit after tax down 12% and 23%, reaching VND 3,716 billion and VND 1,690 billion, respectively.

Compared to the results achieved in the third quarter, despite the decline, the company has completed nearly 80% of its revenue target and exceeded the annual profit target by 7% .

Source

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

Comment (0)