It is necessary to continue to improve the legal corridor, create a fair and trustworthy 'game' and respect the values of private enterprises to create motivation to mobilize private resources.

The event of Vingroup presenting a plan to build a 48.7km metro line connecting District 7 to the Can Gio coastal tourist urban area, Ho Chi Minh City (small photo) is considered a positive signal in calling for private capital for infrastructure - Photo: TU TRUNG

After a period of stagnation, investment under the public-private partnership (PPP) model is showing positive signs as private investors are showing interest in investing in highway, airport, metro projects... and most recently Vingroup wants to build an urban railway to Can Gio (HCMC).

Assoc.Prof.Dr. Tran Chung

Speaking with Tuoi Tre, Associate Professor Dr. Tran Chung - Chairman of the Vietnam Association of Road Traffic Construction Investors (VARSI) - said that it is necessary to continue to improve the legal framework, create a fair and trustworthy "game" and respect the values of private enterprises to create motivation to mobilize private resources.

* Sir, is it true that recently PPP investment has not really been implemented according to a mutually beneficial mechanism, causing many investors to encounter difficulties and lose confidence, so they are not enthusiastic about investing in PPP transportation?

- Before 2020, we implemented PPP investment without any law but only based on decrees, the contract form was mainly implemented according to BOT contracts.

At that time, there was a lack of awareness, so many people thought that the PPP investment method was like private investment. Meanwhile, the nature of PPP is public-private partnership, a cooperation between the State and the private sector. Thereby, to mobilize resources from the private sector to join the State in implementing public works that the State should have done but the State did not have enough resources if it did it alone. Such a "game" should have followed the principles and regulations that were legalized.

In 2020, the National Assembly issued the Law on Public-Private Partnership (PPP). However, some key issues for the development of this investment method are not suitable, making private investors find it unattractive.

It can be said that the first problem is that the role of private investors is not respected. They are always "supporting actors" and not "partners", they realize that they are always in an unequal position throughout the project. This cools their aspirations.

With infrastructure projects, large investment capital, the participation of economic sectors, including the private sector, is required. In the photo: in the near future, Can Gio bridge will be built to make travel more convenient than currently having to rely on Binh Khanh ferry - Photo: TU TRUNG

* Can you explain more about the obstacles, especially after the period 2010 - 2015, especially with transport infrastructure projects?

- As I just mentioned, the biggest problem is inequality, pushing private investors into a situation of either default, bankruptcy, or persistent difficulties.

Typically, 9 PPP projects under BOT contracts encountered difficulties and problems, the main reason being that the State did not properly fulfill its contractual commitments when adjusting the planning (building more bridges, opening more roads with budget capital, causing vehicles to not pass through BOT projects), not implementing support mechanisms, reducing toll stations or not being allowed to collect fees...

Since 2019, investors have continuously "called for help", VARSI has persistently raised concerns with state agencies and in November 2022, the association sent a written report directly to the Prime Minister. The Ministry of Transport (now the Ministry of Construction) has submitted a handling plan, but after many discussions, including in the National Assembly forum, only recently have some projects shown promise.

In this case, the State suffers no loss, but the PPP investor suffers heavy losses when there is not enough revenue while still having to pay interest on loans to invest in the project, leading to the risk of bankruptcy.

The second disadvantage is the difficulty in borrowing credit capital from commercial banks. Normally, when investing under the PPP method, in addition to the equity capital that the investor spends, which is 15% of the total project investment, the investor must mobilize the remaining capital, and the source of mobilization mainly depends on loans from banks.

Banks often mobilize short-term savings so they are very cautious about lending long-term. Meanwhile, transportation projects have a life cycle of over 20 years, so they are potentially risky.

Third, over the years, potential risks regarding the risk-sharing mechanism in the PPP Law have not been clearly guided, which has also discouraged investors.

* At the end of 2024, the National Assembly amended the PPP Investment Law. Do you think PPP investment will improve?

- The revised Law on PPP Investment has important changes such as the State's capital contribution ratio in some specific types of PPP projects. Some additions and amendments, but the amended contents are still not groundbreaking.

We are also waiting for the revised content of Decree No. 35/2021 detailing and guiding the implementation of the Law on PPP Investment and Decree No. 28/2021 regulating the financial management mechanism of investment projects under the PPP method to specify the revised content.

Investors are the subjects directly regulated by legal documents, always wanting to contribute their opinions and hoping that the drafting agencies will listen and accept their opinions to have appropriate regulations, not imposing the will of the management agency. Our legal documents all have a "management" spirit, not really "creative" content.

At present, PPP investors (in particular) and the private economy in general have great confidence in the Party's major policies. General Secretary To Lam has an article emphasizing "private economic development - a lever for a prosperous Vietnam" analyzing the orientations and 7 key solutions for private economic development.

If the bottlenecks are removed, the position of private enterprises will be respected and appreciated, and they will play an important role in the country's economy. I hope that with this recognition, there will be a bright future for private investment in the PPP sector.

Graphics: T.DAT

* In your opinion, what will be the investment opportunities for PPP, especially in transport infrastructure projects, for private investors in the coming time if a fair investment environment is created, ensuring the harmony of interests of investors - the State - the people?

- The North-South high-speed railway projects, Lao Cai-Hanoi-Hai Phong railway, nuclear power plant... will focus on investment with State resources, so the need to mobilize social resources to invest in other projects is a very correct policy of the Party.

With the Party's policy on private enterprises, I think this is a very good opportunity for private enterprises to participate in major national projects.

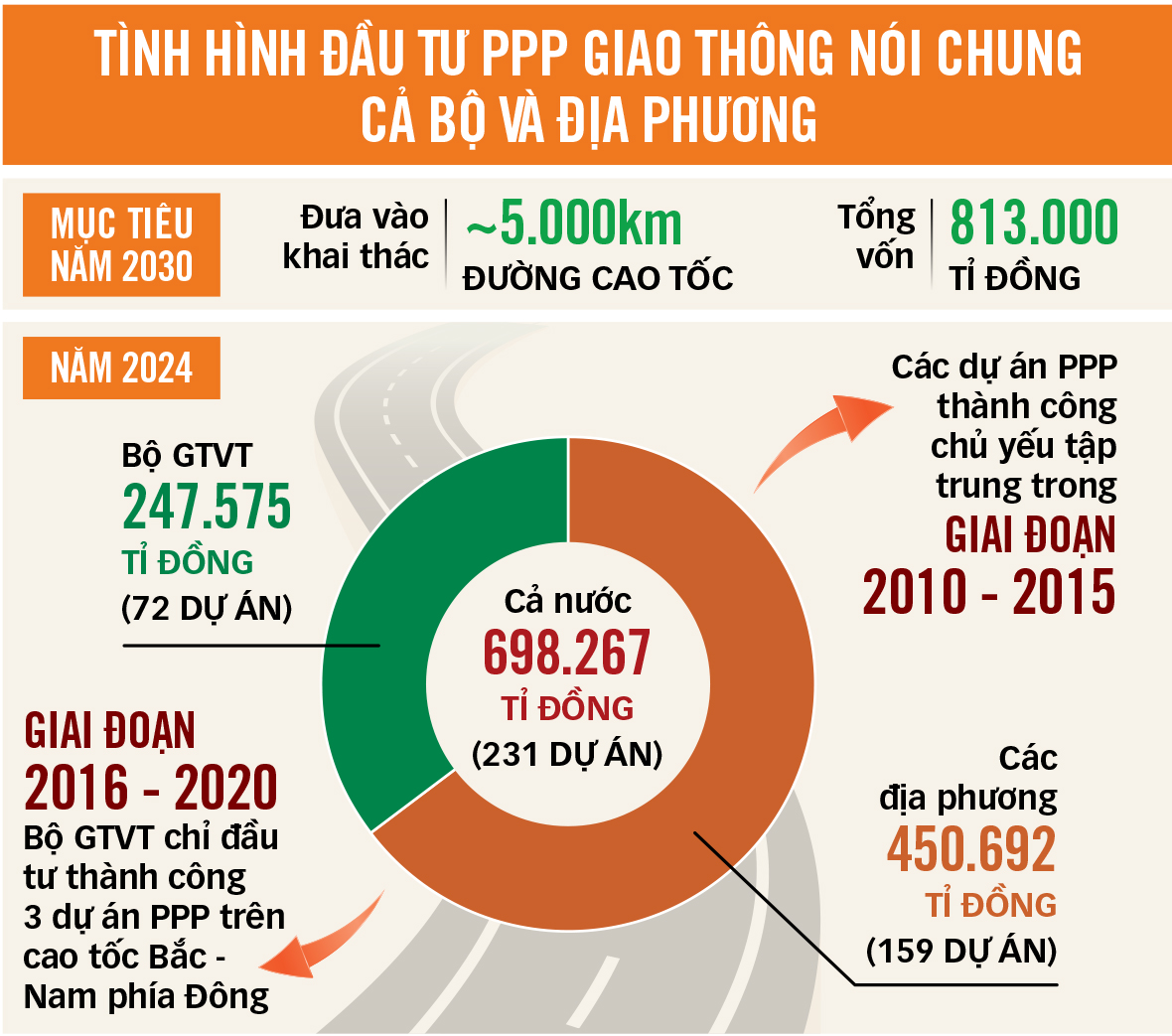

The Party and Government set a target of having about 5,000km of expressways nationwide by 2030. At the same time, existing expressways will be expanded and completed according to the plan. This is an effective PPP investment opportunity when the Road Traffic Law allows BOT investment on existing roads.

Therefore, we hope that the Ministry of Finance and the Ministry of Construction will soon provide guidance on economic and technical factors for implementation. Construction investment projects are economic and technical problems. Therefore, based on guidance from the management agency, PPP investors with experience and long-term responsibility for the project will choose the most appropriate economic and technical solutions.

Don't doubt, encourage private enterprise pride

* According to you, to attract more private participation in PPP investment in transport infrastructure, in addition to perfecting the law, it is necessary to change the previous behavior to see investors as partners with the State to create common values and benefits?

- Private enterprises and private investors are very excited about the Party's new policies. I think that in the near future, resolutions will be passed and the law on the private economy will be perfected, and private enterprises will see that their existence is guaranteed.

There was a time when many people considered PPP transport investors as "bare-handed thieves", seeing them as criminals. But they are Vietnamese people, so genuine investors and private enterprises will prove that they are enterprises with national spirit, doing things that not only bring benefits to the enterprise but also bring benefits to the country.

So, don't doubt but encourage the pride of private enterprises. They are creative, knowledgeable and responsible to the nation.

I have experienced the period when our country borrowed foreign development aid (ODA) with strict conditions in the agreements. Therefore, Vietnamese enterprises, despite their capacity, were still hired by foreign contractors.

But today, some private enterprises, with young, ambitious, intelligent and strong leaders, approach modern management technology based on a deep understanding of the nature of the work to which they will devote themselves.

They understand their capabilities and they proactively gather people with the right capabilities for the positions they are lacking in the model. Not only domestic experts but they also invite good experts from other countries to "spin silk" on modern projects.

For example, when drilling the Deo Ca tunnel, the investor hired good geological and technical experts from other countries to work; when building the tallest building in Vietnam, they also hired construction managers who had commanded the tallest buildings in the world to work.

Vietnamese people have knowledge and aspirations, so let's encourage them. In fact, Vietnamese enterprises have been able to take the lead in large tunnels, cable-stayed bridges, and large buildings in recent times. Let's believe in and appreciate the values they have achieved.

Many risks but lack of guarantee mechanism from the State

Mr. Do Thien Anh Tuan, lecturer at Fulbright University Vietnam, said that the main reason why private investors have not invested in PPP projects is because the risks are too great when investors invest heavily and recover their investment in several decades, but the State lacks a mechanism to guarantee and minimize risks for them.

Although the PPP Law stipulates some forms of State guarantees for some types of PPP projects, such as ensuring minimum revenue, profits, access to land resources, markets, contract enforcement, and State support in site clearance, the specific mechanism for implementing State guarantees for PPP projects is unclear.

Therefore, when risks occur, the State does not have the resources to handle the responsibility of the State. This leads to contingent debt of PPP projects.

For example, investors implement BOT traffic projects but do not guarantee the right to collect tolls, vehicles escape from stations, investors cannot collect tolls, and project revenue does not reach the minimum level as committed in the contract.

Thus, the State cannot direct the flow of vehicles into the project, and should have compensated but lacked a compensation mechanism. The Cai Lay BOT project is a typical example, the investor suffered losses but the State had no compensation mechanism.

In addition, other forms of guarantees such as exchange rate guarantees and foreign currency guarantees currently lack implementation mechanisms. Although the PPP Law stipulates the use of project reserves for expenditure, many other State guarantees do not have specific regulations for allocating implementation resources, so they are at a standstill.

Cumbersome procedures waste resources

One of the obstacles that waste private investment resources is the cumbersome and complicated procedures to comply with the law. There are projects that can be implemented in 2.5 years but the procedures alone take several years, sometimes 5-6 years.

There are cases where local authorities are delegated as the competent authority. When the designer submits a list of standards to apply to the project, instead of asking for opinions from a few related ministries, the locality has to ask for opinions from more than 10 ministries. The biggest loss for investors is the opportunity from these lengthy procedures.

Source: https://tuoitre.vn/kinh-te-tu-nhan-bo-kiep-kep-phu-buoc-len-doi-tac-20250322084231379.htm

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

Comment (0)