On March 19, 2025, DNSE Securities JSC (code DSE) held the 2025 Annual General Meeting of Shareholders and approved many notable contents.

At the meeting, the Board of Directors and Executive Board of DNSE reported on the important milestones the company has achieved after 1 year of IPO. Accordingly, DNSE's current market share on HSX is about 1.85%, reaching 1.79% on HNX and 2.21% on UPCom. Derivatives market share reached double digits in February 2025. Notably, in early 2025, DNSE reached the milestone of 1 million customer accounts opened at the company.

Mr. Nguyen Hoang Giang - Chairman of DNSE expressed his expectation for the growth of the stock market in the context of the upcoming implementation of the KRX system and Russel upgrading the Vietnamese market to an emerging market. Mr. Giang said that DNSE and other securities companies have been waiting for the KRX system for a long time. When the system is put into operation, it will open up more advanced methods and products, approaching the world , thereby making operations in the stock market more effective and open. In addition, Mr. Giang also expects FTSE Russel to soon upgrade the stock market this year, attracting new cash flows into Vietnam.

Based on the positive market outlook, the congress approved a 2025 business plan higher than the previously announced document, with total revenue of VND 1,507 billion, up 85%; after-tax profit of VND 262 billion, up 44% compared to the 2024 results . Previously, DNSE planned to submit a plan of total revenue of VND 849 billion and after-tax profit of VND 262 billion, only 2% growth in revenue.

DNSE's leadership said that DNSE has set higher plans based on a complete and competitive product ecosystem, in the context of a market wave that is expected to explode in the coming time, when KRX comes into operation.

The plan to increase capital and issue an additional 1,200 billion VND in bonds in 2025 was also approved at the Congress, aiming to expand capital business and margin lending activities. It is expected to issue bonds in 3 batches, with a maximum bond term of 24 months from the date of issuance. Recently, in January 2025, DNSE completed the offering and distribution of 3 million bonds with a total value of 300 billion VND to the public.

DNSE also plans to issue 12.6 million ESOP shares, equivalent to 3.82% of the total outstanding shares. The total expected issuance value is a maximum of VND126 billion, with capital coming from surplus capital and/or undistributed after-tax profits.

In order to improve financial capacity, supplement capital for margin trading loans and bonds, deposit certificates, and other valuable papers, DNSE's annual shareholders' meeting also agreed on a plan to increase capital through the issuance of 85.65 million shares to existing shareholders, equivalent to 25% of the number of shares before the issuance date, by exercising purchase rights, at a ratio of 4:1.

The expected minimum offering price is VND12,500/share, expected to raise VND1,070.6 billion. The Board of Directors is authorized to determine the specific offering price. After completing both issuances, DNSE will increase its charter capital to VND4,282.5 billion.

Another important content approved by the Congress is the investment policy, contributing capital to a fund management company and applying for a license to deploy warrants. According to the DNSE Board of Directors, this is a policy that DNSE has agreed on since 2022 but has not yet completed implementation due to not satisfying the factors of market conditions and partners. At the same time, DNSE has recently focused resources on key business areas such as derivatives. This activity is expected to help DNSE expand its financial ecosystem, diversify products and increase sustainable revenue.

|

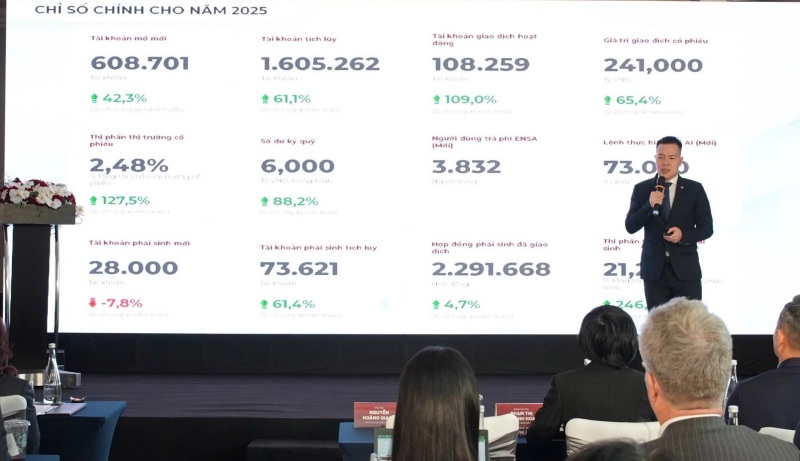

| DNSE's 2025 target numbers |

Updating business results in the first months of the year, in the first 2 months of 2025, DNSE recorded positive signals when it increased by nearly 90,000 newly opened accounts. In January and February 2025, DNSE increased its derivatives market share to 14.67% and 16.32% respectively with more than 1 million contracts traded, maintaining its position in the Top 2 market share. By the end of February, DNSE attracted more than 50,000 investors opening derivatives accounts, nearly 1.9 times higher than in January 2024. It is estimated that in the first quarter of 2025, DNSE will achieve about 64-65 billion VND in profit.

DNSE's 2025 Annual General Meeting of Shareholders was attended by PYN Elite Fund, headed by Mr. Petri Deryng. During the discussion session, PYN Elite raised many questions for DNSE's board of directors.

In particular, this investment fund believes that, in the market, companies with high profit margins all have a large contribution from the self-trading sector (over 50% of revenue). Meanwhile, DNSE has not focused on self-trading for more than a year, and the 2025 plan also has no content related to this sector while 2025 is assessed to have good prospects for securities companies to make money from self-trading, so PYN Elite believes that if DNSE does not promote this activity, it may be a pity.

However, DNSE representative said that the company is currently focusing on building sustainable services for customers, creating value for shareholders. Currently, the company considers the proprietary trading segment to focus on stock investment (with 100 - 130 billion invested in 2 real estate codes), the rest is building a bond portfolio to provide fixed-yield services. The company has not focused on proprietary trading because it is building services and developing customer files.

Accordingly, DNSE's margin balance has grown by more than 30% within 1.5 months, reaching the 5,000 billion margin lending mark in February 2025.

The company is also ready to take the lead when the market develops more strongly based on developing technology infrastructure, optimizing operations, and being ready to go-live the KRX system. The 2025 revenue plan is strongly increased based on the forecast of increased market liquidity and the company's existing platform.

The double-digit ROE target is expected to be achieved in 2026. In particular, DNSE's derivatives segment is growing well and is expected to explode in market share.

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)