| Silver will be more attractive in the precious metals market in 2024. Gold prices are stable, is the precious metals market entering a stable orbit? |

Expectations that the US Federal Reserve (Fed) will soon pivot its policy, combined with escalating geopolitical conflicts, have made precious metals a bright spot in the commodity market in recent times. Gold, silver and platinum prices have all increased sharply. While gold prices have continuously set record highs, silver prices have also increased by more than 13% to a one-year high.

Geopolitical volatility boosts precious metals appeal

Precious metals are attractive assets in times of risk, especially when the Russia-Ukraine conflict persists and conflicts in the Middle East are always at risk of spreading, the safe haven role is promoted to help these items increase in value.

Since 2022, central banks around the world have unexpectedly become more interested in increasing the proportion of gold in foreign exchange reserves. In the first months of 2024, many central banks continued to increase their gold reserves, contributing to pushing prices to record highs.

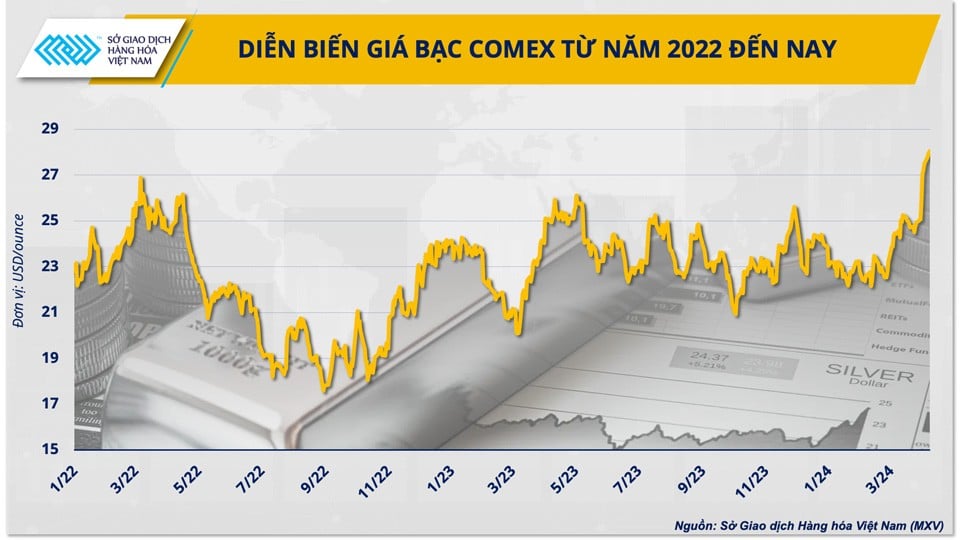

In a similar vein, amid escalating tensions between Israel and Iran last week, silver prices also shined again, jumping more than 12% to $27/ounce, the highest in more than a year. This continues to demonstrate the appeal of the precious metal, which is considered a “safe haven”.

|

| COMEX Silver Price Movement from 2022 to Present |

History has shown that precious metals such as gold and silver always perform well when the world situation fluctuates. While gold has been a familiar safe haven for the market throughout history, over the past decade, many investors have tended to increase their choice of silver products to diversify their "potential" investment portfolios during times of increased risk. Data from the Vietnam Commodity Exchange (MXV) shows that during the Covid-19 pandemic, in the summer of 2020, the price of silver increased for the first time over the 20 USD/ounce mark after 4 years, equivalent to an increase of 17% compared to the beginning of 2020, the price of gold also increased by nearly 30% from 1,575 USD to more than 2,000 USD.

MXV believes that with geopolitical conflicts still potentially spreading, combined with unpredictable developments in elections this year, especially the US presidential election taking place in November, precious metals will still have a lot of room to increase in price.

High interest rate pressure gradually subsides

Cooling macro pressures will also become a supporting force for precious metal prices. Besides gold, silver, with its dual role as a haven and industrial asset, is also forecast to be a bright spot in 2024.

|

| Mr. Pham Quang Anh, Director of Vietnam Commodity News Center |

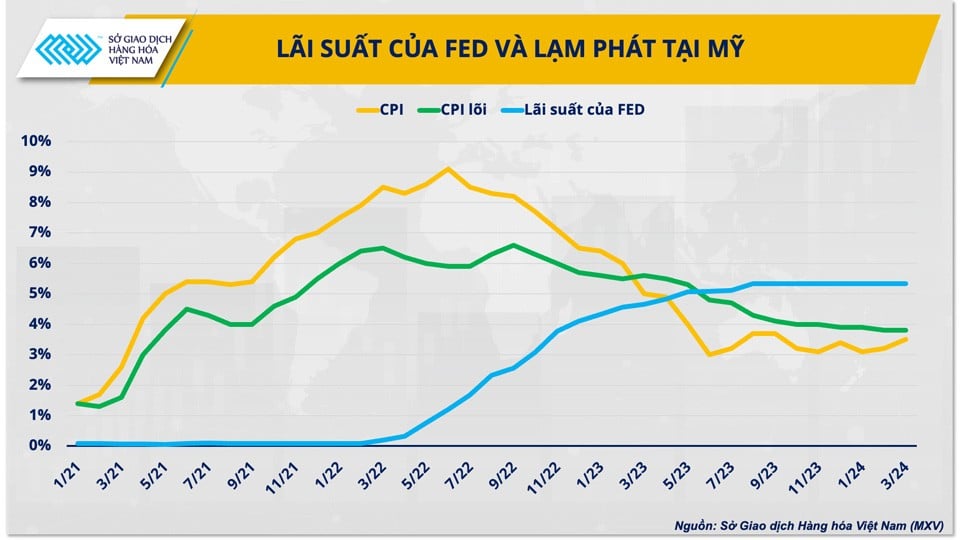

Mr. Pham Quang Anh, Director of the Vietnam Commodity News Center, commented: “Silver prices, like gold, have an inverse relationship with interest rates. A higher interest rate environment will limit demand for silver and gold, as precious metals will become less attractive compared to alternative investments such as savings deposits and holding high-yielding government bonds. Therefore, the scenario of the FED preparing to lower interest rates this year is considered one of the main catalysts supporting silver prices, as the opportunity cost of holding begins to decrease.”

But in fact, in the short term, precious metals still have the potential to compete with interest rates and the USD, as expectations of the FED cutting interest rates soon are gradually wavering. The reason comes from the fact that US inflation is showing signs of "heating up" again.

The US consumer price index (CPI) rose 3.5% year-on-year in March, the highest since September 2023, due to rising gasoline prices and rents, according to a report released by the US Department of Labor on April 10. Immediately after the data was released, financial markets pushed back expectations for the first rate cut to September, instead of June or July as previously predicted.

|

| Fed interest rates and inflation in the US |

While the Fed may delay the rate cut and the timing of the policy pivot remains uncertain, the reduction in borrowing costs is still expected to begin this year. Furthermore, the Federal Open Market Committee (FOMC), the Fed’s policy-making body, set three rate cuts by 2024 at its mid-March meeting. As a result, silver prices still have room to rise as a low-interest-rate environment is a favorable investment environment for the precious metal.

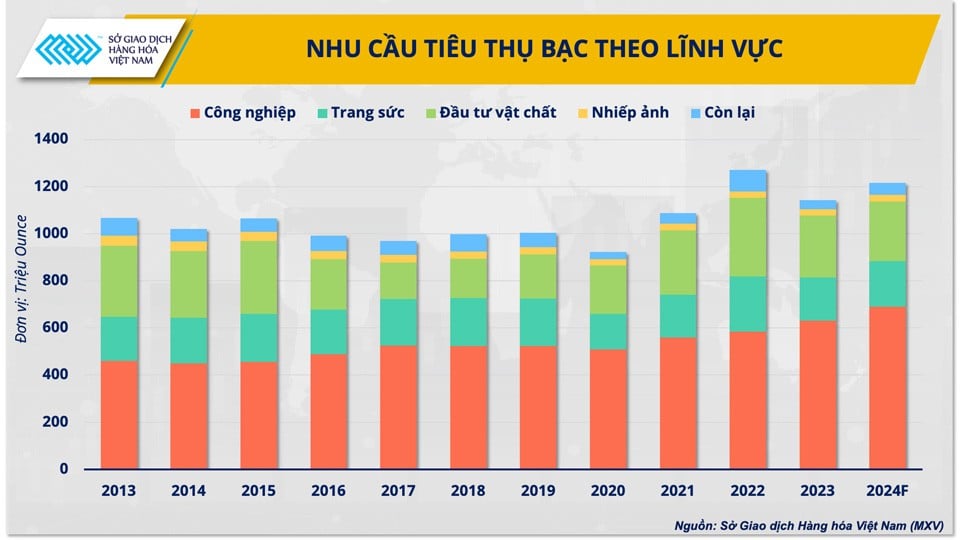

Industrial applications heat up silver prices

“While gold accounts for only 10% of industrial application demand, and up to 40% is investment, silver's application in the industrial and investment sectors is about 60% and 24% respectively. The combined impact of political, macro and production factors will likely make this white metal a bright spot in 2024, alongside traditional gold products,” Mr. Pham Quang Anh assessed.

Silver prices are also more volatile than gold as they are more sensitive to the health of the economy. A strong economy and increased manufacturing activity generally bode well for silver prices.

Currently, the global economic picture is gradually overcoming the difficulties left by the COVID-19 pandemic. The world's two largest economies, the US and China, have witnessed an expansion in manufacturing activities after many consecutive months of contraction. In the latest World Economic Outlook report published at the beginning of the year, the International Monetary Fund (IMF) raised its forecast for global economic growth this year by 0.2 percentage points to 3.1%. Accordingly, industrial demand for silver is also forecast to increase sharply this year.

|

| Silver consumption demand by sector |

Global silver demand is expected to rise to 1.2 billion ounces by 2024, marking its second-highest level on record, according to the latest report from the Silver Institute. Of this, industrial silver consumption is forecast to increase by 4% to a record 690 million ounces, accounting for about 60% of the market.

Notably, the Silver Institute believes that this year’s booming demand will help silver prices conquer the milestone of $30/ounce, the highest price in the past 10 years. And if viewed from a long-term perspective, the upward trend will continue due to the important application of this metal in the clean energy era, making silver a potential product in a sustainable investment portfolio.

Source

Comment (0)