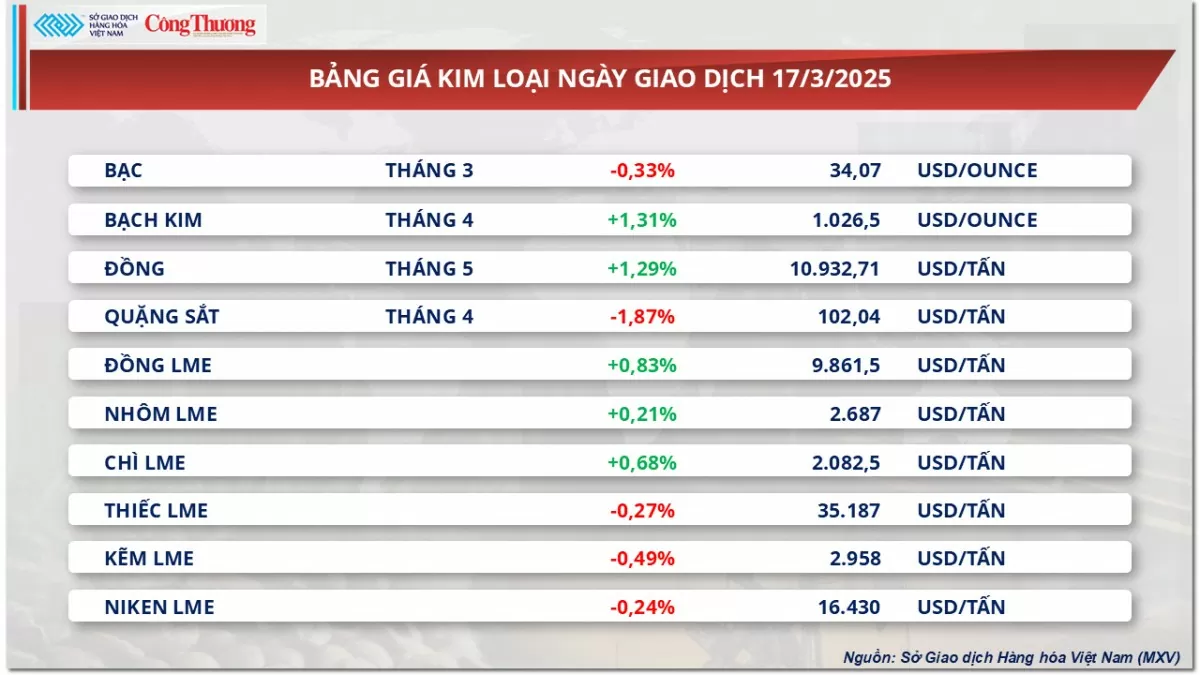

At the end of the trading session on March 17, silver price slightly decreased by 0.33% to 34.07 USD/ounce.

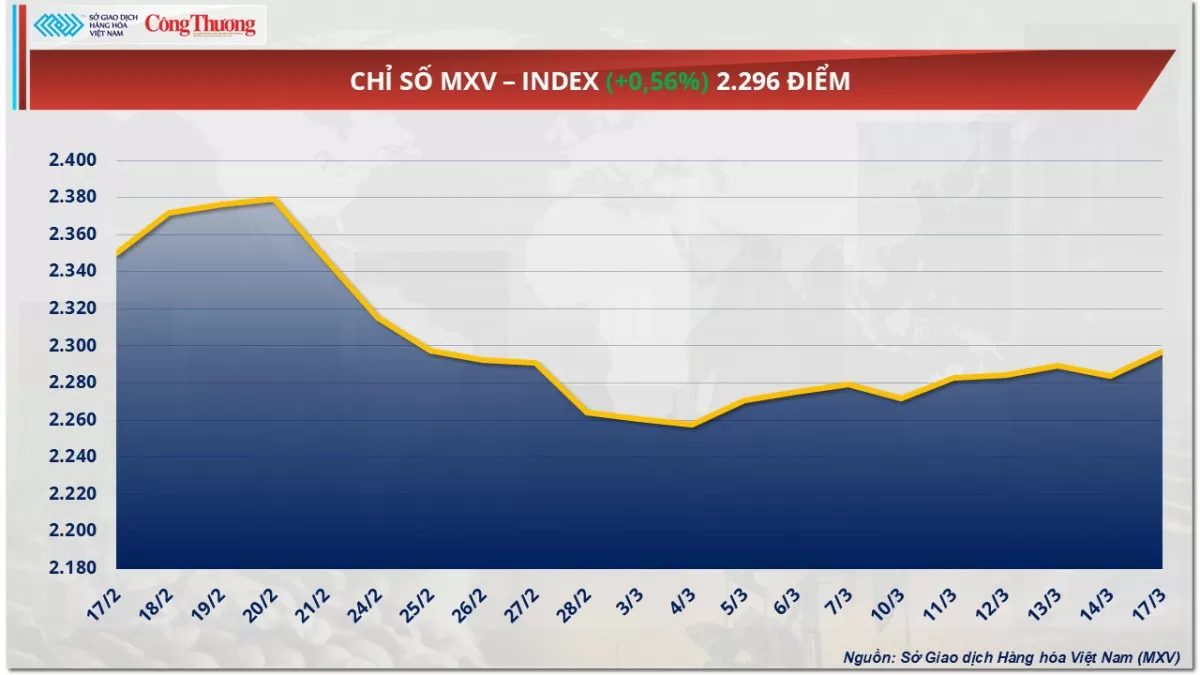

According to the Vietnam Commodity Exchange (MXV), the world raw material market was covered in green in yesterday's trading session (March 17). At the close, overwhelming buying pressure helped the MXV-Index increase by more than 0.5% to 2,296 points - the highest level since late February 2025. Cautious sentiment continued in the metal market when the FED decided on interest rates. In addition, in the agricultural market, soybean prices fluctuated due to the mixed impact of negative fundamental factors and technical recovery at the end of the session.

|

| MXV-Index |

Green and red colors intertwine in the metal market

The first trading session of the week saw a divergence between precious and base metals, as the market awaited the US interest rate decision this week. In addition, supply and demand concerns continued to put pressure on base metal prices.

|

| Metal price list |

At the end of the trading session on March 17, silver prices fell slightly by 0.33% to 34.07 USD/ounce. Meanwhile, platinum continued to increase by 1.31% to 1,026 USD/ounce.

Among the base metals, COMEX copper extended its gains by 1.29% to $4.96 a pound, or $10,932 a tonne, its highest in nearly 10 months. Iron ore, on the other hand, declined 1.87% to $102.04 a tonne.

Markets are now focused on the US Federal Reserve's monetary policy meeting on Thursday, with expectations that the agency will keep interest rates unchanged until June. The high interest rate environment is expected to continue to support the strength of the US dollar, as money flows into bonds to take advantage of attractive yields. This reduces the appeal of non-yielding assets such as precious metals, putting pressure on silver and platinum prices.

Meanwhile, newly released data showed that US retail sales recovered more slowly than expected in February, reflecting modest economic growth. This development took place in the context of President Donald Trump's administration applying strict import tax policies, raising concerns about rising costs and prices. The weak economic outlook in the US has stimulated demand for shelter, partly helping to limit the decline in the price of precious metals in the last trading session.

In other news, copper prices rose to their highest since late May 2024 as the market anticipated that the US tariffs on copper imports could lead to a severe shortage in the country's supply. The move triggered a wave of speculative buying amid concerns about copper supply.

Meanwhile, iron ore prices in the last trading session were under pressure from weak demand in China's real estate and construction markets. The country's crude steel output in the first two months of the year fell 1.5% compared to the same period in 2024, reflecting a decline in consumption of input materials, including iron ore.

Despite Beijing’s stimulus measures, new home prices in China continued to fall in February, while new construction starts fell sharply by 29.6%. Weak demand is believed to be insufficient to absorb excess supply, creating the risk of hot pig iron inventories rising in the coming weeks, further pressuring iron ore prices.

Soybean prices fluctuate

Soybean prices traded sideways yesterday and ended with little change at around $373/ton. The market showed a clear two-way trend as the May contract fell slightly, while the November new crop contract increased slightly. This sideways movement was explained by the conflicting effects of negative fundamentals and technical recovery at the end of the session.

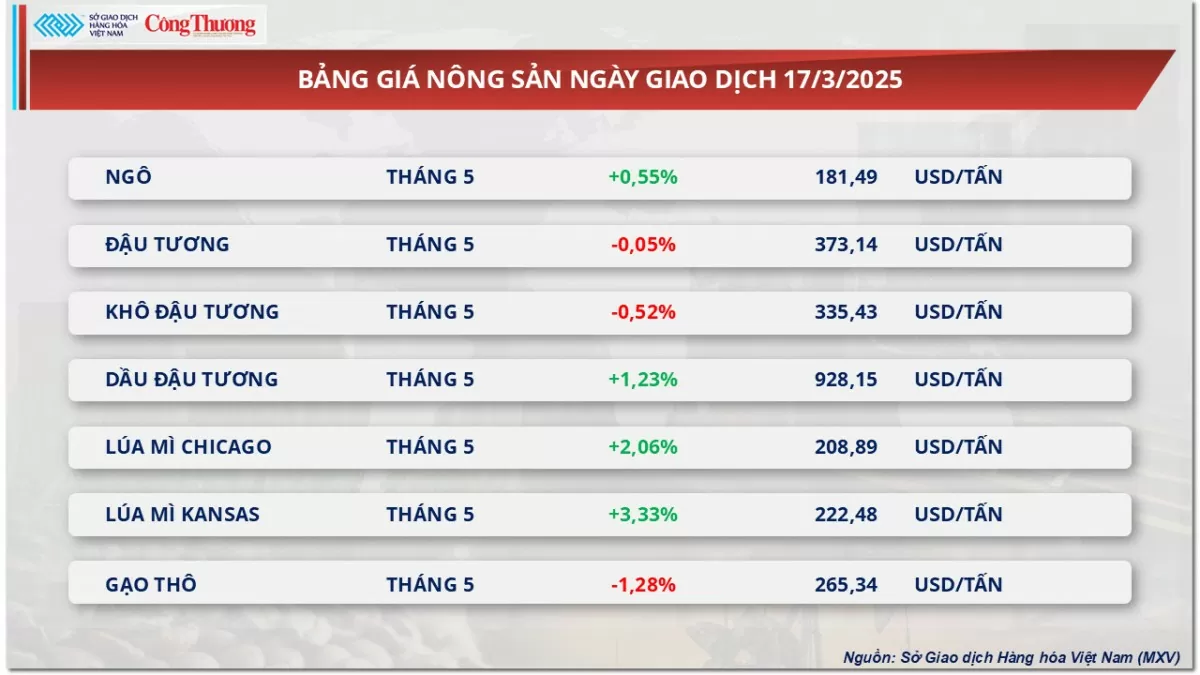

|

| Agricultural product price list |

On the fundamental front, negative news dominated the trading session as the weekly soybean export inspection data came in at just under 647,000 tonnes, down sharply from over 853,000 tonnes the previous week and over 700,000 tonnes a year ago. This reflected a decline in export demand, putting pressure on soybean prices. In addition, the National Oil Mills Association (NOPA) February oil crush report also had a negative impact as the crushing output reached only 4.84 million tonnes, much lower than the market average forecast of 185.2 million bushels and down sharply from 5.45 million tonnes the previous month. The average daily crush rate also fell to a five-month low of just 173,800 tonnes/day, indicating weaker-than-expected domestic demand.

News from Brazil is also adding to the pressure on soybean prices as the 2024-25 harvest in the country has reached around 66-70%, faster than the 62-63% level at the same time last year. This is the fastest harvest rate in March since AgRural began tracking data in 2010-2011. The north and northeast of Brazil are picking up the pace, making up for a slow start. However, in the southern state of Rio Grande do Sul, hot and dry weather is reducing yields. The rapid harvest in Brazil means that global supplies will be replenished strongly, putting further downward pressure on international markets, especially in the US.

However, soybean prices bottomed out shortly before the data was released and then recovered in the second half of the session, suggesting that the market had somewhat priced in the negative news and technical buying pressure helped prices recover.

Source: https://congthuong.vn/gia-bac-quay-dau-giam-nhe-con-3407-usdounce-378742.html

![[Photo] Prime Minister Pham Minh Chinh attends the groundbreaking ceremony of two key projects in Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/6adba56d5d94403093a074ac6496ec9d)

Comment (0)