| Commodity market today, October 10: Oil prices continue to weaken Commodity market today, October 11: Strong buying power returns to the world raw material market |

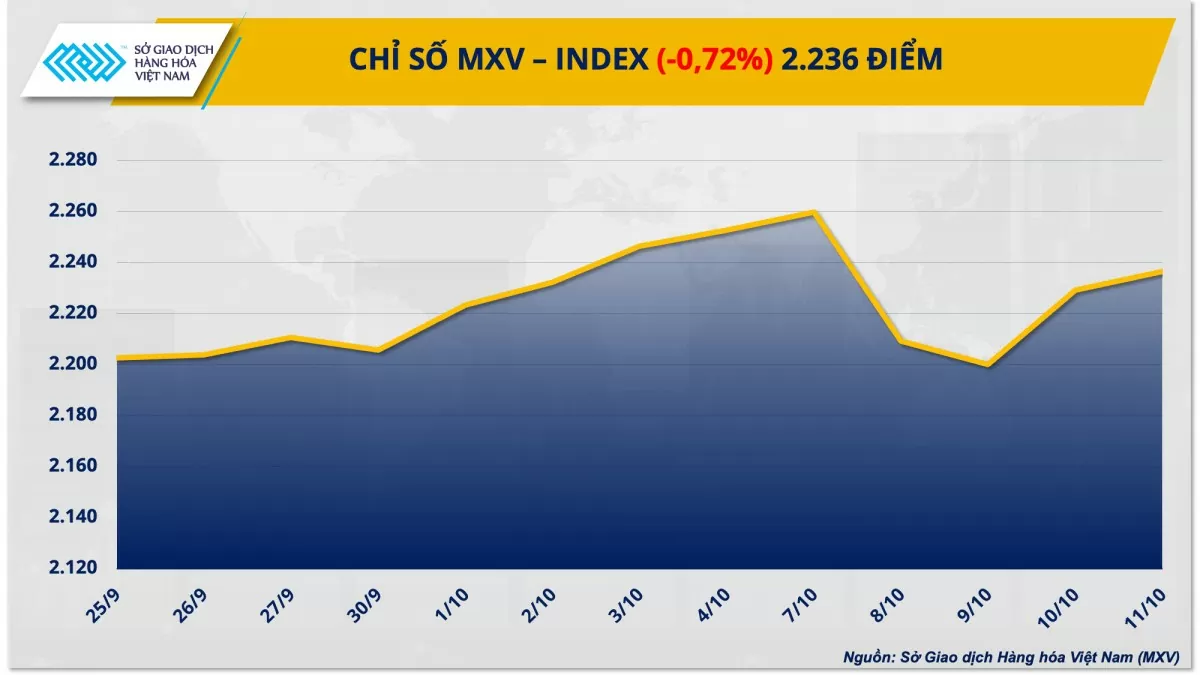

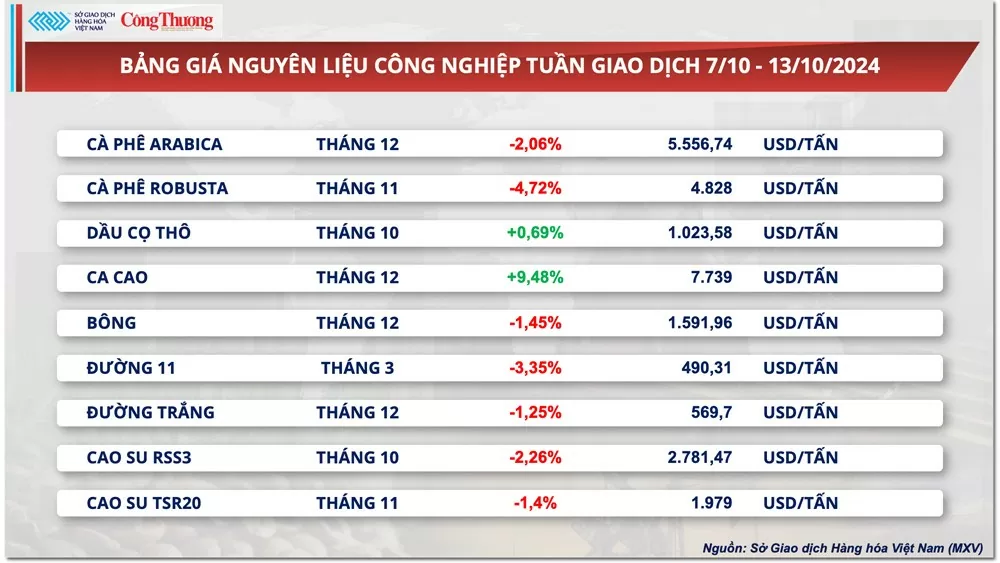

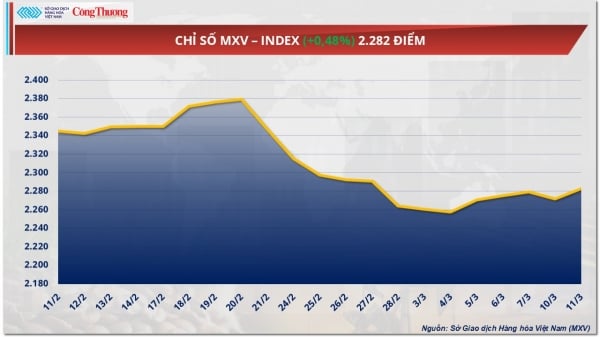

Notably, the metal group recorded negative developments when all 10 items in the group closed in red. In the industrial raw materials market, the prices of two coffee products turned weak after an effort to recover in the middle of the week. Closing, the MXV-Index decreased by 0.72% to 2,236 points.

|

| MXV-Index |

Geopolitical tensions in the Middle East cool down, metal prices weaken

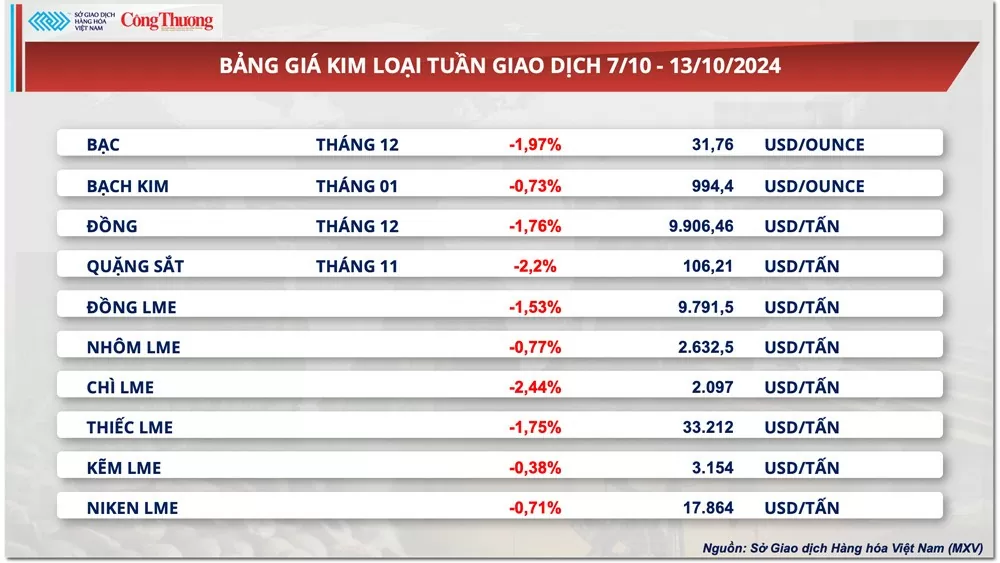

At the end of the trading session last week, the metal market was deep in red, as both precious and base metals fell in price. Specifically, silver prices lost nearly 2%, ending the week at $31.75/ounce, ending a four-week streak of consecutive price increases. Similarly, platinum prices also plunged 0.73%, closing the weekend session at $994.4/ounce.

|

| Metal price list |

Precious metal prices have been under pressure this week as geopolitical tensions in the Middle East have cooled significantly, and tensions have not escalated as much as previously feared. This has reduced demand for safe haven assets such as gold, silver, and platinum.

In addition, expectations that the US Federal Reserve (FED) will continue to cut interest rates aggressively at its November meeting have also decreased, putting further pressure on precious metal prices. Specifically, after a series of recent positive economic data, especially the payroll report, investors no longer believe that the Fed will cut interest rates by another 50 basis points, a strong reversal from previous forecasts. Moreover, some FED officials even warned that they may not cut interest rates after the September inflation report increased more than expected.

Meanwhile, base metals prices also plunged amid disappointing expectations for new economic stimulus measures from China. Copper prices fell 1.76% to $9,906 a tonne. Iron ore prices similarly lost 2.2% to close the week at $106.21 a tonne.

A more optimistic supply outlook also weighed on copper prices last week. According to data from Chilean copper commission Cochilco, copper output at Codelco, the world’s largest copper supplier, reached 125,300 tonnes in August, up 10.1% from a year earlier, driven by strong output at some major mines such as Escondida, which rose 15.5% to 105,300 tonnes.

Earlier, the International Copper Study Group (ICSG) also said that the global refined copper market is expected to have a surplus of 469,000 tonnes this year, a much larger surplus than the group's previous estimate in April of 162,000 tonnes.

Prices of some other goods

|

| Agricultural product price list |

|

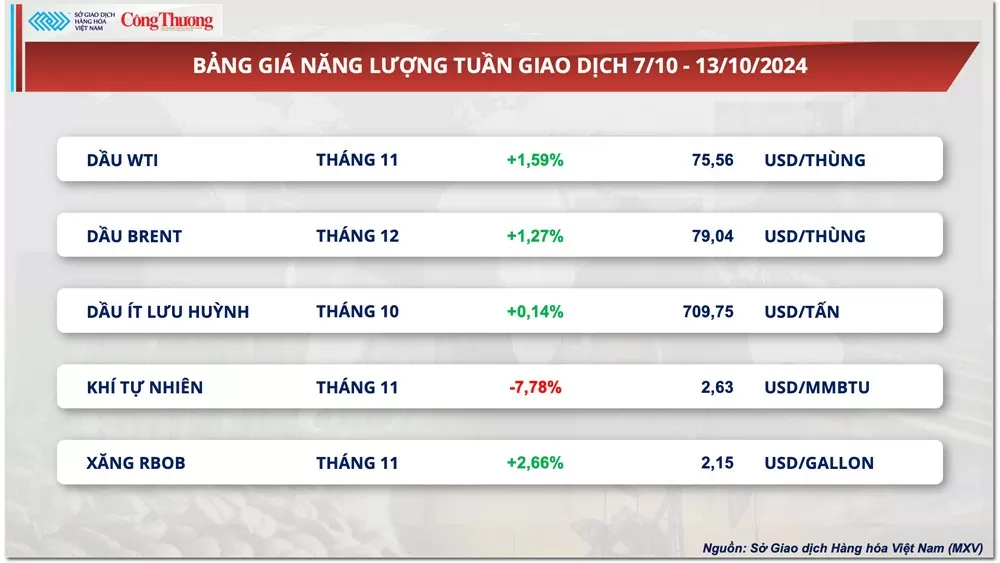

| Energy price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-1410-sac-do-bao-phu-thi-truong-kim-loai-352224.html

Comment (0)